Picture by Mike Petrucci on Unsplash

A broadening number of retail leisure ideas beckons customers—and due to this fact operators, builders and buyers, too—however though leisure spending is rising, quite a few obstacles must be navigated, in keeping with a brand new report from JLL.

“Shoppers need enjoyable experiences,” the report says, “and leisure ideas plan to open new areas to present them what they need.”

The {dollars} are there, JLL makes clear. Within the fourth quarter of final yr, spending on eating out within the U.S. jumped by 13.7 p.c year-over-year, whereas spending at amusement parks and arcades surged by 20.6 p.c year-over-year.

READ ALSO: Retail Leasing Tendencies to Watch

The preferred class, “eatertainment,” options meals, drink and a number of video games in a single venue and is predicted to see the very best variety of new areas. Dave & Busters, for instance, is among the many legacy manufacturers. Promising new ideas embody Andretti Karting & Video games, Fats Cats and EVO Leisure.

The classes of Digital Actuality (VR) and “Aggressive Socializing,” a single recreation together with food and drinks, are estimated to have the second and third most openings deliberate. Manufacturers to look at are Immersive Gamebox, Sandbox VR and Zero Latency VR, and Puttshack, Rooster N Pickle, X-Golf and Flight Membership, respectively.

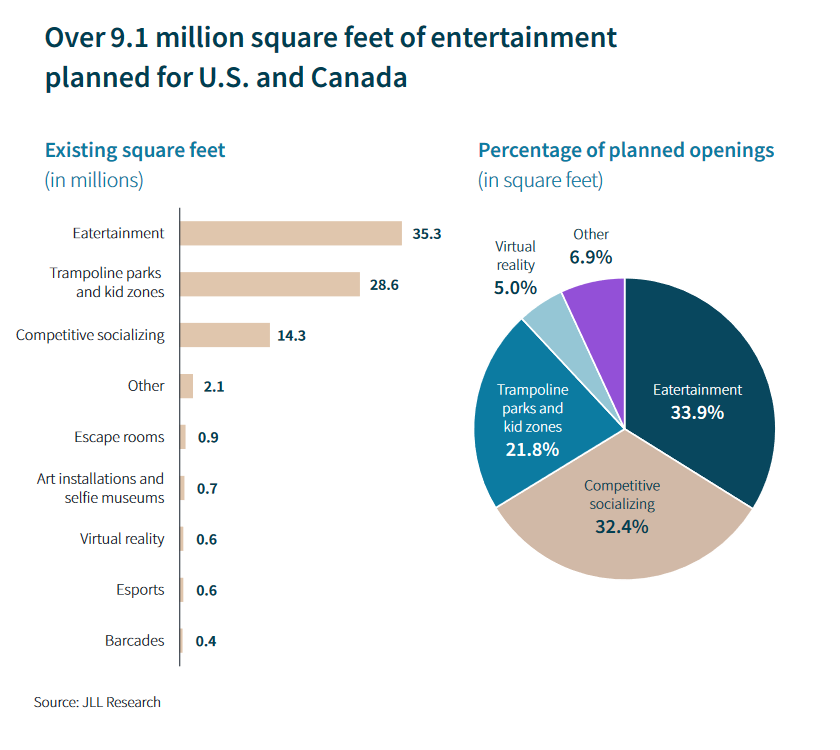

Over 9.1 million sq. toes of leisure deliberate for U.S. and Canada. Chart courtesy of JLL Analysis

Many of those ideas want substantial house, and JLL has recognized 9.1 million sq. toes of latest leisure house scheduled to open within the U.S. and Canada over the subsequent two years.

Financial obstacles

In order that’s the sizable potential, however there are additionally hurdles.

These bigger areas that many ideas want are expensive to construct, assuming the uncooked house could be discovered. JLL cautions that the largest impediment in negotiations between landlords and tenants is the amount of cash the owner must contribute in upfront development {dollars}, whereas tenant enchancment allowances for an costly idea might price as a lot as $400 per sq. foot.

Greater upfront development prices naturally result in larger rents over the lease time period, usually 10 to fifteen years. In an surroundings of rising rates of interest, this due to this fact favors landlords and tenants that may keep away from borrowing.

In short, JLL says, landlords need a confirmed idea led by a robust staff and/or backed by a strong marketing strategy, a creditworthy tenant (Puttshack obtained $150 million in development capital from BlackRock final yr), a tenant that matches inside a venture’s general imaginative and prescient, and the potential for repeated visits to the tenant.