Calling 2023 a “yr of stabilization for the development business,” JLL’s 2024 forecast states a robust venture pipeline will preserve the business busy within the U.S. throughout the coming yr, regardless of greater rates of interest and slower non-public begins.

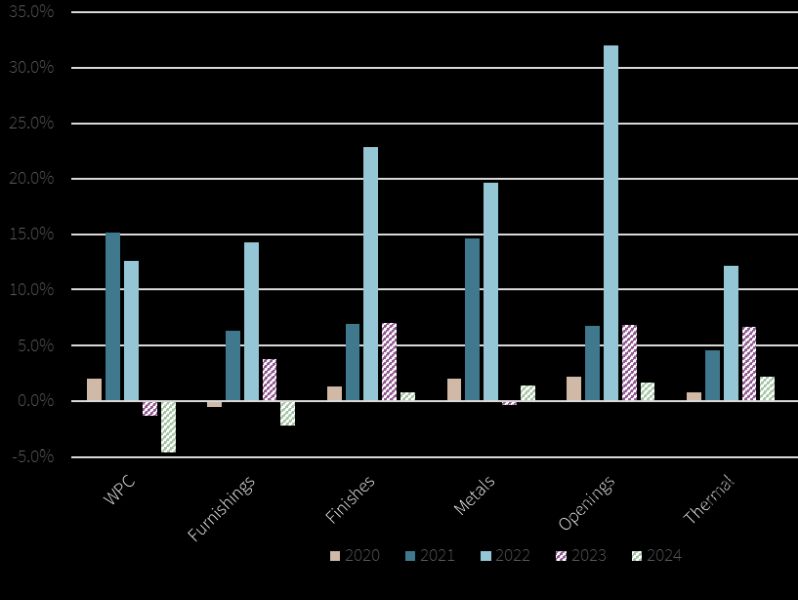

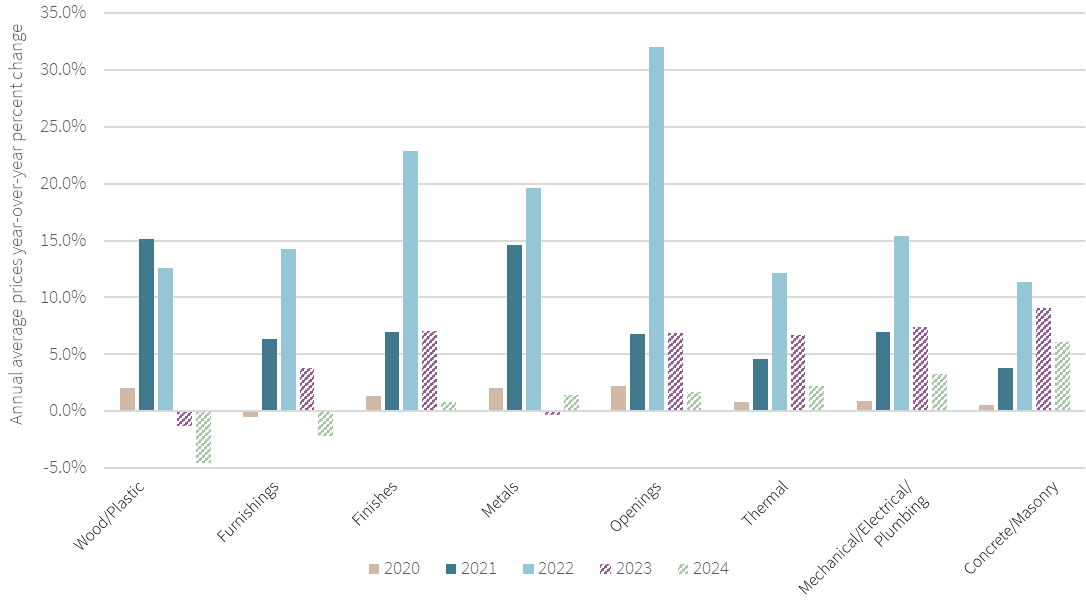

Publishing at the moment, JLL’s forecast for U.S and Canada development developments notes prices, provide chains and sector-specific wants within the constructed surroundings grew to become simpler to cope with in 2023, in comparison with post-pandemic provide chain points and shortages the earlier yr. JLL expects complete development prices will see a modest progress—between 2 % and 4 %—all through 2024. There shall be shorter lead occasions and extra steady costs for supplies, with electrical parts being a notable exception. Total, JLL tasks materials prices to rise between 2 % and 6 %.

Annual common costs for development supplies, year-over-year change. Chart courtesy of JLL Analysis, Bureau of Labor Statistics

Labor shortages are anticipated to persist, and development wages will improve to remain aggressive, most likely within the 3 % to five % vary. Sadly, the report notes that restricted labor availability is predicted to be an ongoing drawback. JLL states the development labor drive is already insufficient and tempo of progress shall be gradual all through 2024.

READ ALSO: Rising Traits for CRE in 2024 and Past

“Falling productiveness ranges and absence will drive contractors to prioritize retention and the business to speed up investments in tech in addition to various manufacturing methods,” the report notes.

JLL said whereas some AI and robotics might assist alleviate some labor constraints, present applied sciences can’t resolve the employee substitute drawback that’s anticipated to proceed for the foreseeable future.

‘Greater for longer’ impacts

Though the upper rates of interest and declining non-public begins haven’t slowed development spending considerably, the JLL report states there could also be results within the second half of 2024 from the so-called “greater for longer” rate of interest surroundings as tasks within the present pipeline ship. JLL cited declining architectural billings, which dropped probably the most in September since December 2020, as an affect later within the yr. Nonetheless, the JLL report states further public spending on infrastructure and manufacturing development is predicted to attenuate the full spending slowdown.

The rise in public-funded development also needs to stop value regression on supplies, in keeping with JLL. Development of tech-heavy areas may also preserve demand above manufacturing capability, which is predicted to affect the high-demand electrical merchandise probably the most. Whereas provide chains are manageable for now, JLL factors on the market are quite a few potential threats that would create volatility within the provide chain once more and push costs up, comparable to more and more frequent pure disasters, commerce conflicts and geopolitical tensions, which could possibly be heightened throughout the 2024 election yr.

Methods for achievement

The development developments outlook states the worldwide pandemic revealed there are inadequacies within the constructed surroundings that may be structural and sophisticated to resolve, so JLL provides three core methods for achievement for the yr forward for these within the development business.

- Know your folks: JLL states it’s necessary to construct sturdy partnerships with these with technical means and expertise to innovate and problem-solve in unsure occasions. The report describes retention, upskilling and belief constructing as vital expertise.

- Know your tasks: Each venture is totally different and it’s necessary to anticipate hurdles and know what instruments, comparable to synthetic intelligence and constructing info modeling, ought to be proactively deployed.

- Know your markets: Understanding market dynamics is extra necessary than ever. Those that shall be profitable will know how one can anticipate macro and micro impacts on folks and tasks, comparable to adjustments in environmental laws, materials prices and shifting preferences.