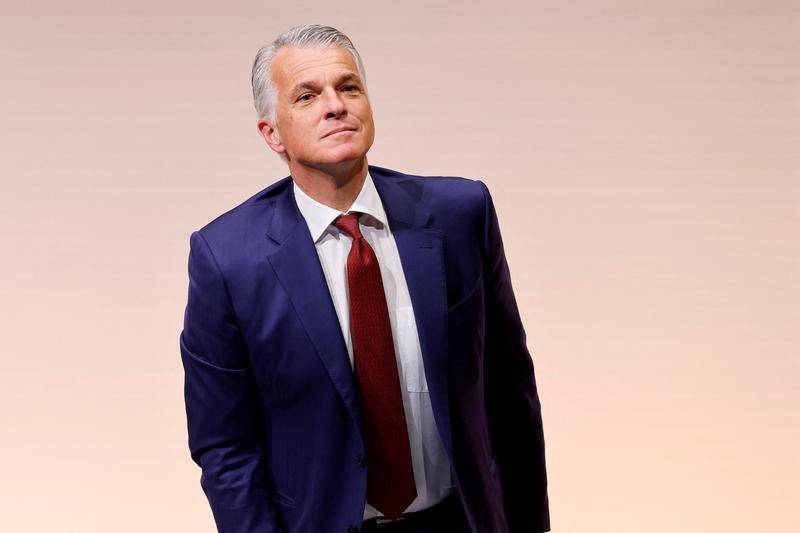

(Reuters) – Incoming UBS Chief Govt Sergio Ermotti has sought to ease worries concerning the measurement of the brand new financial institution being created by its takeover of Credit score Suisse.

Critics have voiced concern concerning the pressured deal, designed to assist safe monetary stability globally throughout a interval of turmoil, which can create a brand new Swiss financial institution with $1.6 trillion in property and greater than 120,000 employees.

“Even placing UBS and Credit score Suisse collectively, we gained’t be on the prime of the classification for worldwide banks by way of measurement,” Ermotti stated in an interview with Italian enterprise every day Il Sole 24 Ore.

“We’ve a very good place because of our actions, and our higher important mass at a worldwide stage will definitely give us one other benefit. The query of extreme measurement doesn’t come up,” added Ermotti, who’s Swiss however an Italian speaker.

Ermotti, who was beforehand chief govt of UBS from 2011 to 2020 and is now chairman of insurance coverage group Swiss Re, will take the helm on the financial institution from April 5.

He indicated that the mixed financial institution would persist with the profitable UBS technique.

“I keep that the mannequin ought to be that of the present UBS whose core options embrace a central function for wealth administration exercise and the containment of funding banking and its associated dangers,” he added.

In Switzerland, the general public and politicians have additionally voiced issues concerning the stage of state help for the banks, with almost 260 billion Swiss francs ($284 billion) in liquidity and ensures provided by the federal government and Swiss Nationwide Financial institution.

“In the event you have a look at the complete framework for the acquisition, I believe you may say that the ensures from the Nationwide Financial institution and Confederation are affordable,” Ermotti stated.

($1 = 0.9148 Swiss francs)

Writing by Keith Weir; Modifying by Emelia Sithole-Matarise