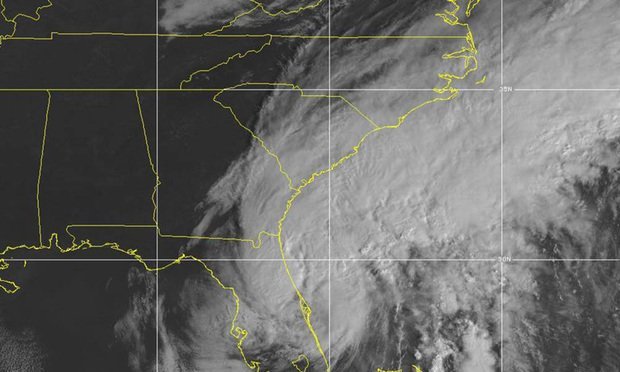

Hurricane Ian is, and continues to be, a harmful and harmful power, inflicting loss of life, damage, and disruption. Some estimates of financial harm working a minimal of $30 billion and presumably as excessive as $70 billion.

Though it can take time to get correct numbers, Trepp estimated the industrial actual property publicity in what has been one of many hottest markets within the nation.

Begin with mortgage publicity. The overall is $51.95 billion, primarily based on the hurricane path forecast from September 28 by way of 30. Company lenders are on the hook for $31.07 billion, or about 61% of the overall, largely Fannie Mae and Freddie Mac. Business mortgage-backed securities (CMBS, largely Conduit and SASB) are one other $17.27 billion. In third place are industrial actual property collateralized mortgage obligations (CRE CLOs) at $2.98 billion.

Subsequent, Trepp checked out metropolitan statistical areas (MSAs) and ranked them by excellent mortgage balances after which by share at excessive danger—at the very least 4 on a scale of 1 by way of 5—of environmental-related bodily harm (ERPD) or environment-related enterprise interruption (ERBI).

“Tampa and Orlando account for about 46% of the overall mortgage publicity,” Trepp famous. “Cape Coral, the MSA taking the brunt of Hurricane Ian’s preliminary power, accounts for roughly 4% of the publicity (excellent steadiness of $2 billion) with 99% of the properties at excessive danger for bodily harm and 76% at excessive danger for enterprise interruption.”

However Jacksonville has an $8.1 billion danger, the third highest. Essentially the most in danger in different states are Charleston-North Charleston, South Carolina ($2.9 billion excellent); Savannah, Georgia ($2.0 billion); Hilton Head Island, South Carolina ($0.8 billion); Myrtle Seashore, South Carolina ($0.4 billion); Hinesville, Georgia ($0.1 billion); and Brunswick, Georgia ($0.1 billion).

Then there’s the are the forms of properties: multifamily, retail, lodging, healthcare, workplace, cell residence, industrial, and different. Trepp solely offered a breakout for Cape Coral-Fort Myers in Florida, however the specifics for any locality is vital. The potential for property harm is of nice concern, however enterprise interruption is a further layer of concern.

Retailers, as an illustration, might expertise a interval of no operation, doubtlessly affecting the power of them to pay lease and of landlords to have money circulate for their very own operational bills. With heavy harm in vacationer areas, lodging amenities are certain to take a success.

Multifamily tenants aren’t companies, however they rely upon with the ability to work. Once more, that will not be doable as their employers could possibly be shut down as a consequence of situations. And below Florida legislation, landlords are accountable for various issues, together with, in absence of particular well being, housing, or constructing codes, upkeep of plumbing, roof, home windows, screens, roof, flooring, and different structural elements. Additionally, working water and sizzling water, in addition to warmth through the winter.

There don’t appear to be apparent exceptions, and the legislation is stringent. “A tenant should notify the owner, in writing, by hand supply or mail, of noncompliance with Florida legislation or the necessities of the rental settlement. The written discover shall additionally point out the tenant’s intention to terminate the rental settlement as a consequence of this noncompliance. The tenant might terminate the rental settlement if the owner fails to return into compliance inside seven days after supply of the written discover.”