Picture by geralt by way of Pixabay.com

Regardless of macroeconomic headwinds together with inflation, rising rates of interest and uncertainty, PwC expects business actual property deal exercise to gradual however stay resilient in 2023, significantly for industrial which continues to have robust fundamentals.

These headwinds will create alternatives for many CRE sectors within the new yr, in response to the skilled companies agency’s US Offers 2023 outlook. The report notes buyers will adapt to the headwinds with a concentrate on each flight-to-quality and flight-to-safety, pushed partly by intensified underwriting assumptions placing extra consideration on high-quality, performing belongings. PwC acknowledged portfolios will probably be adjusted and rightsized to make sure publicity to these high-quality belongings, that are more likely to be newly constructed and redeveloped belongings with robust ESG credentials quite than older properties.

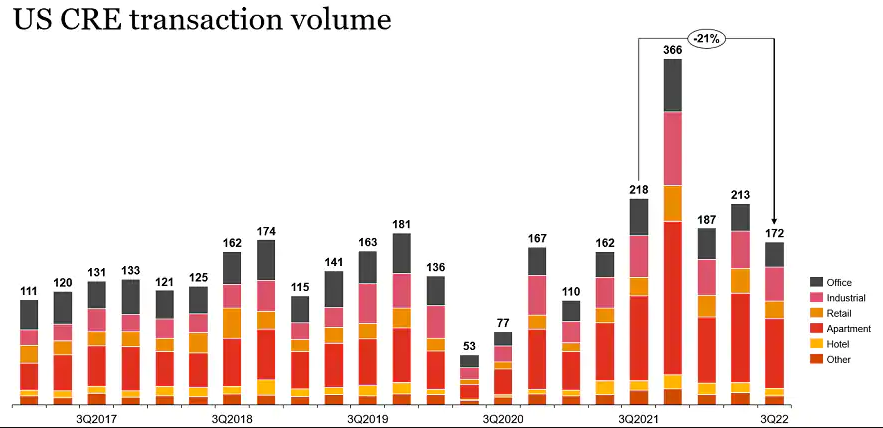

The report does acknowledge that complete third-quarter 2022 transactions throughout the board had been down 21 p.c year-over-year however notes that’s compared to a “searing third-quarter of 2021.” If you evaluate third-quarter deal exercise to the identical durations in 2020 and 2019, transactions had been up by 123 p.c and 6 p.c, respectively.

US CRE transaction quantity. Chart courtesy of PwC

Workplace was the sector with the steepest decline within the third quarter, down 33 p.c in comparison with the third quarter of 2021. The drop in workplace transactions is pushed by a lag within the return to the workplace following the pandemic, in addition to a rise in subleases mixed with report lease expirations. The mixture means provide continues to outpace demand, making a difficult surroundings, significantly for older workplace properties. PwC mentioned corporations that provide employees extra versatile schedules in good buildings ought to lower your expenses as a result of they are going to be capable of extra simply retain employees in a happier, more healthy office.

Offers additionally dropped within the third quarter for the economic sector, lowering 18 p.c in comparison with the third quarter of 2021, which was a “red-hot” interval. PwC states the sector ought to stay “buoyant” in 2023 as a result of corporations are nonetheless attempting to construct up logistics and storage capabilities to fulfill the calls for of the e-commerce market and capacity-constrained provide chains.

READ ALSO: The Watchwords for 2023 Are Uncertainty and Stress

Whereas transaction quantity has decreased, PwC acknowledged fundamentals are robust. Rents have continued to climb due to the dearth of provide and slowed supply resulting from inflation. Nevertheless, rents are anticipated to gradual in some markets as the availability does come on-line.

PwC famous third-quarter retail transactions had been down by 9 p.c in comparison with the post-pandemic surge within the third quarter of 2021. Flight to high quality can also be taking part in a job in gross sales of retail properties. That bifurcated development is predicted to proceed within the new yr with high-quality, well-located retail belongings favored over older, poorly positioned and technologically out of date belongings that may face headwinds and will should be repurposed. The outlook calls the scenario a “story of two halves” and states shoppers are spending cash at high-quality belongings in good areas which have experiential retail choices in addition to in style omnichannel methods corresponding to click-and-collect, curbside pickup and ship-from-store.

Deal-making methods

PwC’s outlook states corporations must be reviewing their portfolios to see if there are belongings that may be divested, and capital allotted to probably the most promising companies. The report calls divestures “a important device in reworking and reconfiguring a agency.” Divestitures executed in a well timed method can improve an organization’s probabilities for worth creation.

The agency additionally advises a “return to capital self-discipline” due to the upper prices of capital and inflationary surroundings. Nevertheless, PwC notes dry powder ranges stay at all-time highs with more and more larger ranges being raised by personal autos together with non-traded REITs and personal fairness funds.

The report states non-traded REITs raised report ranges of capital through the first half of the yr, together with Blackstone with $11.6 billion adopted by Starwood at $3.3 billion. Whereas new gamers can enter the area, PwC expects extra merger and acquisitions in 2023 on the heels of enormous M&A offers in 2022.