Picture by Gerd Altmann through pixabay.com

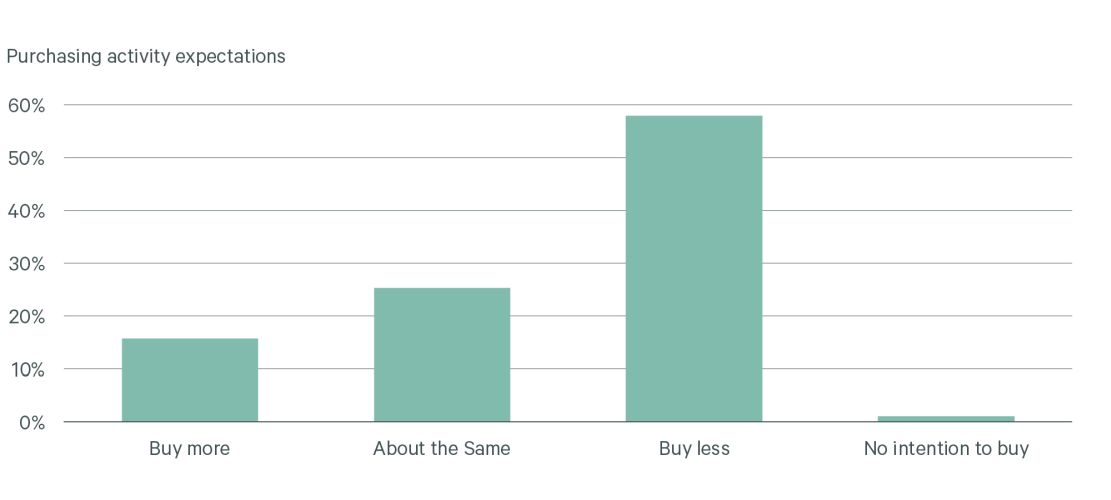

Citing rising rates of interest, a possible recession and restricted credit score, greater than half of the traders who participated in a brand new CBRE 2023 U.S. Investor Intentions Survey mentioned they count on to purchase fewer belongings this 12 months in comparison with 2022.

Practically 60 % of respondents count on to buy much less actual property than final 12 months, with nearly half saying they might lower their spending by greater than 10 %. The survey discovered solely 15 % count on to buy greater than final 12 months.

READ ALSO: What Will Retail Look Like in 2023?

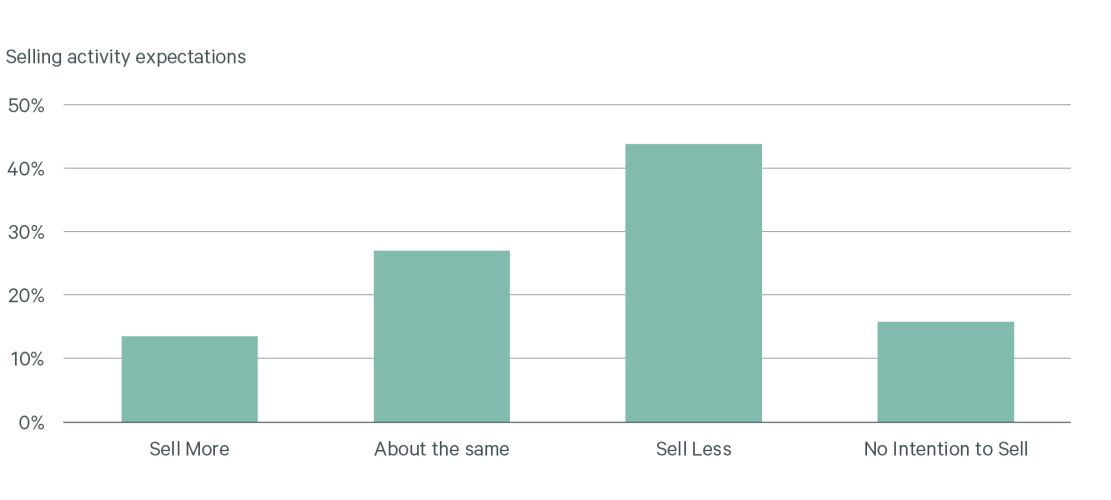

The macroeconomic situations that led to decreases in transaction volumes within the second half of 2022 and uncertainty about what’s forward for 2023 could also be inflicting industrial actual traders to hit pause on promoting this 12 months too.

MSCI Actual Property reported funding gross sales dropped 43 % in October 2022 from the earlier 12 months, to $42.8 billion—the third straight month of year-over-year declines. Pricing issues, particularly the widening bid-ask unfold between sellers and patrons, look like impacting plans for tendencies as properly. About 60 % of the respondents mentioned they are going to both promote much less actual property this 12 months than final 12 months or not promote in any respect. Solely 27 % instructed CBRE they count on to promote the identical quantity as final 12 months.

Buying exercise expectations. Chart courtesy of CBRE Analysis

With much less shopping for and promoting exercise anticipated, CBRE is forecasting the entire funding quantity to be down by 15 % from 2022. However the agency’s analysis group expects funding exercise to extend within the second half of 2023, as rates of interest and financial situations stabilize.

Promoting Exercise Expectations. Chart courtesy of CBRE Analysis

In an effort to chill inflation, which hit almost 40-year highs final 12 months, the Federal Reserve applied seven consecutive price hikes in 2022, elevating the goal federal funds price vary to 4.25-4.5 %. The federal funds price might surpass 5 % this 12 months because the Fed, which is aiming to get inflation again to a 2 % vary, is anticipated to hunt further rate of interest hikes at the very least within the early a part of 2023.

Funding methods

CBRE’s survey discovered extra traders count on to undertake opportunistic and debt methods this 12 months than final 12 months, due to enticing returns as a result of larger rates of interest and tighter monetary situations. Many additionally count on to start to see pricing reductions, maybe as a lot as 30 %, throughout industrial actual property sectors, with procuring malls and value-add workplace belongings anticipated to supply the best reductions.

Multifamily, notably condominium complexes, and fashionable industrial and logistics services in main markets are nonetheless anticipated to be essentially the most sought-after belongings for funding in 2023, in accordance with the CBRE survey. Retail traders favor grocery-anchored facilities and workplace traders are following the flight to high quality development and looking for largely Class A belongings in prime places.

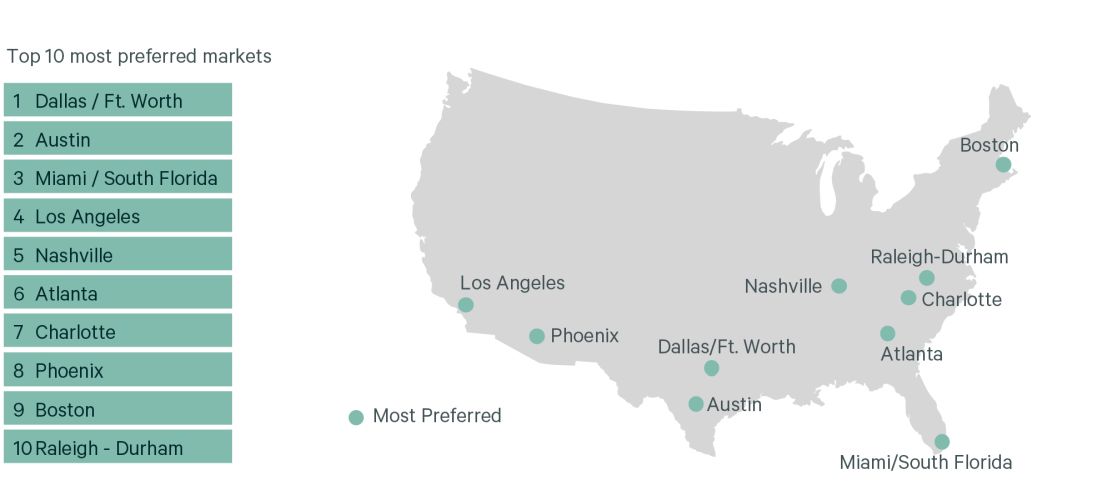

Prime 10 Most Most well-liked Markets. Chart courtesy of CBRE Analysis

Of these surveyed, nearly 70 % mentioned they don’t count on to alter their fund allocations this 12 months resulting from market situations. And most traders are nonetheless anticipating making investments in high-performing Solar Belt markets, led by Dallas-Fort Value and Austin in Texas, Miami, Los Angeles and Nashville, Tenn.