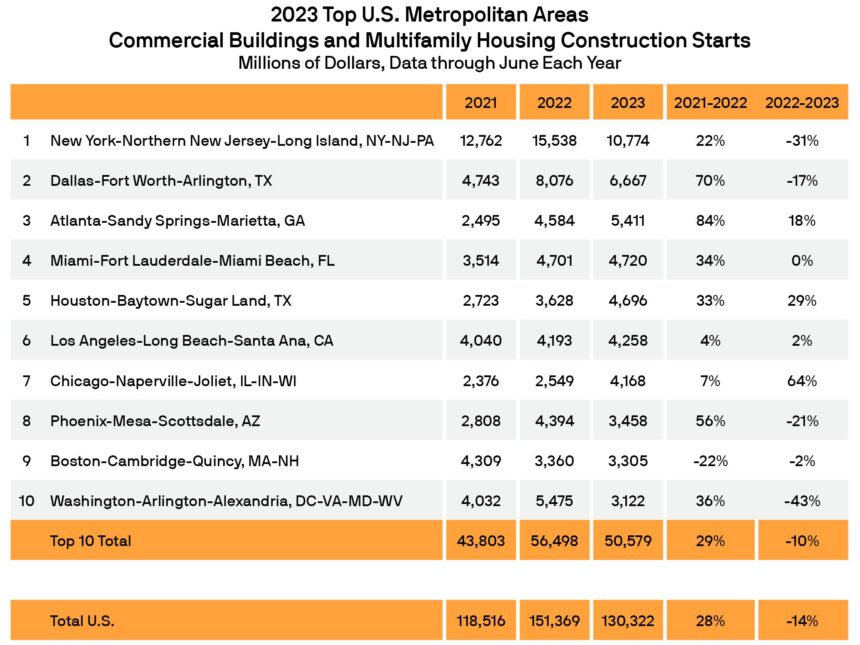

Graph of the ten largest metros for building begins. Picture and knowledge courtesy of Dodge Building Community

Citing tightening financial situations, new knowledge from Dodge Building Community discovered the worth of business and multifamily building begins as falling nationally by 14 p.c to $130 billion on a year-to-year foundation by June, dropping 10 p.c within the high 10 metropolitan areas throughout the USA.

The highest 10 metro areas accounted for 39 p.c of all industrial and multifamily begins within the U.S. within the first half of 2023, in comparison with 37 p.c from January to June 2022.

The report pointed to tighter lending requirements, larger rates of interest, slowing demand and societal modifications, together with continued distant work, as impacts on industrial and multifamily building. The report places workplace buildings, shops, motels, warehouses, industrial garages within the industrial class and likewise contains multifamily housing within the general rating. Within the industrial sector, it doesn’t tally figures for institutional tasks similar to instructional amenities, hospitals, conference facilities, casinos and transportation terminals. It additionally doesn’t embody manufacturing buildings, public works, electrical utilities, fuel crops and single-family housing.

Richard Department, chief economist for Dodge Building Community, stated in ready remarks that begins are anticipated to worsen within the second half of this 12 months as rates of interest head even larger. Yesterday, the Federal Reserve introduced its 11th charge hike since March 2022. After pausing in June, the Federal Reserve raised the federal funds charge 25 foundation factors, to a variety of between 5.25 p.c and 5.5 p.c. Fed chair Jerome Powell wouldn’t decide to additional motion in September, though economists say there might be no less than yet another charge hike this 12 months.

Department stated the tighter monetary situations and important market shifts have led to what he referred to as precipitous declines in building begins throughout many metro areas. Whereas markets are anticipated to start to recuperate subsequent 12 months, Department stated important structural modifications within the industrial actual property sector might result in a tepid restoration with ranges nicely beneath what was seen earlier than the pandemic started in 2020.

Industrial Sees Vivid Spots

The information for the industrial sector was a bit uneven; six of the highest 10 metro markets noticed the worth of business building begins enhance within the first half of 2023 whereas 4 markets – together with the Washington, D.C., market, which had a 42 p.c lower – noticed industrial begin values drop. Different markets seeing decreases in building begins have been New York (down 11 p.c), Dallas (down 17 p.c) and Phoenix (down 20 p.c). Of the markets seeing will increase, Chicago had the most important proportion soar, up 71 p.c in comparison with the identical interval in 2022. Atlanta started the 12 months off sturdy with a 61 p.c enhance in industrial begins adopted by Los Angeles (up 33 p.c), Houston (up 24 p.c), Boston (up 5 p.c) and Miami (up 4 p.c).

The report cites among the high industrial building tasks in every of the highest 10 markets. In New York, which was high marketplace for each industrial and multifamily begins at $10.8 billion (down 31 p.c), one of many largest tasks beginning within the first half of the 12 months was the Faculty Level Logistics Heart in Queens. In March, a three way partnership of Wildflower Ltd. and Drake Actual Property Companions obtained $94 million in financing from Walker & Dunlop for the event of the roughly 309,000-square foot industrial venture within the Faculty Level part of Queens. Wildflower broke floor on the $146 million improvement in June 2022, with completion anticipated within the second quarter of 2024.

READ ALSO: Building Spending Booms Throughout the Board

In Dallas, Dodge studies there have been features in workplace and retail building begins regardless of the 17 p.c drop in industrial building tasks. Nevertheless, the market’s greatest tasks to interrupt floor have been a $154 million Aligned knowledge heart and $119 million Google knowledge heart.

Atlanta had a robust first half of 2023 with a 61 p.c enhance in industrial begins with all classes besides retail posting features. Knowledge heart tasks have been additionally among the many largest tasks to start earlier this 12 months together with the $642 million Fb Stanton Springs knowledge heart and one other knowledge heart venture estimated at $117 million.

Chicago additionally began the 12 months sturdy with industrial begins up 71 p.c. Dodge states the achieve was the results of a big enhance in workplace begins in addition to upswings in lodge and retail building. The biggest industrial venture to get underway was the $1 billion Prime knowledge heart campus in Elk Grove Village, Unwell., that may have three buildings totaling about 750,000 sq. toes. The hyperscale knowledge heart could have a complete capability of 150 MW upon full build-out. A $330 million workplace constructing at 917 W. Fulton Market additionally started building, in keeping with Dodge.

Los Angeles additionally noticed two workplace buildings break floor within the first half of the 12 months because the market’s largest industrial tasks to get began. One is the $490 million JMB Century Metropolis Heart workplace constructing and the opposite is a $70 million workplace constructing at 6381 Hollywood Blvd.

In Houston, Dodge famous all of the classes posted wholesome progress with a number of industrial tasks main the way in which for the market’s 24 p.c in industrial begins. Dodge cited the $77 million Port 99 warehouse and the $50 million FreezPak chilly storage constructing.