The prospect of an financial downturn is having wide-ranging impact on how industrial actual property executives are approaching firm technique, operations and the trade’s prospects this 12 months. All is just not doom and gloom, nevertheless. To stunning diploma, trade leaders discover causes for optimism, regardless of a largely sobering outlook.

The prospect of an financial downturn is having wide-ranging impact on how industrial actual property executives are approaching firm technique, operations and the trade’s prospects this 12 months. All is just not doom and gloom, nevertheless. To stunning diploma, trade leaders discover causes for optimism, regardless of a largely sobering outlook.

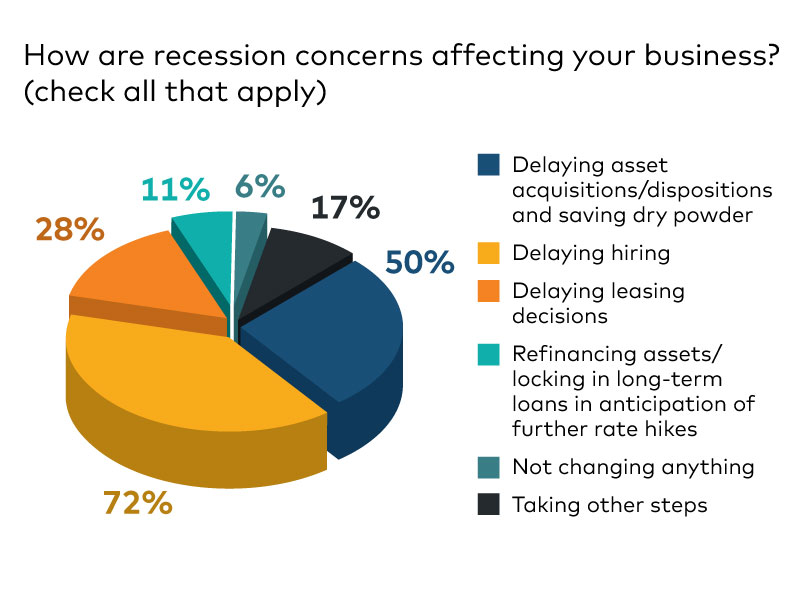

By a substantial margin, the potential for a recession is having the best affect on hiring, as 72 p.c of respondents stated that they had been delaying hiring. The ballot affords additional affirmation that recession considerations are hampering deal quantity. Half of respondents are delaying offers, and one other 27 p.c are delaying offers and holding their powder drive for the second. (As a result of members had been invited to call a number of choices, outcomes for this query add as much as greater than 100%.)

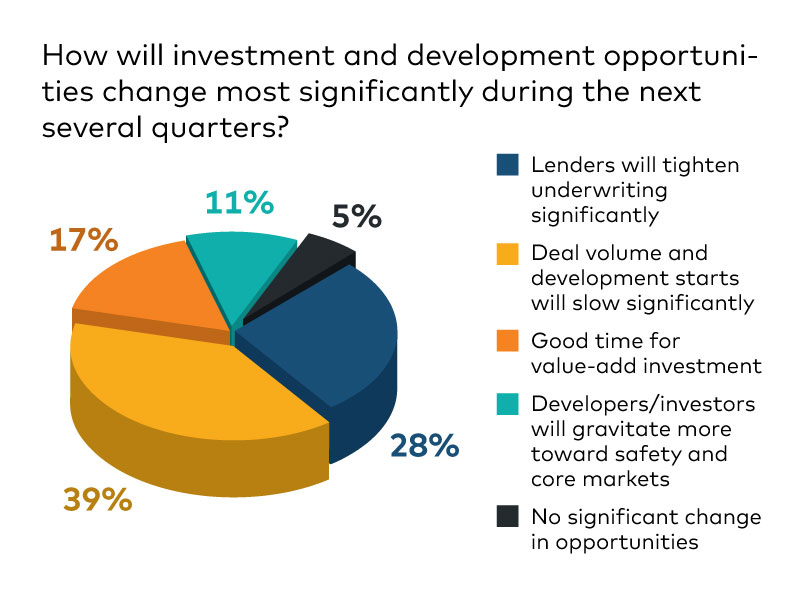

The expectation of delays is a recurring theme within the 12 months’s first survey. Practically 4 in 10 imagine that improvement begins and deal quantity will decline considerably over that stretch. A couple of-quarter of respondents cited tighter underwriting by lenders to be the standout development. A smaller group, 11 p.c, say {that a} flight to security and core markets would be the major results of modified circumstances.

The expectation of delays is a recurring theme within the 12 months’s first survey. Practically 4 in 10 imagine that improvement begins and deal quantity will decline considerably over that stretch. A couple of-quarter of respondents cited tighter underwriting by lenders to be the standout development. A smaller group, 11 p.c, say {that a} flight to security and core markets would be the major results of modified circumstances.

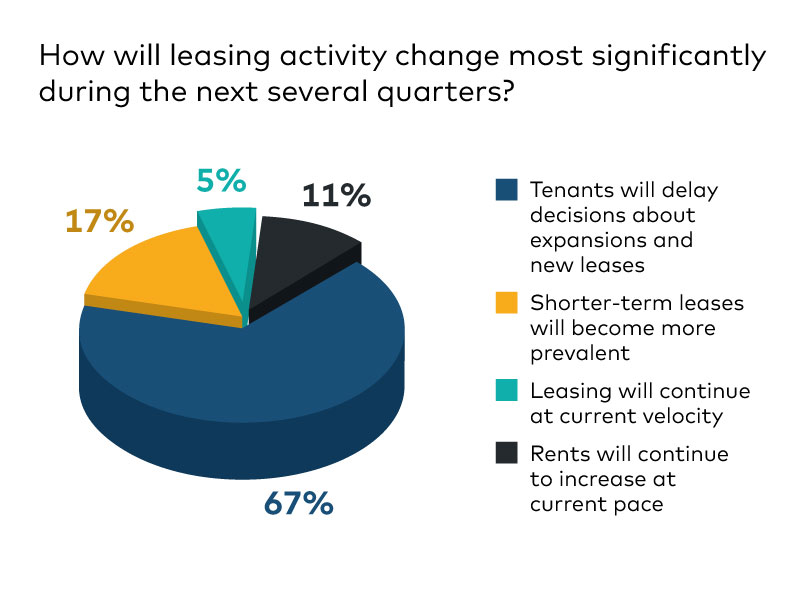

If the projections of this survey’s respondents foreshadow the long run, leasing quantity will proceed to take successful. Tenants will delay each commitments to new leases and increasing their current footprints, in accordance with 67 p.c of members. One other 17 p.c anticipate short-term leases to be extra prevalent throughout the subsequent few quarters.

If the projections of this survey’s respondents foreshadow the long run, leasing quantity will proceed to take successful. Tenants will delay each commitments to new leases and increasing their current footprints, in accordance with 67 p.c of members. One other 17 p.c anticipate short-term leases to be extra prevalent throughout the subsequent few quarters.

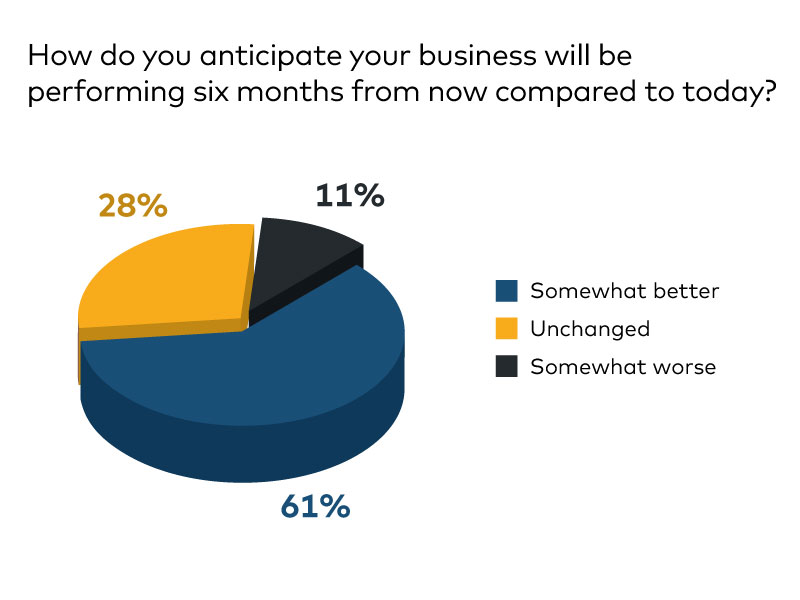

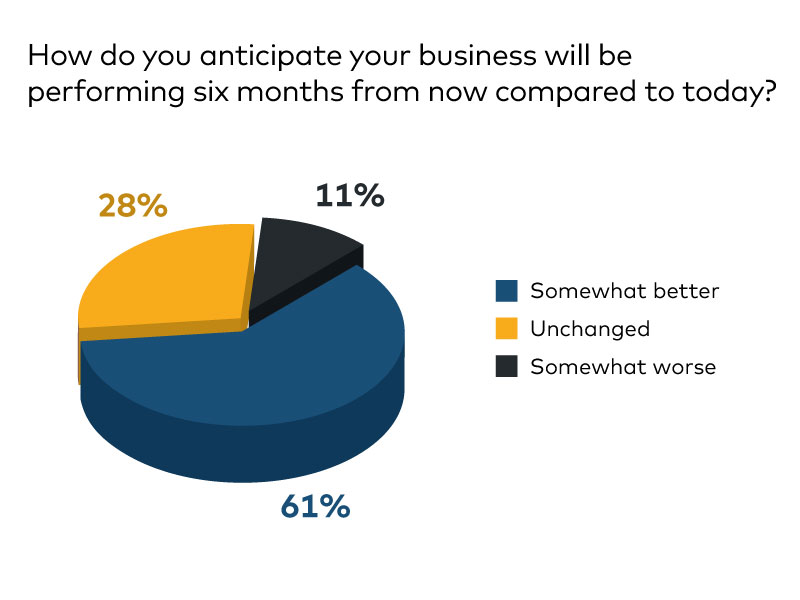

Given the considerations in regards to the affect of an financial slowdown, nevertheless, respondents are unexpectedly upbeat in regards to the efficiency of their very own companies. Sixty-one p.c say they anticipate their enterprise to be performing higher in six months than it’s immediately. In final 12 months’s first-quarter survey, solely 23 p.c predicted improved efficiency, whereas 62 p.c stated that they anticipated unchanged situations.

Given the considerations in regards to the affect of an financial slowdown, nevertheless, respondents are unexpectedly upbeat in regards to the efficiency of their very own companies. Sixty-one p.c say they anticipate their enterprise to be performing higher in six months than it’s immediately. In final 12 months’s first-quarter survey, solely 23 p.c predicted improved efficiency, whereas 62 p.c stated that they anticipated unchanged situations.

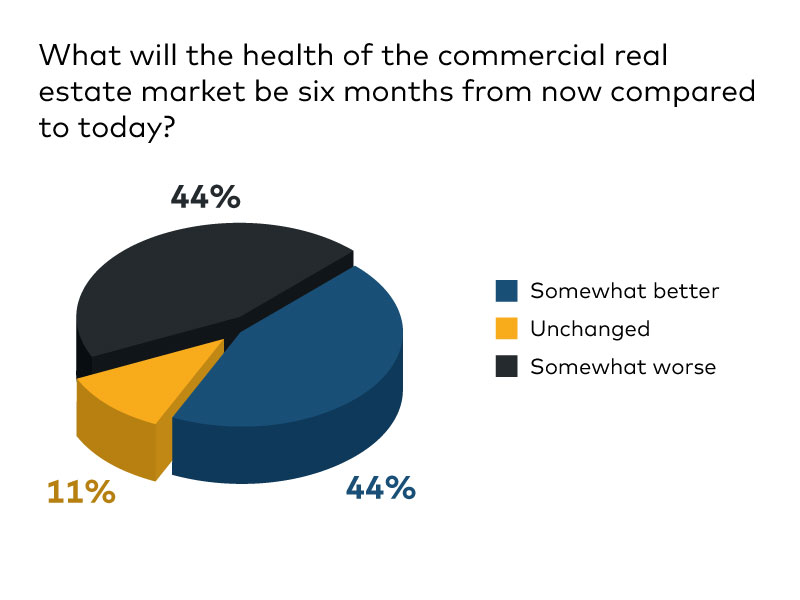

A notable shift has taken place in expectations for the trade’s prospects this 12 months within the sense that extra respondents foresee large change. Through the first quarter of 2022, a big plurality—46 p.c—agreed that the trade’s well being can be unchanged six months sooner or later.

A notable shift has taken place in expectations for the trade’s prospects this 12 months within the sense that extra respondents foresee large change. Through the first quarter of 2022, a big plurality—46 p.c—agreed that the trade’s well being can be unchanged six months sooner or later.

With a attainable recession in sight, a majority within the newest survey see large change forward. But they’re cut up down the center over the path of that change. Forty-four p.c anticipate the trade to be considerably much less wholesome, and 44 p.c say industrial actual property will likely be more healthy.

That makes it outstanding that CPE 100 members skew barely extra pessimistic in regards to the economic system than they did at the moment in 2022. Final 12 months, 23 p.c stated that they anticipated the economic system to be performing worse in six months. That share ticked as much as 39 p.c throughout the first quarter. However, the proportion of respondents who say that the economic system will likely be doing higher this 12 months stays near final 12 months’s—39 p.c in comparison with 38 p.c.

That makes it outstanding that CPE 100 members skew barely extra pessimistic in regards to the economic system than they did at the moment in 2022. Final 12 months, 23 p.c stated that they anticipated the economic system to be performing worse in six months. That share ticked as much as 39 p.c throughout the first quarter. However, the proportion of respondents who say that the economic system will likely be doing higher this 12 months stays near final 12 months’s—39 p.c in comparison with 38 p.c.