TORONTO, March 5 (Reuters) – Junior mining firms hoping to provide lithium, nickel and different inexperienced vitality metals are fearful that Canada’s crackdown on some abroad buyers might restrict their capability to boost funds for mines and associated services.

Ottawa final fall proposed bolstering its Funding Canada Act (ICA) to present authorities ministers energy to dam or unwind important minerals investments in the event that they imagine such offers threaten nationwide safety. The adjustments would primarily give the federal government higher management over firms listed on the Toronto Inventory Alternate and are anticipated to be finalized this spring.

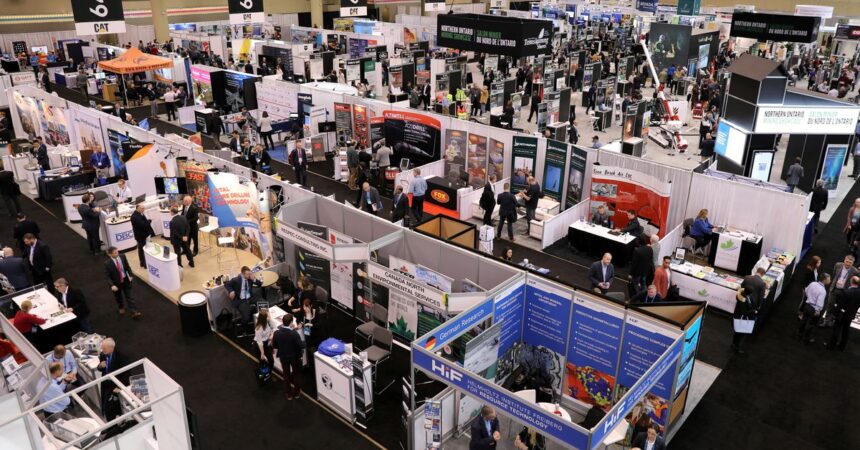

That stress will likely be high of thoughts at this week’s annual Prospectors and Builders Affiliation of Canada (PDAC) convention in Toronto, one of many world’s largest gatherings of mining firms and their financiers.

Practically half of the world’s mining firms are listed in Toronto and town has lengthy been a premier vacation spot for junior mining firms to boost funds, above even rival exchanges in Sydney, New York and London.

Newest Updates

View 2 extra tales

“The ICA evaluate course of might be prolonged and unpredictable, resulting in uncertainty for potential buyers and will make it harder for junior miners to draw investments,” mentioned Stephen Payne, who runs the vitality and pure assets workforce at consultancy BDO Advisory.

The adjustments are broadly seen as a defensive measure in opposition to China, which has invested $7 billion in Canada’s base metals sector prior to now 20 years, in line with S&P Market Intelligence. Canadian officers final fall ordered Chinese language firms to promote stakes in three Toronto-listed lithium firms, two of that are growing mines exterior Canada.

“The impact of those orders was to spook buyers and sure drive capital and mining entrepreneurs to different jurisdictions,” mentioned Paul Fornazzari, an legal professional for one of many firms pressured to shed its Chinese language buyers.

Canada’s Trade Ministry, which is spearheading the foundations change, referred to as important minerals “key to the long run prosperity of our nation.”

“We’re decided to work with Canadian companies to draw international direct investments from companions that share our pursuits and values,” mentioned a spokesperson for Trade Minister Francois Philippe Champagne.

Nonetheless, the federal government’s crackdown might rebound and damage Canada because the mining business underpins a big a part of the nation’s financial system, buyers and analysts say.

“Little doubt the implications of a call to limit a significant avenue of capital circulate must be supplemented by capital that’s related in dimension and well timed,” mentioned Dean McPherson, head of world mining on the Toronto Inventory Alternate.

Ottawa final yr had launched plans to take a position C$3.8 billion ($2.79 billion) to spice up Canada’s personal important supplies sector and streamline mine allowing.

“The federal government must be aware that they are probably creating a niche that must be stuffed,” mentioned Pierre Gratton, president of the Mining Affiliation of Canada, an business commerce group.

($1 = 1.3603 Canadian {dollars})

Reporting by Divya Rajagopal; Modifying by Josie Kao

: .