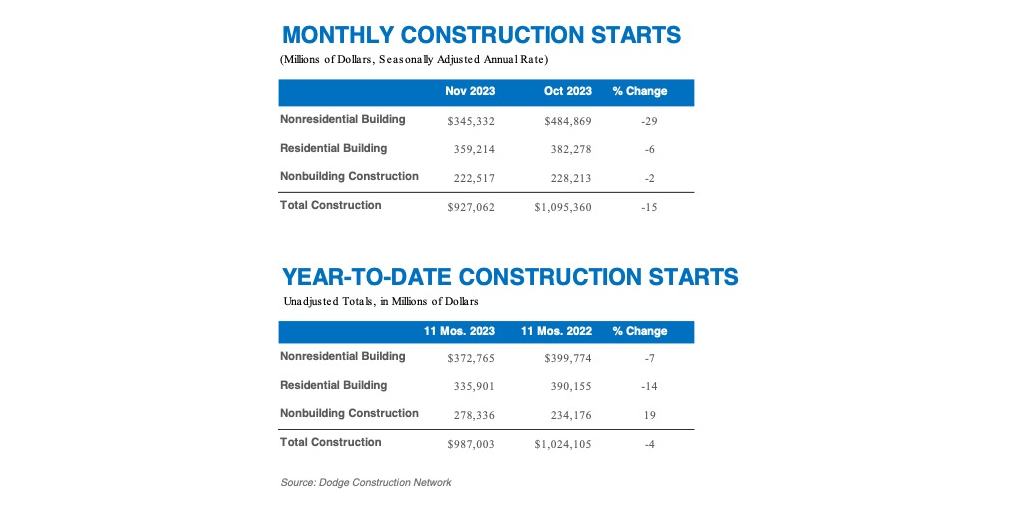

Building begins have dropped 15 % in November to a seasonally adjusted annual charge of $927 billion, in keeping with the most recent report from Dodge Building Community.

The nonresidential, residential and nonbuilding sectors all noticed a dip in development begins, however the nonresidential aspect noticed the most important impression with a 29 % plummet. In comparison with the October report, development begins misplaced much more momentum in November.

Building begins within the U.S. continued to drop in November. Desk courtesy of Dodge Building Community

When trying on the year-to-date numbers, complete development begins had been down 4 % in comparison with the identical time interval final 12 months. Extra particularly, residential begins noticed a 14 % lower and nonresidential noticed a 7 % decline, whereas nonbuilding begins noticed a 19 % enhance in year-to-date statistics.

READ ALSO: Revitalizing Vacant Workplaces By way of Housing Conversions

Trying on the 29 % drop for nonresidential constructing begins, the Dodge report reveals that manufacturing begins fell a staggering 74 % after a powerful October. The report additionally discovered a 19 % decline with business mission begins, with solely workplace buildings seeing a slight uptick. Regardless of the general downward momentum, institutional development begins rose 7 % as a result of an lively health-care sector.

In response to the Dodge report, the most important nonresidential initiatives to interrupt floor in November embrace the $1.9 billion Youngsters’s Hospital of Philadelphia Inpatient Tower in Pennsylvania and the $1.6 billion LG Vitality Battery Plant in Queen Creek, Ariz.

Weak momentum till mid-2024

Whereas not as extreme of a decline because the nonresidential sector, development begins with each nonbuilding and residential initiatives additionally noticed a slight downward development. Nonbuilding development begins fell 2 % in November to a seasonally adjusted charge of $223 billion, with the most important mission to interrupt floor final month being the $834 million I-405 Brickyard to SR 527 enhancements in Bothell, Wash. Residential development begins dropped 6 % to a seasonally adjusted charge of $359 billion in November. The most important multifamily mission to start out development was the $200 million 55 Broad Road conversion in New York Metropolis.

In response to Richard Department, chief economist for the Dodge Building Community, development begins are feeling the impression of upper rates of interest from the Federal Reserve. Department added in his ready assertion that development begins will stay weak till the midpoint of 2024, following an anticipated charge minimize from the Federal Reserve originally of subsequent 12 months.