Vertical Chilly Storage, Bolingbrook, Unwell., warehouse. Picture courtesy of Vertical Chilly Storage

The chilly storage phase, a small however rising area of interest inside the broader industrial sector of business actual property, has seen substantial development because the pandemic and trade consultants anticipate that to proceed, pushed by growing demand and wish for temperature-controlled storage and transportation of meals, prescription drugs and chemical substances.

Business Property Government took a better take a look at this market, focusing primarily on meals storage and transportation, and located investor curiosity in chilly storage started climbing as e-commerce began surging, notably through the COVID-19 disaster. Developments within the meals provide enterprise that started pre-pandemic, such because the rise of meal prep kits and grocery dwelling supply companies, took off through the pandemic.

A June 2022 CBRE analysis report on the chilly storage sector acknowledged e-commerce’s share of whole grocery gross sales within the U.S. was anticipated to rise from 13 % in 2021 to 21.5 % by 2025. Based on CBRE, there was roughly 225 million sq. ft of U.S. chilly storage actual property in 2022. Citing USDA figures, CBRE reported there was about 3.7 billion cubic ft of gross refrigerated storage capability, up 2.2 % from 2020.

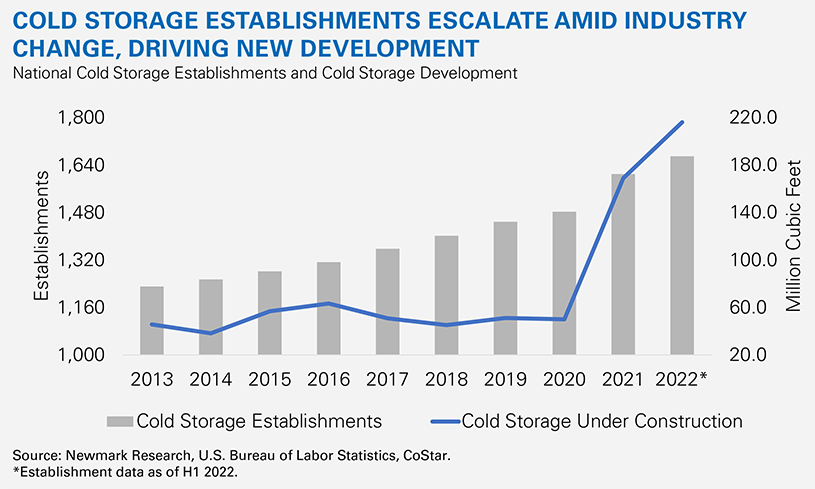

Chilly Storage Growth. Chart courtesy of Newmark Analysis

A March 2023 Newmark report acknowledged nationwide chilly storage growth hit an all-time excessive of 9.8 million sq. ft—an estimated 216.2 million cubic ft—by the tip of 2022. Between 2013 and 2020, annual common development had been 2.2 %. By comparability, the general variety of chilly storage services jumped 8.6 % from 2020 to 2021 and an extra 7.5 % from 2021 to the primary half of 2022, in accordance with Newmark.

David Sours, Senior Vice President of Nationwide Meals Amenities Group, CBRE. Picture courtesy of CBRE

David Sours, senior vice chairman of CBRE’s Nationwide Meals Amenities Group, informed CPE chilly storage constructing deliveries soared through the pandemic, with a 46 % improve in 2021 over 2020 and a 93 % year-over-year improve in 2022.

“It definitely helped the expansion trajectory fairly dramatically,” Stephen Levine, govt managing director, industrial & logistics at Newmark, stated of the spike in e-commerce lately and the way it’s boosted demand for extra chilly storage growth and attracted extra traders.

READ ALSO: Nearshoring Is Boosting Provide Chain Resilience

West Hutchison, president & CEO of Vertical Chilly Storage, a rising firm that develops and operates chilly storage and logistics options throughout the U.S., agreed.

“Vertical Chilly Storage was fashioned previous to the pandemic, however sure, COVID-19 accelerated among the traits within the market that we see demand for, like e-commerce, meal kits and prescription drugs,” Hutchison informed CPE.

West Hutchison, President & CEO, Vertical Chilly Storage. Picture courtesy of Vertical Chilly Storage

Sponsored by actual property funding agency Platform Ventures, Vertical Chilly Storage operates seven distribution facilities with a complete of greater than 2 million sq. ft of warehouse house. In late Might, the corporate acquired MWCold, operator of two temperature-controlled warehouses totaling about 545,000 sq. ft within the Indianapolis space.

The biggest of the 2 belongings is a two-story, 390,000-square-foot chilly storage facility inbuilt 1956 on a 13.3-acre web site that options blast freezing, export companies and fast thaw. The multi-modal web site has 33,000 pallet positions and 46 dock doorways and is served by CSX and Norfolk Southern railroads. The 159,000-square-foot Pendleton, Ind., warehouse has 19,600 pallet positions and 15 dock doorways and might deal with a number of temperature zones right down to -20°F. The places of the 2 services allow two day or much less service to 75 % of U.S. and Canadian populations.

Noting the corporate is each buying and constructing greenfield chilly storage services, Hutchison stated, “We’re in energetic negotiations for extra acquisitions and are in numerous levels of planning for a number of greenfield and growth initiatives.”

Stephen Levine, Government Managing Director, Industrial & Logistics, Newmark. Picture courtesy of Newmark

He stated plans for 2 ground-up services might be introduced quickly and each are anticipated to be working inside two years. Hutchison didn’t say the place these belongings can be constructed however the firm has properties in Florida, North Carolina, Nebraska, Indiana and Texas. The January 2022 acquisition of Lone Star Chilly Storage marked the agency’s entry into one of many nation’s key logistics markets, Dallas-Fort Price. Lone Star Chilly Storage owned one property in Richardson, Texas, a 227,331-square-foot warehouse with 5.6 million cubic ft of storage, 17,982 pallet positions and 40 dock doorways. The power has seven multi-temperature rooms from -20 to 45 levels with companies together with blast freezing and case choosing.

“We like the present markets we’re in and are actively seeking to proceed rising in these markets in addition to others all through North America, whether or not that’s in conventional main markets, rising markets which were historically seen as secondary, and even distant places if a buyer wants manufacturing help,” Hutchison informed CPE.

Rising markets in chilly storage

Lisa DeNight, nationwide industrial analysis managing director at Newmark, stated Dallas and Houston by far grew their chilly storage inventories probably the most over the previous 5 years.

Lisa DeNight, Nationwide Industrial Analysis Managing Director, Newmark. Picture courtesy of Newmark

“It surpassed the New Jersey/New York/ Philadelphia larger statistical space,” she famous, including that the Dallas-Fort Price metro “is poised to surpass that bigger market when it comes to chilly storage stock by 12 months finish.”

Amanda Ortiz, industrial & logistics analysis director at CBRE, agreed.

“Dallas-Fort Price is the mecca for this type of exercise proper now. They verify plenty of these containers [like land and labor availability] in order that’s why there’s a lot extra growth and chilly storage occurring there,” Ortiz stated.

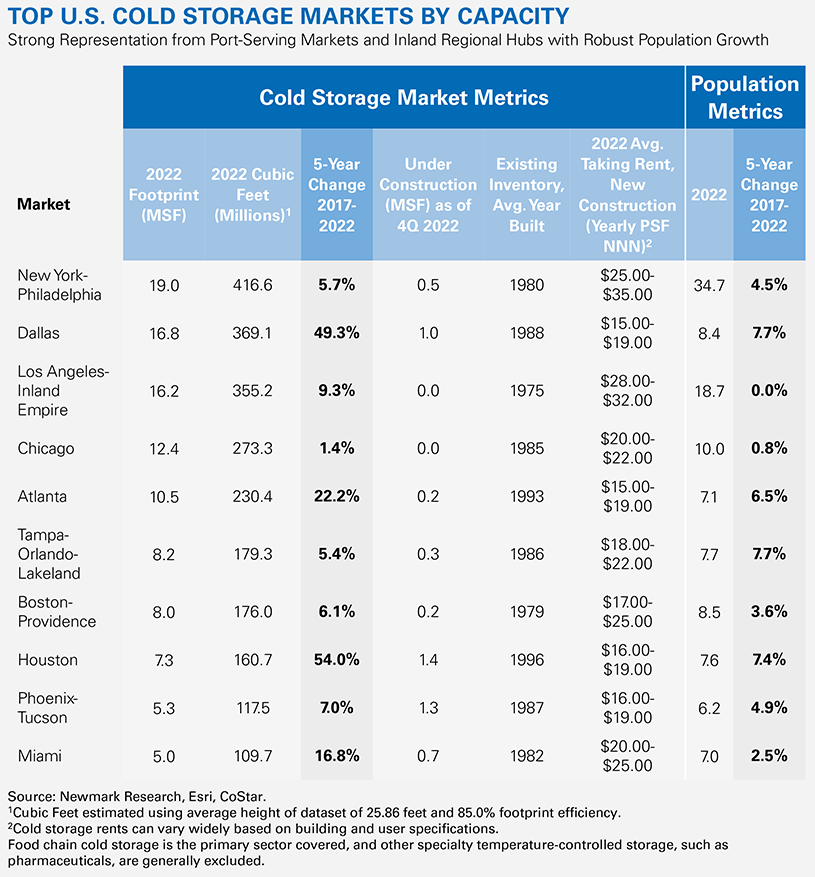

A listing of the nation’s prime 10 chilly storage markets by capability in Newmark’s March 2023 Industrial Perception report reveals main will increase in each Dallas and Houston, in addition to Atlanta and Miami. The truth is, seven of the highest 10 chilly storage markets are in Solar Belt states, six of which have seen the biggest will increase in chilly storage stock since 2017, with a median of 26.4 % improve in stock, in accordance with Newmark.

Amanda Ortiz, Industrial & Logistics Analysis Director, CBRE. Picture courtesy of CBRE

These figures mirror broader warehouse/distribution traits in these states, which have seen a median 4.8 % inhabitants development over the identical interval, Newmark stories. For instance, the New York-Philadelphia market, at present the highest U.S. chilly storage market with about 19 million sq. ft of house as of 2022, noticed a 5.7 % improve in capability through the 2017 to 2022 interval whereas quantity 2, Dallas, with 16.8 million sq. ft of house in 2022, had seen a bounce of 49.3 % throughout the identical stretch. Atlanta, quantity 5 on the record with 10.5 million sq. ft, elevated 22.2 %; Houston, quantity 8 on the record with 7.3 million sq. ft, had a 54 % improve and Miami, taking the quantity 10 spot with 5 million sq. ft, noticed a 16.8 % improve in capability.

“DFW as an entire is likely one of the largest industrial markets within the nation, rating within the prime three. They’ve bought land in every single place and you may attain an amazing quantity of inhabitants in a really quick period of time. And its proximity to Mexico and different ports makes it a supremely vital logistical hub,” stated Levine.

DeNight famous that whereas the ambient warehouse market has seen a major decline in new building this 12 months, down 30 % within the first quarter of 2023, new chilly storage growth “has remained extremely secure at possibly 9.6 million sq. ft.”

Looking forward to future growth, DeNight pointed to a late June announcement from Americold Realty Belief, a worldwide operator of roughly 250 temperature-controlled warehouses, and Canadian Pacific Kansas Metropolis rail community that they have been planning on finding chilly storage services alongside the railway from the U.S. Midwest to Mexico as half of a bigger plan to broaden intermodal transportation choices for chilly storage merchandise. The primary facility might be inbuilt Kansas Metropolis, Mo., and can hyperlink Chicago to stops in Mexico. The temperature-controlled service will concentrate on transport U.S.-produced meat to Mexico and Mexican produce to the U.S. in addition to streamlining border crossing procedures. CPKC has already elevated its fleet of refrigerated containers forward of the collaboration.

DeNight stated this type of cross-border direct rail hyperlink is an instance of shifts within the quantity of perishable items that might be coming throughout the borders and might be a “demand driver for the subsequent 5 to 10 to a few years sooner or later.”

Even with the uptick the chilly storage sector has seen lately, new deliveries are starting to sluggish from these pandemic-year highs. On the finish of the primary half of 2023, Sours stated there was a couple of 7 % improve in deliveries. With a couple of extra initiatives anticipated earlier than the 12 months is over, he expects the general improve might be about 10 to 12 % year-over-year from 2022.

“It’s nonetheless development however it’s slowing,” Sours stated.

Each Levine and Sours stated financial situations previously 12 months, notably the rising rate of interest surroundings, inflation and capital markets crunch, have performed a task in deal slowdowns on this sector in addition to within the broader industrial actual property market.

Investor curiosity in chilly storage will increase

However traders proceed to be interested in the chilly sector area of interest. Whereas it beforehand had been seen as very dangerous, it all of the sudden had a broader enchantment.

“It’s turn into a little bit of a darling inside industrial,” Sours stated.

CBRE’s “2022 U.S. Traders Intention Survey” discovered practically 40 % of respondents stated they have been pursuing chilly storage belongings in 2022, up from 22 % in 2021 and seven % in 2019. The CBRE June 2022 analysis report, “Chilly Storage Demand Grows Amid Tailwinds,” discovered traders have been interested in the market due to its development prospects and better yields in comparison with the normal warehouse sector. At the moment, strong demand had pushed the cap charge unfold between chilly storage and dry warehouses to as little as 50 foundation factors, in accordance with the CBRE report.

Levine stated funding curiosity got here from institutional traders, non-public fairness, household workplace traders, meals corporations “and everyone in between.” Some, he stated, have been extra profitable than others.

There has additionally been plenty of trade consolidation notably with the massive, world public refrigerated warehouse corporations like Americold and Lineage Logistics, which account for about 70 % of the North American whole chilly cupboard space. United States Chilly Storage controls about 10 % adopted by different corporations which can be additionally seeking to broaden organically and by way of acquisitions.

Prime U.S. Chilly Storage Markets. Desk courtesy of Newmark Analysis, Esri, CoStar

However as each Sours and Levine famous, chilly storage growth remains to be thought of a dangerous funding, notably within the present rate of interest surroundings. The Newmark report famous there are vital challenges, notably when creating speculative chilly storage services. Challenges embrace specialised expensive building, that are no less than twice the associated fee per sq. foot of conventional warehouses; excessive working prices; distinctive tenant necessities and inflexibility for potential future conversion as a result of a lot of the demand is shopper particular.

A few of the spec properties that have been most just lately constructed are nonetheless sitting empty, probably as a result of the builders constructed bigger belongings than the market might deal with or as a result of tenants had specialised wants that weren’t met by the spec services.

One other problem is getting old stock and the necessity for modernization, stated DeNight. Based on Newmark, the typical age of chilly storage services within the prime U.S. markets is 37 years. In California, the inventory is 49 years outdated on common, DeNight stated.