Internet earnings for workplace properties has grown tougher and tougher to take care of because the variety of challenges for the sector has continued to develop. The nationwide emptiness charge as of September was 17.8 %, as might be seen in the latest CommercialEdge market bulletin, having constantly gone up because the pre-pandemic 13.4 %. The markets are burdened with massive quantities of debt, a lot of which is slated to mature within the close to future signaling excessive misery on the horizon, whereas banks and buyers are making efforts to decrease their publicity to the asset class.

As of October, the quantity of debt in U.S. workplace markets reached $920 billion, in keeping with the CommercialEdge evaluation of greater than 80,000 properties. Manhattan registered by far the most important quantity at $174.5 billion, nearly triple that of Los Angeles which took second place with $60 billion. Then again, the smallest quantities of debt have been expectedly seen in smaller markets similar to Raleigh–Durham and Nashville, each clocking in at roughly $7 billion.

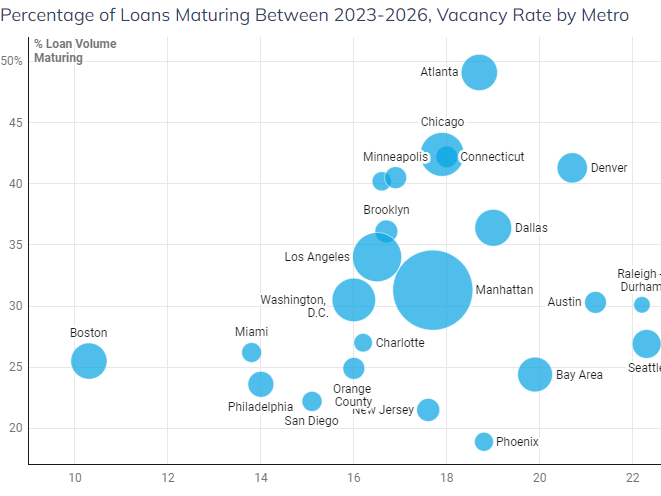

Proportion of loans maturing between 2023-2026, Emptiness charge by metro. Chart courtesy of CommercialEdge

Impending misery on the horizon

Nationally greater than 16.1 % of all loans are slated to mature by the tip of subsequent 12 months, representing $148.2 billion. Metro Houston will see the best share of maturities on this subsequent 12 months at 29.7 % or $8 billion. By means of the tip of 2026, the ratio of due loans shoots as much as practically one third, at a complete exceeding $300 billion. Greater than half of the debt in Atlanta and Houston will attain maturity on this time-frame, at 52.6 and 50.5 %.

Misery throughout the markets has registered a pointy enhance, and is predicted to rise additional, with 5.8 % of CMBS loans being delinquent as of October this 12 months, 400 foundation factors above the determine registered in October 2022, in keeping with the CRE Finance Council and Trepp knowledge quoted available in the market bulletin. CMBS and collateralized mortgage obligation issuers securitized $3.7 billion of workplace loans by means of the primary three quarters of 2023, a 75 % year-over-year drop, as revealed by Business Mortgage Alert.

Learn the complete CommercialEdge market bulletin.