Picture by Gerd Altmann through pixabay.com

If it seems like funding in industrial actual property is down—quite a bit—it’s, in accordance with fourth-quarter numbers in a brand new report from CBRE. U.S. industrial actual property gross sales quantity dropped by 63 % year-over-year within the fourth quarter of 2022, to $128 billion.

To place that in perspective, nevertheless, the fourth quarter of 2021 was gorgeous, approaching $350 billion in funding quantity. In 2022 total, CBRE reviews, though quantity fell by 17 % to $671 billion from the document yr of 2021, the 2022 whole was nonetheless the second-highest annual quantity on document.

READ ALSO: The Fed’s Misguided Path on Curiosity Charges

Extra meaningfully, maybe, the $128 billion within the fourth quarter simply previous was modestly under the common from 2015 by means of 2019, at $132.5 billion.

Funding quantity by purchaser sort, This fall 2022 vs. This fall 2021. Chart courtesy of CBRE

On the overseas funding aspect, incoming cross-border funding crashed by 81.3 % year-over-year from $33.3 billion in This fall 2021 to only $6.2 billion within the fourth quarter of 2022. International buyers have been web sellers by a ratio of $1.4 in inclinations for each $1 in acquisitions in 2022. CBRE cites a robust U.S. greenback and uncertainty concerning the total financial system as the primary causes.

REITs, too, have been web sellers within the fourth quarter, whereas institutional and personal buyers have been web patrons.

Merchandise and locations

Amongst asset lessons, multifamily was the highest sector within the fourth quarter, with $48 billion of funding quantity, adopted by industrial/logistics at $32 billion and workplace at $19 billion.

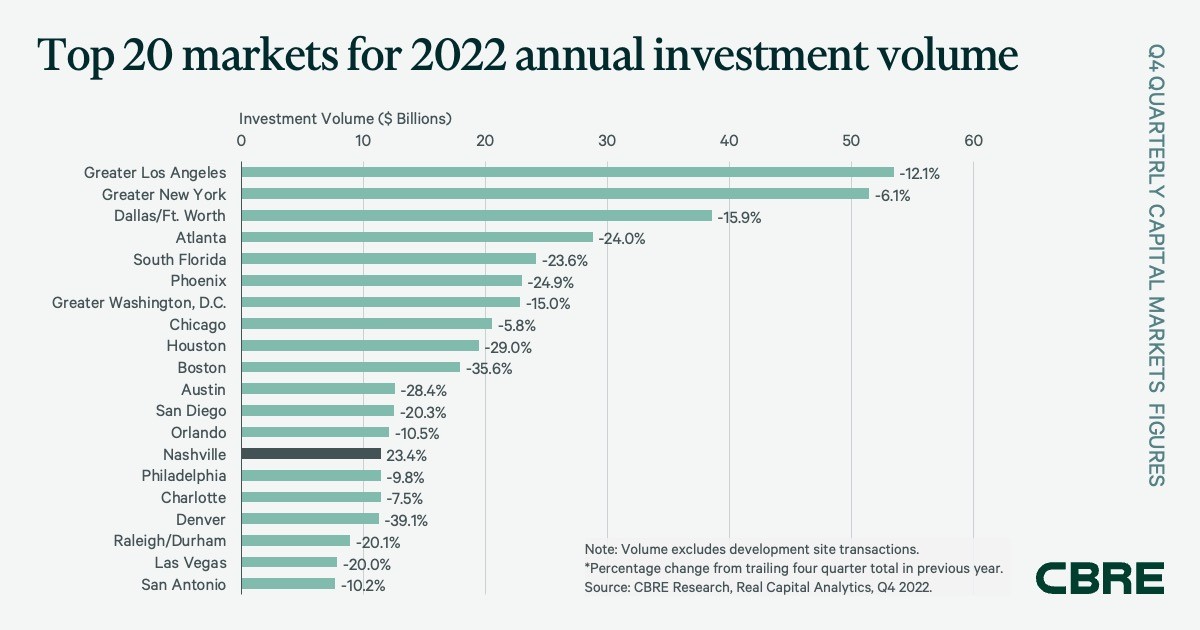

High 20 markets for 2022 annual funding quantity. Chart courtesy of CBRE

On a trailing-four-quarter foundation, Los Angeles was the highest metro with $53 billion in quantity, adopted by New York with $51 billion. Curiously, among the many prime 20 markets for CRE investments, solely Nashville had year-over-year development (of 23.4 %) from 2021 to 2022. Even New York and Los Angeles, with their huge funding numbers and perennial enchantment, noticed sizable declines (on a trailing-four-quarter foundation), of 6.1 % and 12.1 %, respectively.

The most important proportion declines (on the identical foundation) have been seen in Denver (39.1 %), Boston (35.6 %), Houston (29.0 %) and Austin (28.4 %).