Financial reviews from the federal authorities and a few personal third events on development spending and employment have implications for varied points of business actual property, in accordance with a report from Moody’s Analytics.

Begin with development spending, as on January 3, the Census Bureau introduced that November 2022 development exercise of $1,807.5 billion was 0.2% over October’s $1,803.2 billion, which was revised downward by 0.2%. And, as these notes usually say, the boldness interval across the November numbers was plus or minus 0.8%. As a result of the boldness interval included zero, the company can’t inform whether or not there was an precise change or not.

Even with the change in October, in accordance with the Moody’s evaluation, “the November 2022 improve is supported by beneficial properties in nonresidential development that greater than offset residential declines.” And whereas single-family development was down 2.9% month over month, or -10.2% 12 months over 12 months, multifamily development was up 2.4% month over month or 10.7% 12 months over 12 months. Since April 2020, “personal residential new multifamily development spending has nicely outpaced single household and the trajectories have transfer in severely reverse instructions in latest months.” The cut up seemingly owes to greater mortgage charges, as Moody’s notes, and possibly the explosion in home costs, given different knowledge and what sources have instructed GlobeSt.com over time.

Nonetheless, issues aren’t simple for multifamily. Final 12 months wasn’t as vibrant as anticipated, with solely 100,000 complete items added, in accordance with Moody’s. Labor and supplies shortages or delays, compounded by financing, took their toll.

“As for 2023, the long-term prospects for the sector stay very vibrant, and the prepare has left the station for a lot of of improvement initiatives; given this, we count on a considerable improve in completions later in 2023, prompting complete completions for the 12 months to be within the neighborhood of 200,000 items,” the agency wrote.

Employment noticed the JOLTS report for November exhibiting job openings at 10.46 million, down from October’s revised 10.51 million — nonetheless virtually 1.7 jobs per unemployed particular person. The quits charge was up 10 foundation factors to 2.7%, so employees nonetheless really feel assured that they will go away one job and discover one other.

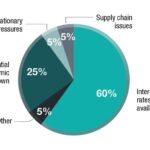

The December jobs figures backed that up to some extent: 223,000 new jobs that have been above consensus expectations of about 200,000. The labor market might have cooled barely, but it surely’s nonetheless strong. Moody’s famous what others have stated — that that is extra grist for the Federal Reserve’s plans to maintain rising rates of interest, which drive short-term and adjustable-rate financing. However there’s one other implication for multifamily.

“Affordability points stay, and that is taking among the chew out of hire development, however This fall nonetheless noticed nicely above common development and whereas we count on a deceleration in that development to return sooner or later in 2023, we don’t count on any widespread multifamily hire declines except we see fairly a bit extra labor market stress,” Moody’s wrote.