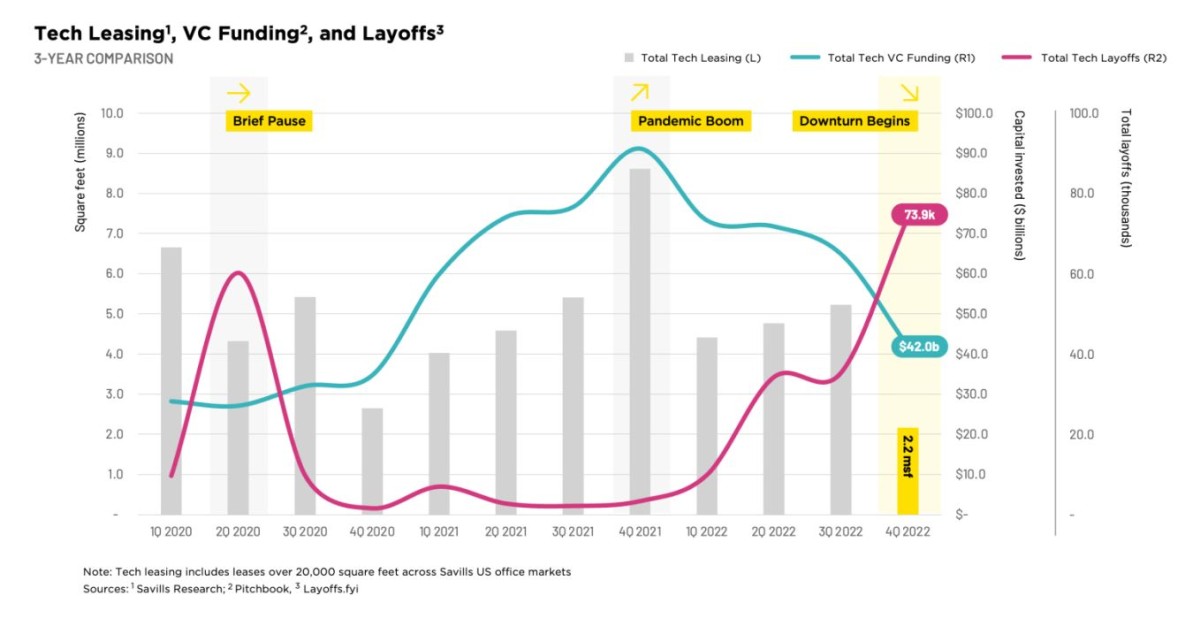

Spurred by layoffs, post-pandemic impacts on house necessities wanted for a altering office and financial headwinds, expertise firms, as soon as the main workplace occupier within the U.S., are leasing much less house resulting in important drops in tech leasing.

In line with the newest Savills The Tech Tenant report, the expertise trade leased 2.2 million sq. toes of workplace house within the fourth quarter of 2022, the bottom quarterly quantity leased within the final 5 years. The house, which incorporates leases over 20,000 sq. toes throughout U.S. markets tracked by Savills, was down 57 p.c from the typical quarterly complete of 5.1 million sq. toes leased by the pandemic earlier than the fourth quarter of 2022. It was down 74 p.c from the quarterly common of 8.6 million sq. toes two years previous to the pandemic.

Workplace leasing throughout the tech sector dwindled on the shut of 2022, as enterprise capital funding stalled, trade layoffs surged and firms continued considering find out how to use workplace house going ahead. Chart courtesy of Savills

A latest CBRE report discovered finance and insurance coverage corporations changed expertise firms for the best share of the highest 100 U.S workplace leases final yr, accounting for 25—or greater than double their share in 2021 and practically one-quarter of the highest 100’s complete sq. footage of 30.3 million sq. toes leased in 2022. Citing the impression of hybrid work on the sector, CBRE stated tech corporations accounted for 17 of the highest 100 leases final yr, down from 36 in 2021. CBRE famous total leasing was down versus 2021 when the highest 100 U.S. workplace leases totaled 30.7 million, stating rising rates of interest and better building prices probably influenced bigger occupiers to remain in present house and renew slightly than incur build-out prices with a brand new lease.

Colin Yasukochi, Govt Director, CBRE Tech Insights Heart. Picture courtesy of CBRE

Colin Yasukochi, govt director, CBRE Tech Insights Heart, stated tech firms had robust progress lately as they responded to e-commerce and different pandemic-related tendencies that boosted revenues and led to elevated hiring and workplace leasing. However now, confronted with a mix of macroeconomic points, together with decreased revenues because the post-pandemic financial system began to normalize, and a transfer towards extra hybrid work, tech firms are trying more durable at extra workplace house and shrinking their actual property portfolios.

“The expansion constructed into their earlier workplace house commitments is unlikely to materialize within the subsequent 5 years. They don’t want to carry onto all that house,” Yasukochi stated. “We’re seeing loads of house come again to the market.”

READ ALSO: US Cities Lead the World in Tech

Brad Tisdahl, CEO of Tenant Danger Evaluation, stated the tech trade is right-sizing companies to the brand new panorama.

Brad Tisdahl, Founder & CEO, Tenant Danger Evaluation. Picture courtesy of Tenant Danger Evaluation

“Tech bought very huge and there was extra capital shifting round and extra alternative for them to maneuver round and tackle new bets,” he stated. “Tech has been shedding employees and because of this making headlines to cut back house in loads of markets.”

In October, for instance, Meta, the guardian of Fb and Instagram, introduced it was exercising an early termination clause and giving up 200,000 sq. toes of house at 225 Park Ave. South in Manhattan. Meta had beforehand halted plans to increase house at 770 Broadway and within the Hudson Yards growth on Manhattan’s Far West Facet. Meta reduce on house in different tech hubs across the U.S. in latest months, together with deciding to sublease practically 600,000 sq. toes at 400 W. Sixth St. in Austin, Texas. In January, Meta stated it was giving up 435,000 sq. toes at 181 Fremont St. in San Francisco that housed Instagram workers. Meta additionally terminated a 457,000-square-foot-lease in a two-building Silicon Valley workplace campus. Within the Seattle market, Meta stated it might sublease a six-story constructing close to downtown Seattle and a 325,000-square-foot house in Bellevue, Wash.

READ ALSO: Prime 10 Markets for Workplace Deliveries in 2022

David Nelson, Regional President, Brokerage, Northern California/Nevada, Kidder Mathews. Picture courtesy of Kidder Mathews

Meta is just not the one main tech participant to backtrack on workplace plans within the Seattle space in latest months. Google notified the Metropolis of Kirkland, Wash., that it was not going to purchase a 10-acre automobile dealership property, the place it was planning a significant redevelopment and house for as many as 6,000 workers. Microsoft stated it might not be renewing a 561,494-square-foot lease in downtown Bellevue.

David Nelson, regional president, brokerage, Northern California/Nevada for Kidder Mathews, famous workplace vacancies are excessive in San Francisco, hitting about 25 p.c, and subleasing exercise can be important, with about 8.9 million sq. toes accessible in subleases up to now within the first quarter. He stated 2022 ended with about 9.5 million sublease house accessible.

Shadow house

Nelson raised one other subject, a pattern he calls shadow house—workplaces which are nonetheless being leased however not at present occupied or subleased. Nelson stated that’s more durable to trace.

“The general slowdown in San Francisco was actually underway previous to the layoffs because the pandemic has actually taken a toll on the workplace market there,” Nelson stated, including “It’s been onerous getting individuals again to the workplace.”

READ ALSO: Designing the Suburbs of the Future

Nelson stated it’s unclear whether or not firms will renew the identical quantity of sq. footage when a few of that shadow house at present beneath lease comes up for renewal due to the impression of distant and hybrid work. He expects that almost all firms that haven’t deserted the market will renew, although presumably for much less house.

Max Saia, Director of Investor Analysis, VTS. Picture courtesy of VTS

Max Saia, director of investor analysis at VTS, a New York-based expertise platform that gives knowledge insights and options to the industrial actual property trade, stated leasing difficulties within the Bay Space are anticipated to proceed all year long. He doesn’t count on to see indicators of significant workplace demand restoration in San Francisco till 18 to 24 months from now.

The most recent VTS Workplace Demand Index reported the biggest decline in demand for workplace house in January was in San Francisco, with a 37.8 p.c year-over-year drop, adopted by Seattle and Chicago, whose VODIs fell 30.3 and 29.9 p.c year-over-year, respectively. The smallest decline was in Boston, whose VODI fell 10.5 p.c from a yr in the past, adopted by New York Metropolis and Washington, D.C., each of which declined 11.9 p.c year-over-year. The VODI at present solely tracks U.S. gateway markets, so no Solar Belt markets are included in its evaluation.

“Though [tech] layoffs aren’t as huge of a shock because the pandemic and WFH [work from home] insurance policies, it’s one thing that will probably be a net-negative by the remainder of the yr,” Saia stated. “Clearly the tech sector is being impacted essentially the most on this financial downturn, and we’re seeing that mirrored by rounds of layoffs. These financial headwinds could have hostile impacts for workplace demand—notably with these firms having decreased headcount.”

With a robust jobs market and a file low unemployment charge nationally at 3.4 p.c, laid-off expertise employees could also be discovering associated work in different industries. Although Tisdahl famous that “doesn’t present a lot solace to the landlords which have loads of tech tenants. The final six to eight months have been an actual painful time period for individuals in tech and for landlords that lease to tech tenants.”

Flight to high quality

VTS discovered New York Metropolis and Los Angeles’ demand for brand new workplace house are recovering extra rapidly than a market like San Francisco. New York Metropolis has regained virtually 50 p.c of its preliminary pandemic decline in total new workplace leasing and Los Angeles 40 p.c of its total decline, in line with the VODI. By comparability, VTS notes San Francisco has solely recovered 25 p.c of its demand for brand new workplace leasing, probably because of the tech-dominated financial system that has traditionally been extra remote-friendly, even previous to the pandemic.

Saia stated each tenant’s scenario is completely different however “the net-trend is certainly towards decreasing their total footprint and a few type of discount in house wants is sort of a default assumption being made by our clients as we speak.”

One pattern that does appear to be persevering with is the flight to high quality. Yasukochi stated it’s extra prevalent in downtown markets.

“When that does happen, usually we see firms taking much less house however prepared to pay extra,” he stated.

Steven Rotter, Vice Chairman, Brokerage, JLL. Picture courtesy of JLL

Steven Rotter, JLL, vice chairman, brokerage, and co-leader of the expertise and media staff in New York, stated the flight to high quality pattern appears to be pairing recently with one other rising pattern—the push to get employees again to the workplace.

“All the brand new developments in New York, San Francisco, Austin, Miami and Chicago are essentially the most energetic proper now,” Rotter stated.

He stated employers are saying ‘We wish you again within the workplace and the excellent news is we’ve got a brand-new workplace, nicer, newer workplace house,’ as they encourage present workers to return to the workplace and compete with different firms to land the most effective expertise by leasing in just lately constructed Class A buildings with extra facilities together with gyms, outdoors areas and full-service cafes.

Rotter stated landlords of Class B buildings are additionally more and more making investments of their properties to be aggressive and entice tenants who need a number of facilities however don’t wish to pay Class A rents.

Rotter stated regardless of the detrimental headlines concerning the leasing market there was enchancment in latest months.

“I’m seeing main exercise within the huge cities and seeing hub and spoke workplaces in among the secondary and tertiary markets,” Rotter stated.

He pointed to markets like Los Angeles, the place the studio manufacturing trade is booming and spurring workplace leasing and Denver, the place many individuals moved to throughout the COVID-19 pandemic for a greater high quality of life. Different energetic markets he cited embody Chicago and Dallas.

READ ALSO: Behind the Rise of Mass Timber Towers

In New York Metropolis, Rotter and Vice Chairman Joe Messina represented personal fairness agency KKR when it closed on a deal in January to lease the 220,000-square-foot house at 30 Hudson Yards that Meta declined to resume. KKR already occupied greater than 300,000 sq. toes of house at 30 Hudson Yards.

30 Hudson Yards. Picture courtesy of Greg Isaacson

Rotter stated a giant pattern in New York Metropolis is giant enterprise capital firms which have traditionally been situated on the West Coast leasing house on the East Coast to supervise portfolio investments in New York, Boston or different East Coast markets. Rotter stated his staff has dealt with three within the final yr.

As for the tech firms, Tisdahl notes there’ll all the time be some churn within the trade impacting workplace leasing. A tech firm may be shedding employees in some capability now however that doesn’t imply they received’t be including, rehiring or requiring new house sooner or later. He pointed to Elon Musk, who made headlines in late 2021 when he moved Tesla’s headquarters out of California to Texas. In late February, Musk introduced the electrical automobile firm can be opening a worldwide engineering headquarters in Palo Alto, Calif.