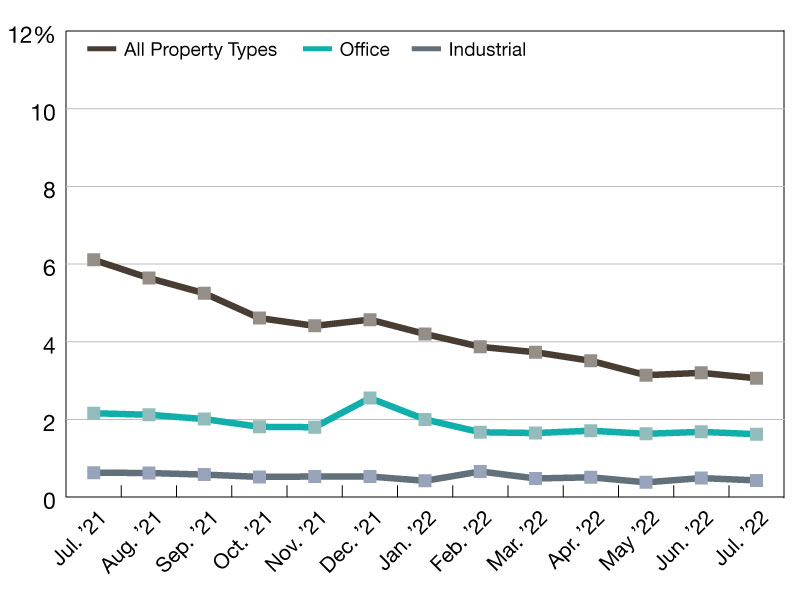

After a uncommon uptick in June 2022, the Trepp CMBS Delinquency Charge resumed its two-year lengthy decline.

In June, the speed inched up for under the second time since June 2020. In July, the speed declied anew and has now fallen for 23 of the final 25 months. The July quantity additionally represented one other post-COVID-19 low.

The Trepp CMBS fee in July was 3.1 %, a lower of 14 foundation factors from June. The proportion of loans within the 30 days delinquent bucket is 0.1 %, down 9 foundation factors for the month.

12 months-over-year, the general US CMBS delinquency fee is down 305 foundation factors. 12 months-to-date, the speed is down 151 foundation factors. The proportion of loans which can be significantly delinquent is now 3.0 %, down 5 foundation factors for the month.

If defeased loans have been taken out of the equation, the general 30-day delinquency fee can be 3.2 %, down 15 foundation factors from June. One 12 months in the past, the speed was 6.1 %, whereas six months in the past it was 4.2 %.

For general property varieties CMBS 1.0 and a couple of.0+, the commercial fee fell six foundation factors to 0.4 %, workplace dropped six factors to 1.6 % and retail fell 12 foundation factors to six.6 %. For CMBS 2.0+, industrial went down 4 foundation factors to 0.2 %, workplace up two foundation factors to 1.3 % and retail down 4 foundation factors to five.7 %.

—Posted on Aug. 25, 2022

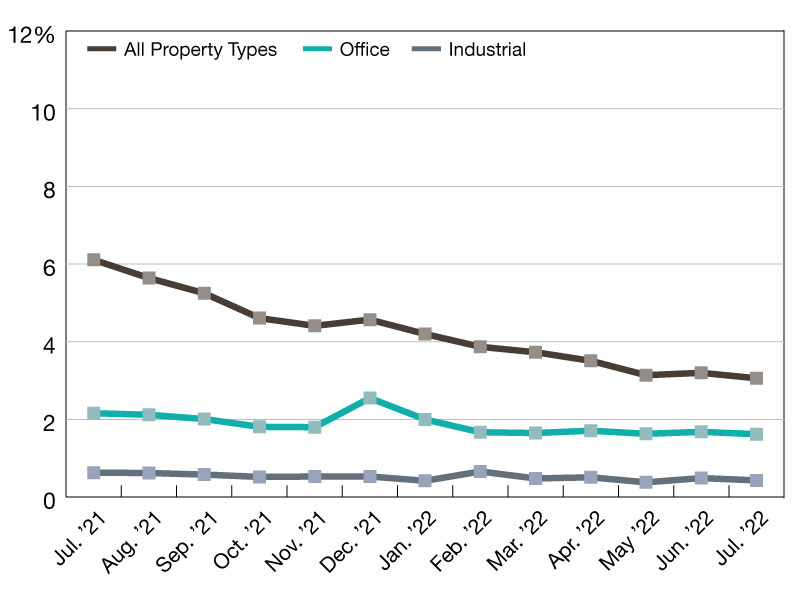

The Trepp CMBS delinquency fee posted a uncommon uptick in June 2022. The speed moved up simply six foundation factors, and solely time will inform if that is only a blip, or an inflection level triggered by greater borrowing prices for business actual property and weakening fundamentals for the U.S. economic system.

The uptick is just the second enhance within the fee over the past 24 months. The final enhance within the fee got here in late 2021.

The Trepp CMBS delinquency fee in June was 3.2 %. All main property varieties say small will increase of their respective delinquency charges in June. The all tiem excessive on this foundation was 10.3 % registered in July 2012. One 12 months in the past, the speed was 6.2 %, whereas six months in the past it was 4.6 %.

The proportion of loans within the 30 days delinquent bucket is now 0.18 %, up 5 foundation factors for the month.

12 months-over-year, the general fee is down 295 foundation factors. 12 months-to-date, the speed is down 137 foundation factors. The proportion of loans which can be significantly delinquent is now 3.0 %, up one foundation level for the month. If defeased loans have been taken out of the equation, the general 30-day deliquency fee can be 3.4 %, up 5 foundation factors from Could.

The CMBS 1.0 and a couple of.0+ charges for industrial elevated 11 foundation factors to 0.49 %, whereas workplace elevated 5 foundation factors to 1.7 %.

—Posted on Jul. 27, 2022

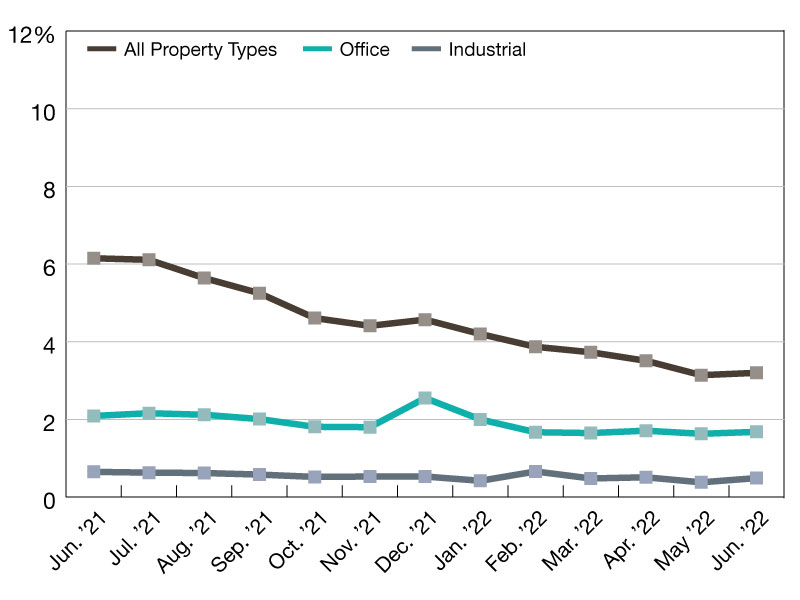

The Trepp CMBS delinquency fee posted one other giant decline in Could 2022. On the present enchancment fee, the general delinquency fee may fall beneath 3 % within the coming months, a prospect that appeared unthinkable through the COVID-19 pandemic. As a refresher, the delinquency fee hit 10.3 % in June 2020 amid the market volatility brought on by the pandemic. This was close to the all-time excessive of 10.3 % seen in July 2012.

The Could 2022 delinquency fee was 3.1 %, a decline of 37 foundation factors from April. That’s the largest decline since January 2022. The speed has now fallen in 22 of the final 23 months with solely a short uptick in late 2021. All main property varieties noticed enhancements in Could 2022.

The proportion of loans within the 30 days delinquent bucket is 0.1 %–down 4 foundation factors for the month. 12 months-over-year, the general US CMBS delinquency fee is down 302 foundation factors. 12 months-to-date, the speed is down 143 foundation factors.

For general property sort evaluation 1.0 and a couple of.0+, the commercial fee fell 13 foundation factors to 0.4 %, whereas workplace dipped eight foundation factors to 1.6 %.

—Posted on Jun. 22, 2022

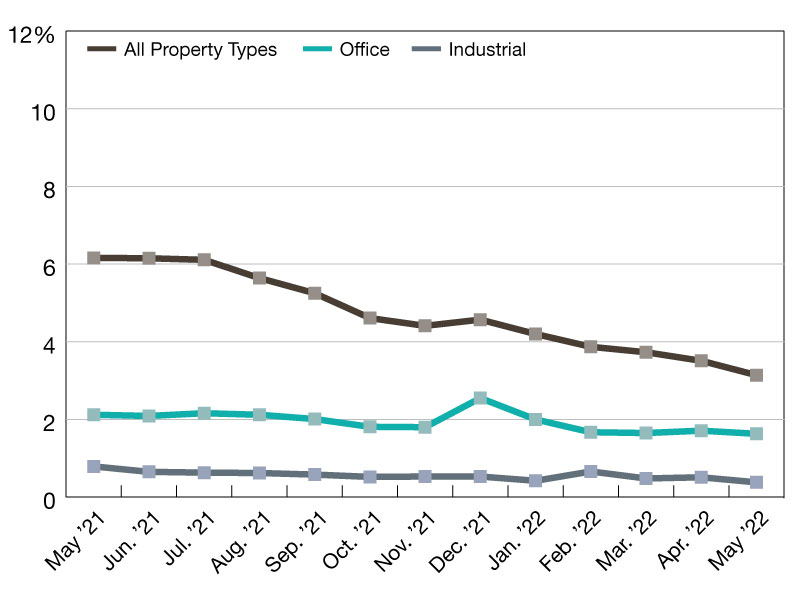

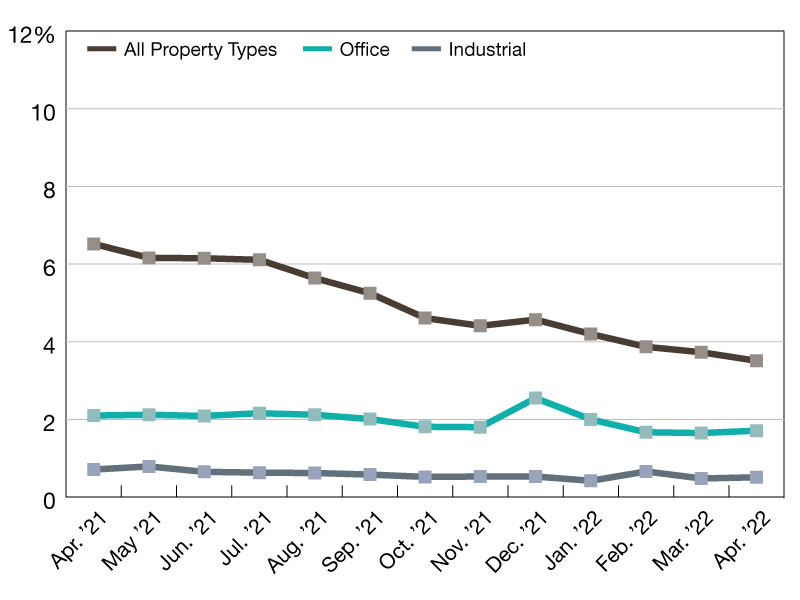

The Trepp CMBS delinquency fee posted one other sizable decline in April 2022, persevering with a development that began just a few months after the onset of COVID-19.

The speed has now fallen in 21 of the final 22 months with solely a short uptick in late 2021. The Trepp CMBS delinquency fee in April was 3.5 %, a decline of twenty-two foundation factors from March. The proportion of loans within the 30 days delinquent bucket is 0.2 %—down two foundation factors for the month.

The all-time excessive on this foundation was 10.3 % registered in July 2012. The COVID-19 excessive was 10.3 % in June 2020. 12 months over 12 months, the general US CMBS delinquency fee is down 301 foundation factors. 12 months to this point, the speed is down 106 foundation factors. The proportion of loans which can be significantly delinquent is now 3.3 %, down 20 foundation factors for the month.

One 12 months in the past, the speed was 6.5 %. Six months in the past, it was 4.6 %. The commercial fee elevated three foundation factors to 0.5 %, whereas workplace went up six foundation factors to 1.7 % for CMBS 1.0 and a couple of.0+. For simply CMBS 2.0+, industrial went up 9 foundation factors to 0.3 % and workplace inched up 9 foundation factors as properly, to 1.3 %.

—Posted on Could 23, 2022

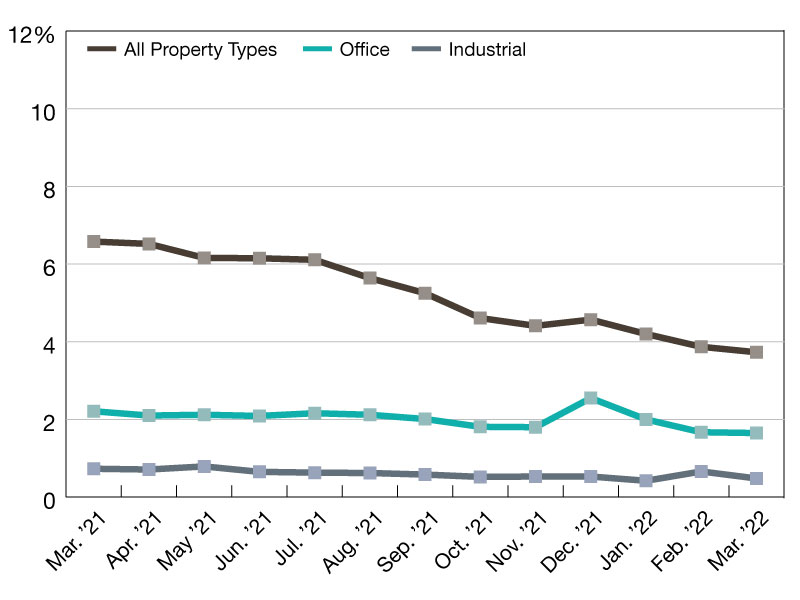

The latest enhance in rates of interest, commodity costs, and common volatility hasn’t had any noticeable efficiency within the CMBS market except for some unfold widening up and down the credit score stack. The Trepp CMBS delinquency fee posted one other decline in March, persevering with a development that began virtually two years in the past. The speed has now fallen in 20 of the final 21 months with solely a short uptick in late 2021. The general delinquency fee in March 2022 was 3.7 %, a decline of 14 foundation factors from February.

The proportion of loans within the 30 days delinquent bucket is 0.2 %, up one foundation level for the month. By way of loans in grace interval, 1.9 % of loans by excellent stability missed the March cost however have been lower than 30 days delinquent. That’s up 5 foundation factors from February. 12 months-over-year, the general fee is down 285 foundation factors. 12 months-to-date, the speed is down 84 foundation factors.

The proportion of loans which can be significantly delinquent is now 3.5 %, down 15 foundation factors for the month. If defeased loans have been taken out of the equation, the general 30-day delinquency fee can be 3.9 %, down 16 factors from February. One 12 months in the past, the speed was 6.6 %, whereas six months in the past it was 5.3 %. For general property varieties, CMBS 1.0 and a couple of.0+.

—Posted on Apr. 27, 2022

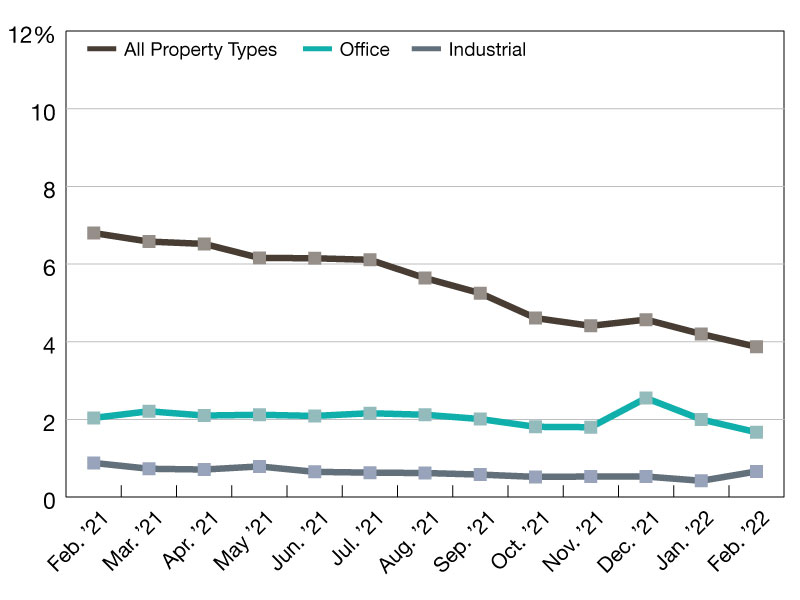

The Trepp CMBS delinquency fee continued its spectacular decline in February 2022. The speed has now fallen in 19 of the final 20 months with solely a short uptick in late 2021. The delinquency fee in February was 3.9 %, a decline of 31 foundation factors from January. That’s the primary time the speed has been beneath 4 % since April 2020.

The proportion of loans within the 30 days delinquent bucket is now 0.2 %, up two foundation factors for the month. By way of loans in grace interval, 1.9 % of loans by stability missed the February cost however have been lower than 30 days delinquent. That’s a drop of 30 foundation factors and may very well be an indication that extra enhancements within the delinquency fee are forthcoming.

The general US CMBS delinquency fee dropped 31 foundation factors in February to three.9 %. (The all-time excessive on this foundation was 10.3 % registered in July 2012. The COVID-19 excessive was 10.3 % in June 2020.) The proportion of A/B loans (i.e. loans in grace interval or past grace interval) was 1.9 % in February. 12 months over 12 months, the general US CMBS delinquency fee is down 293 foundation factors. 12 months to this point, the speed is down 70 foundation factors. The proportion of loans which can be significantly delinquent (60+ days delinquent, in foreclosures, REO, or nonperforming balloons) is now 3.7 %, down 33 foundation factors for the month. If defeased loans have been taken out of the equation, the general 30-day delinquency fee can be 4.1 %, down 33 foundation factors from January. One 12 months in the past, the US CMBS delinquency fee was 6.8 %. Six months in the past, the US CMBS delinquency fee was 5.6 %. Loans which can be previous their maturity date however nonetheless present on curiosity are thought-about present.

The CMBS 2.0+ delinquency fee fell 29 foundation factors to three.5 % in February. That, too, is a post-April 2020 low. The speed is down 261 foundation factors year-over-year. The proportion of CMBS 2.0+ loans which can be significantly delinquent is now 3.3 %, down 32 foundation factors for the month. If defeased loans have been taken out of the equation, the general CMBS 2.0+ delinquency fee can be 3.7 %, down 31 foundation factors for the month. For CMBS 1.0 and a couple of.0+, the commercial delinquency fee moved up 24 foundation factors to 0.7 %. The workplace delinquency fee declined 33 foundation factors to 1.7 %. For CMBS 2.0+, the commercial fee went up 20 foundation factors to 0.31 %. The workplace fee went down 32 foundation factors to 1.2 %.

—Posted on Mar. 25, 2022

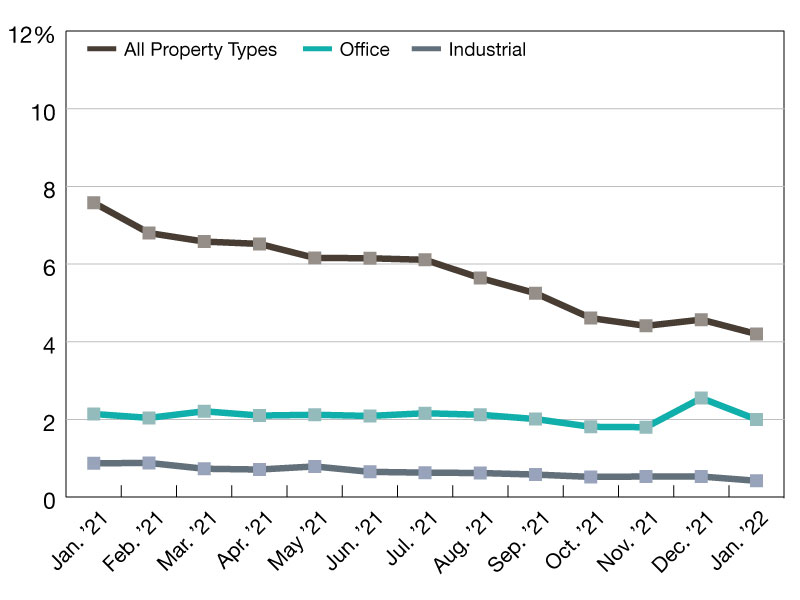

The Trepp CMBS delinquency fee resumed its decline in January 2022 after a one-month pause in December 2021. In December, the speed elevated for the primary time since June 2020. Previous to the rise, the speed had fallen for 17 consecutive months. In January, the general delinquency quantity noticed a large decline because the Trepp CMBS delinquency fee posted its lowest studying since April 2020. The January 2022 CMBS delinquency fee was 4.2, a lower of 39 foundation factors from the December quantity.

The decline within the fee was helped by the curing (reverting from delinquent to present standing) of two huge HNA Group loans which complete greater than $1.2 billion. The 245 Park Ave. (NY) mortgage and the 181 W. Madison St. (Chicago) mortgage each went from being 30 days delinquent in December to being reported as present in January. (An affiliate of the HNA Group filed for chapter which led the 2 loans to go to particular servicing. The truth that the loans turned present in January doesn’t but imply that lenders are out of the woods on these belongings.) The proportion of loans within the 30 days delinquent bucket is now 0.2 %, down 33 foundation factors for the month. By way of loans in grace interval, 2.2 % of loans by stability missed the January cost however have been lower than 30 days delinquent. That was up 4 foundation factors for the month. Our numbers above replicate percentages that assume defeased loans are nonetheless a part of the denominator.

The proportion of A/B loans (i.e. loans in grace interval or past grace interval) was 2.17% in January. 12 months over 12 months, the general US CMBS delinquency fee is down 340 foundation factors. The proportion of loans which can be significantly delinquent (60+ days delinquent, in foreclosures, REO, or nonperforming balloons) is now 4.0 %, down 6 foundation factors for the month. If defeased loans have been taken out of the equation, the general 30-day delinquency fee can be 4.4 %, down 39 foundation factors from December. One 12 months in the past, the US CMBS delinquency fee was 7.6 %. Six months in the past, the US CMBS delinquency fee was 6.1 %.

The CMBS 2.0+ delinquency fee fell 40 foundation factors to three.8 % in January. That, too, is a post-April 2020 low. The speed is down 308 foundation factors year-over-year. The proportion of CMBS 2.0+ loans which can be significantly delinquent is now 3.6 %, down 6 foundation factors for the month. If defeased loans have been taken out of the equation, the general CMBS 2.0+ delinquency fee can be 4.0 %, down 39 foundation factors for the month.

For CMBS 1.0 and a couple of.0+, the commercial delinquency fee fell 10 foundation factors to 0.4 %, whereas workplace declined 53 foundation factors to 2.0 %. For two.0+, industrial went down 10 foundation factors to 0.1 %, whereas workplace went down 56 foundation factors to 1.5 %.

—Posted on Feb. 28, 2022