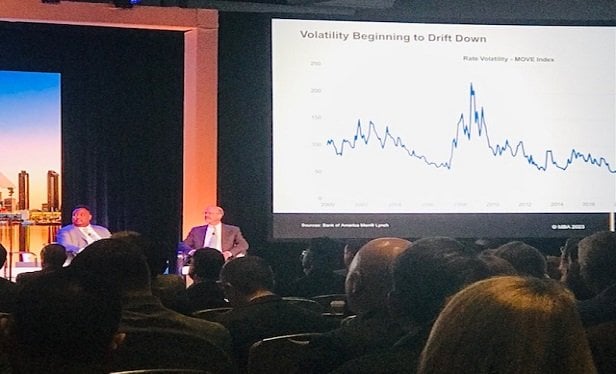

SAN DIEGO—The present uncertainty within the financial system and market is greater now than it was on the peak of the pandemic, in response to Mike Fratantoni, Chief Economist and Senior Vice President of Analysis and Business Expertise, Mortgage Bankers Affiliation. These uncertainties, he informed the viewers throughout the MBA CREF 23 convention and expo on Monday, vary from geopolitical uncertainties to coverage uncertainty and naturally, rate of interest coverage. “Count on that this volatility will come down as soon as the Fed reaches their peak fee, however it’s a huge characteristic of the market proper now,” he stated. “Our forecast is that the US shall be in a recession throughout the first half of this 12 months.”

The explanation: “The delayed influence of fee hikes will work their means by way of the financial system within the coming months.” In the meantime, the presently sturdy job market will diminish with the unemployment fee anticipated to rise, he added.

These traits are already turning into obvious in some metrics, he stated, noting that MBA believes that “long term charges are already pricing within the weak spot within the financial system.”

Jamie Woodwell, MBA’s Head of Industrial Actual Property Analysis, identified one other signal of the weakening financial system, specifically that borrowing and lending backed by business and multifamily properties slipped additional to shut out 2022. In keeping with MBA analysis, the final quarter of the 12 months sometimes sees the best volumes, however “the coolness attributable to rising rates of interest, questions on property valuations, and elevated financial uncertainty made the fourth quarter of 2022 the weakest of the 12 months.”

Woodwell continued that “Depositories have been the one main capital supply to extend volumes from the earlier 12 months, however even its fourth quarter exercise was roughly half of what it was a 12 months earlier. The general image is certainly one of slower borrowing within the face of what have been important shifts available in the market.”