Few traits have had a larger affect on industrial actual property finance and funding lately than the 16-month sequence of rate of interest hikes by the Federal Reserve. That’s probably behind the tendency of most industrial actual property decision-makers are probably taking a wait-and-see method within the wake of the Fed’s determination to pause fee hikes final month, in accordance with the most recent CPE 100 Sentiment Survey.

Few traits have had a larger affect on industrial actual property finance and funding lately than the 16-month sequence of rate of interest hikes by the Federal Reserve. That’s probably behind the tendency of most industrial actual property decision-makers are probably taking a wait-and-see method within the wake of the Fed’s determination to pause fee hikes final month, in accordance with the most recent CPE 100 Sentiment Survey.

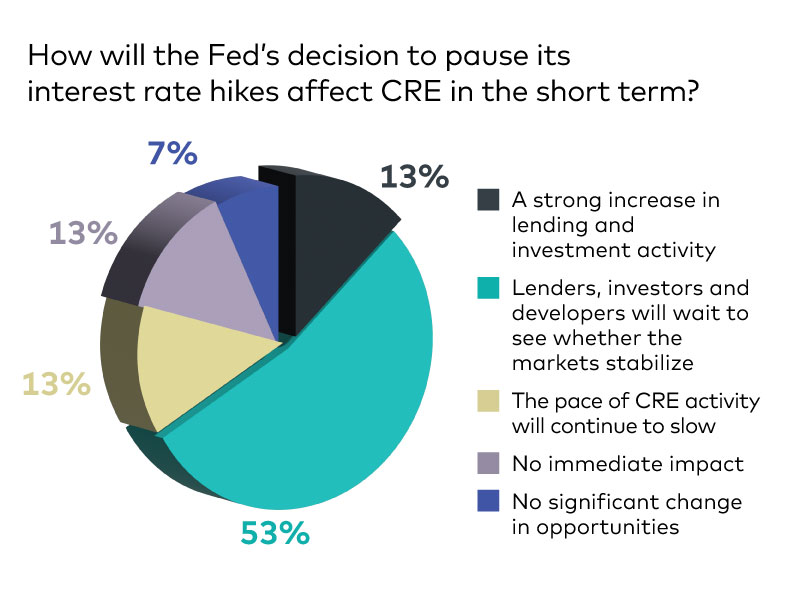

Fifty-three % of respondents agreed that the short-term method of traders, builders and lenders might be to attend and see whether or not the markets are stabilizing. Solely 13 % stated that the pause within the will increase that started 16 months in the past will immediate a robust enhance in lending and funding exercise.

That tally was a noteworthy, if maybe unsurprising, results of the quarterly survey of the CPE 100, an invited group of trade leaders representing a broad cross-section of economic actual property enterprise areas.

That tally was a noteworthy, if maybe unsurprising, results of the quarterly survey of the CPE 100, an invited group of trade leaders representing a broad cross-section of economic actual property enterprise areas.

A rising consensus of Fed-watchers is that the central financial institution is poised to hike charges once more this month. Federal Reserve Chair Jerome Powell will announce the choice on July 26.

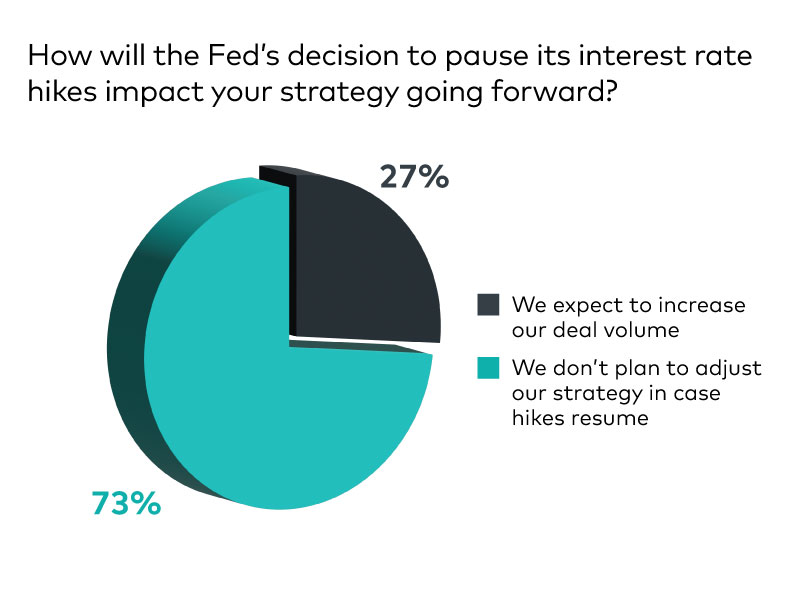

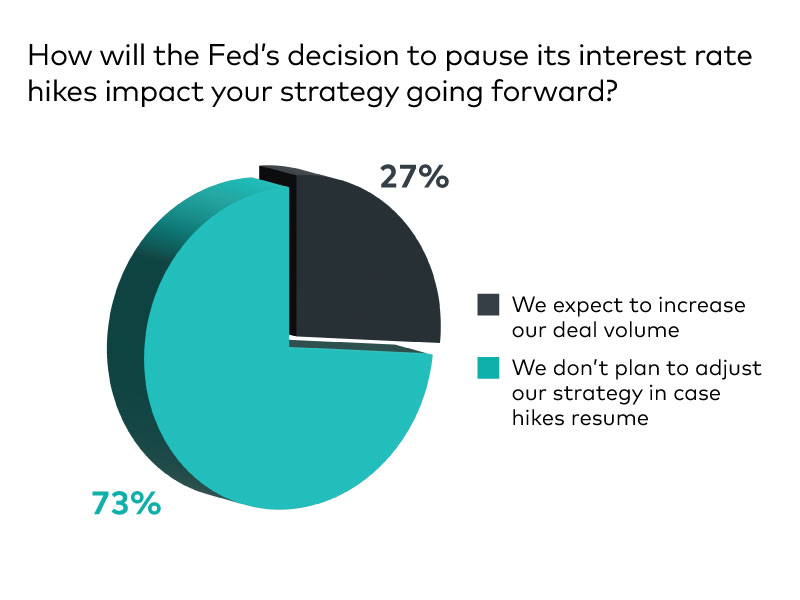

Furthermore, executives are taking an equally cautious method to their firm’s technique, given the Fed’s current monitor document of elevating charges. Solely about one-quarter indicated that they anticipate an uptick of their deal quantity on account of the Fed’s determination to pause hikes.

Furthermore, executives are taking an equally cautious method to their firm’s technique, given the Fed’s current monitor document of elevating charges. Solely about one-quarter indicated that they anticipate an uptick of their deal quantity on account of the Fed’s determination to pause hikes.

On the opposite finish of the spectrum, 73 % stated that they don’t anticipate to change their technique in case the central financial institution begins elevating charges once more.

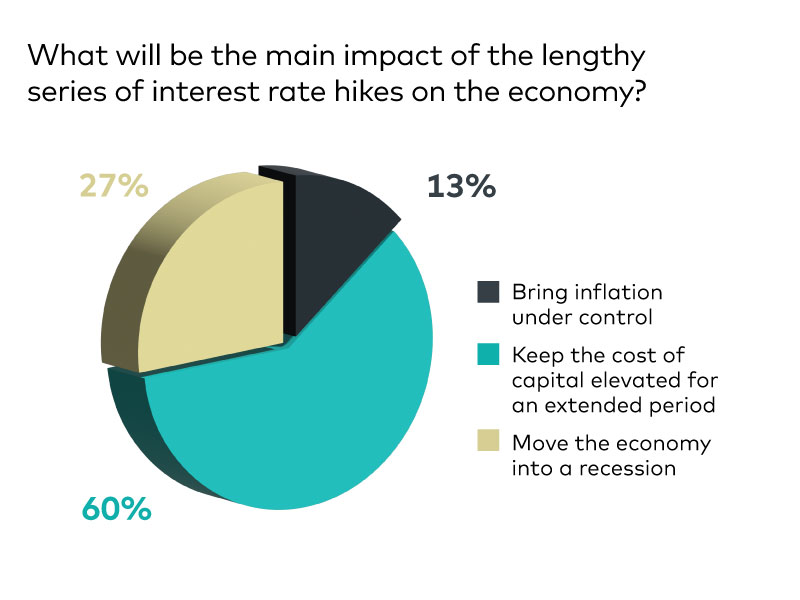

Concerning the speed hikes’ most salient impact, 60 % of respondents instructed CPE that the principal end result might be an prolonged stretch of upper capital prices. One other 27 % consider that the speed hikes will push the financial system into recession.

Concerning the speed hikes’ most salient impact, 60 % of respondents instructed CPE that the principal end result might be an prolonged stretch of upper capital prices. One other 27 % consider that the speed hikes will push the financial system into recession.

Solely 13 % agree that bringing inflation below management would be the most important outcome.

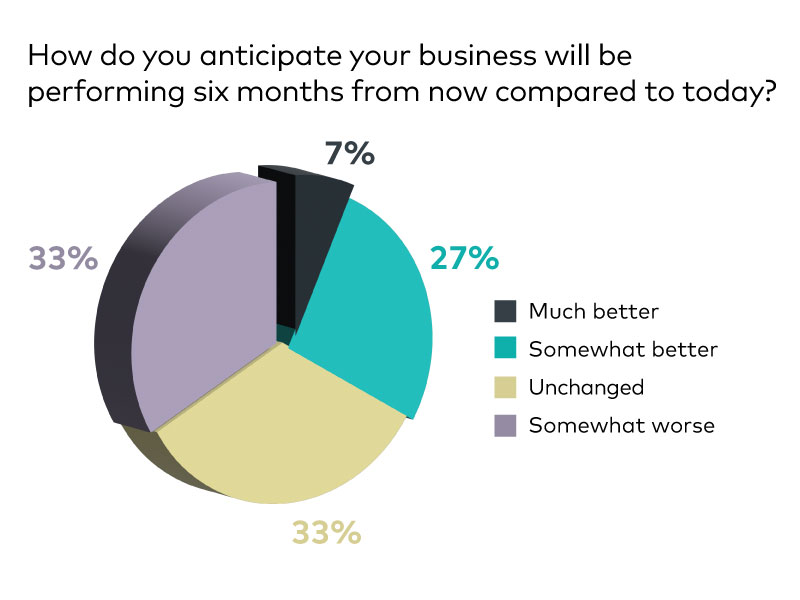

As they maintain off on main changes to their technique, the CPE 100’s view of the market’s prospects this 12 months have ticked down. Essentially the most placing change was in respondents’ expectations in regards to the efficiency of their very own companies.

Within the first-quarter survey, 61 % of respondents stated that they anticipated their corporations to be performing higher in six months. That share has dropped almost in half for the reason that first quarter.

Within the first-quarter survey, 61 % of respondents stated that they anticipated their corporations to be performing higher in six months. That share has dropped almost in half for the reason that first quarter.

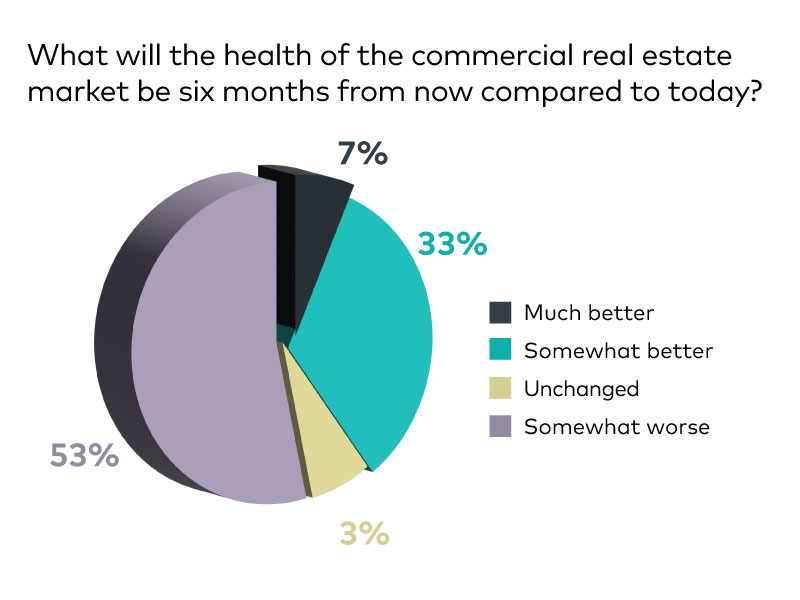

About 40 % of respondents say that the trade’s well being in six months might be considerably higher or a lot better, virtually similar to the primary quarter outcomes. However 53 % of respondents anticipate the trade to be performing considerably worse in six months, up from 44 % within the first quarter.

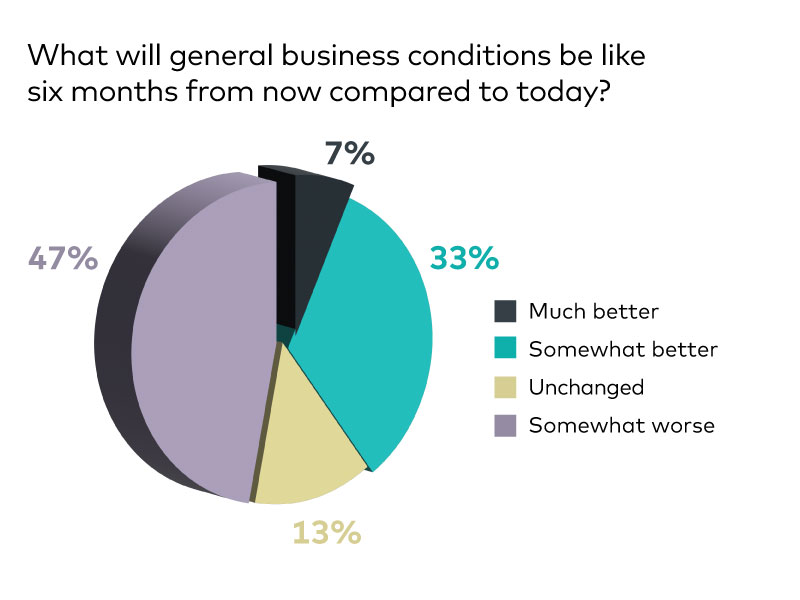

Concerning the well being of the financial system, the extent of optimism stays just about unchanged. The share of the CPE 100 who anticipate the financial system to be not less than considerably higher six months from now continues to be 40 %. But the share of survey contributors believing that financial situations will worsen edged as much as 47 % in the course of the second quarter from 39 % within the first quarter.

Concerning the well being of the financial system, the extent of optimism stays just about unchanged. The share of the CPE 100 who anticipate the financial system to be not less than considerably higher six months from now continues to be 40 %. But the share of survey contributors believing that financial situations will worsen edged as much as 47 % in the course of the second quarter from 39 % within the first quarter.