As considerations over local weather change intensify and laws evolve, industrial actual property buyers and house owners are below rising stress to scale back carbon footprints of their properties, or “decarbonize” them. Most not too long ago, California handed the Local weather Accountability Package deal, which would require a big quantity private and non-private firms conducting enterprise within the state to report on their GHG emissions and disclose climate-related monetary dangers. This comes simply earlier than the anticipated SEC guidelines for climate-related dangers disclosures for all publicly traded firms. Except for regulatory stress, transitioning in direction of extra sustainable practices mitigates monetary and bodily dangers. However how ought to firms go about setting the fitting decarbonization targets and the way may they obtain these targets?

One usually used framework is the Carbon Threat Actual Property Monitor (CRREM) Pathway technique, which helps firms assess their carbon and vitality efficiency and decide when and the way a lot they should decarbonize in an effort to keep away from stranded belongings (properties vulnerable to financial obsolescence as a result of not assembly regulatory requirements or market expectations).

Understanding the CRREM Pathway

The objective of Carbon Threat Actual Property Monitor is to assist firms “assess, handle, and keep away from danger.” The CRREM Pathway gives a toolset for buyers and house owners to judge the publicity of their actual property belongings to carbon-related transition dangers, and its main goal is to supply a roadmap for decarbonizing properties in alignment with the worldwide local weather targets of the Paris Settlement.

Briefly, the CRREM Pathway gives sure steps that firms will comply with:

- Threat Evaluation: Start with a radical evaluation of properties to know the carbon-related dangers. The CRREM device might help decide the present and future regulatory publicity based mostly on location, kind of property, and different variables.

- Set Targets: Based mostly on the evaluation, firms would set clear decarbonization targets for every property. CRREM gives decarbonization pathways for numerous asset sorts, serving to house owners align with worldwide local weather targets.

- Stakeholder Engagement: Corporations collaborate with tenants, service suppliers, and different stakeholders. Stakeholder involvement is essential in implementing sustainable measures and attaining decarbonization targets.

- Decarbonization Measures: As soon as targets are set, firms will determine on and implement the vitality effectivity measures mandatory in an effort to assist the properties decarbonize.

- Monitoring and Reporting: Frequently monitor the carbon efficiency of the properties and evaluate the info to CRREM targets and forecasting.

The CRREM device is at present not as strong within the US as it’s in Europe – CRREM at present solely has information for fifteen US cities – nevertheless, there are methods across the lack of information by utilizing estimations to fill in gaps.

Decarbonization Proforma

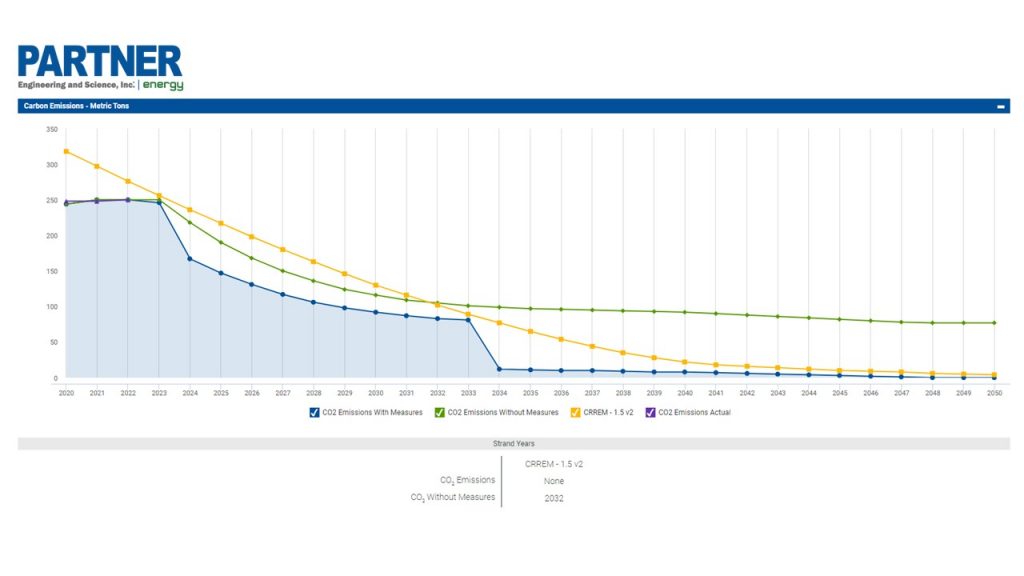

As soon as the shopper has dedicated to the CRREM Pathway or one other web zero carbon pathway, it’s time to plan which measures to implement in an effort to obtain the decarbonization objective. That is the place know-how can considerably ease the decision-making course of. Companion Vitality makes use of our Decarbonization Proforma device, which takes inputs from the pathway to calculate the present carbon efficiency of the property and predict future efficiency based mostly upon projected electrical utility decarbonization modeling.

The proforma features a listing of vitality conservation and electrification alternatives recognized for the location. The shopper can select the implementation yr for bettering a property, and the proforma will calculate the impact on carbon emissions permitting the shopper to satisfy carbon emissions discount targets for the property. This device permits shoppers to capital plan, evaluate their belongings to the CRREM Pathway, and monitor progress over time.

A Word on Stranded Belongings

An rising concern for industrial actual property buyers and house owners, notably within the context of decarbonization and the CRREM pathway, is the problem of stranded belongings. These are properties which can be vulnerable to a write-down or devaluation. Within the realm of sustainability and local weather change, belongings can turn out to be ‘stranded’ as a result of regulatory modifications, technological developments, or evolving market calls for that render sure properties much less priceless or completely out of date.

Implications for Business Actual Property

- Regulatory Stress: As governments the world over enact stricter carbon emission laws, properties that can’t meet these requirements might face penalties or larger taxes, rendering them much less worthwhile and even non-viable. An instance of that is NYC’s Native Legislation 97, which would require buildings over 25,000 sq. toes to attain 40% discount of emissions by 2030 and 80% by 2050. There are hefty penalties for non-compliance, together with $268 for each extreme ton of emissions above the cap yearly.

- Shift in Tenant Preferences: Tenants, each industrial and residential, are more and more searching for energy-efficient and sustainable properties. Whether or not it is because of an organization’s personal sustainability targets or private tenant preferences, buildings that fail to cater to those calls for might face larger emptiness charges. In sure circumstances, tenants might favor a sustainable property as a result of regulatory pressures on them. For instance, California’s WAIRE Program requires operators of warehouses within the South Coast AQMD space to scale back their nitrogen oxide and diesel emissions or be topic to charges. On this case, a warehouse property with EV charging stations could be extra preferable for the tenants occupying it.

- Transition Prices: Belongings which can be late to adapt may incur larger transition prices sooner or later. As an illustration, retrofitting an previous constructing to satisfy new vitality requirements might be considerably dearer than integrating these options throughout preliminary development.

The urgency to decarbonize industrial actual property properties will doubtless improve given the pending legal guidelines and laws, in addition to heightened investor expectations. The CRREM pathway gives a scientific and environment friendly strategy to this problem, although it’s not the one one out there. By integrating decarbonization pathways with sensible carbon discount strategies, CRE buyers and house owners can safeguard their belongings for the long run. For corporations with a big portfolio, decarbonization of a whole portfolio can appear a frightening job, however that is the place sustainability consulting agency and the fitting know-how might help by guiding the shopper towards their targets. For extra details about getting began with decarbonization, tune into Companion Vitality’s dwell webinar “Methods and Instruments for Reaching Decarbonization Objectives”.