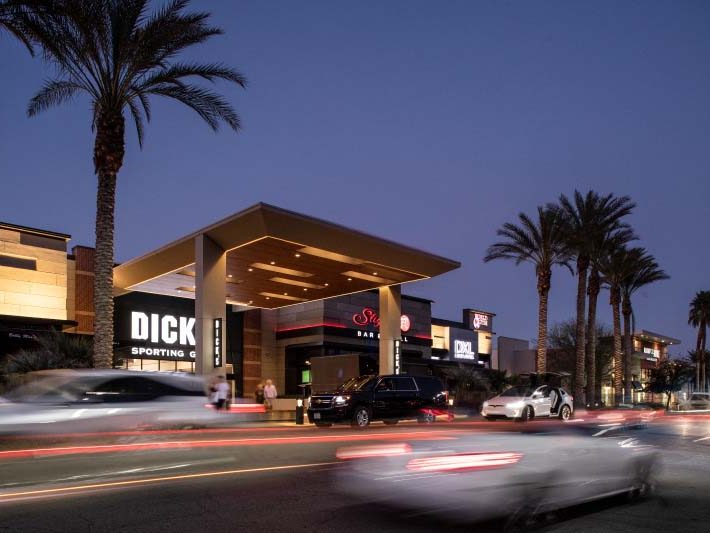

Dick’s Sporting Items anchors The Retailers at Palm Desert. Picture courtesy of Pacific Retail Capital Companions

Pacific Retail Capital Companions, a Los Angeles-based retail funding, growth and administration firm, has acquired The Retailers at Palm Desert, a virtually 1 million-square-foot enclosed mall in Palm Desert, Calif., within the coronary heart of Coachella Valley. The agency plans to rework the 72-acre property right into a mixed-use vacation spot.

Inbuilt 1982 and renovated in 2013, the mall had beforehand been owned by Europe-based Unibail-Rodamco-Westfield. The property went into foreclosures with a third-party particular servicer and the title was modified from Westfield Palm Desert to The Retailers at Palm Desert by October 2021. A 575,000-square-foot portion of the mall, not together with the anchor shops, had served as collateral for a $125 million interest-only mortgage that was securitized in 2014 into CMBS, in keeping with Trepp. In August, Trepp reported normal phrases for a mortgage modification and assumption had been agreed upon however no particulars got at the moment.

READ ALSO: When Will It Be a Good Time to Put money into Retail?

Most lately, URW offered Westfield Valencia City Heart, a 1 million-square-foot shopping center in Santa Clarita, Calif., to Centennial Actual Property in September as a part of its ongoing two-year deleveraging methods for U.S. properties. Centennial bought the asset for $4 million in extra of the property’s current $195 million debt; URW had defaulted on the mortgage in January. Additionally this 12 months, URW offered Westfield Mission Valley and Westfield North County Honest, two buying facilities with a complete of two.7 million sq. toes within the San Diego, Calif., space.

Palm Desert particulars

The one enclosed mall in Coachella Valley, The Retailers at Palm Desert attracts residents and vacationers alike. Anchored by JCPenney, Macy’s, Dick’s Sporting Items and Barnes & Noble, the mall has greater than 100 retail shops and eateries together with Champs Sports activities, H&M, Bathtub & Physique Works, Categorical, GameStop and Scorching Matter. World Health club, Elite Cosmetology and Faculty of the Desert are additionally tenants on the property positioned at 72-840 Freeway 111.

Whereas PRCP has not but introduced specifics for the location’s redevelopment, CEO Steve Plenge mentioned in ready remarks they plan to unencumber underutilized retail area and add a mixed-use part that would come with inexperienced area, multifamily housing and leisure choices. Plenge famous the corporate focuses on reworking and repositioning malls by way of a value-add technique.

PRCP offers, redevelopments

The Retailers at Palm Desert marks the second acquisition made by PRCP this 12 months. The primary one was in Might, when the agency entered the New Jersey market by buying the 1.2 million-square-foot Bridgewater Commons mall and the adjoining Village at Bridgewater Commons, a 94,000-square-foot open-air buying heart. PRCP assumed Bridgewater Commons’ current mortgage and secured an extension that may present the corporate time to execute its plan to rework the mall right into a mixed-use vacation spot.

READ ALSO: Right here Comes the Neighborhood: Blended-Use Initiatives’ Bid to Match In

Different mall-to-mixed-use initiatives PRCP is concerned in throughout the nation embody:

- The positioning of the previous Galleria at White Plains in White Plains, N.Y., the place PRCP, in partnership with the Cappelli Group and SL Inexperienced, has proposed a $2.5 billion mixed-use mission that might demolish the now shuttered 900,000-square-foot mall and two parking garages and construct seven residential towers with greater than 3,000 models, a meals corridor, retail retailers and pedestrian promenade. Practically half of the District Galleria web site could be open area.

- Yorktown Heart in Lombard, Sick., the place PRCP acquired the previous Carson’s anchor field and is reworking it right into a mixed-use vacation spot by including greater than 600 multifamily models and a park.

- The Retailers at South City in Sandy, Utah, the place efforts are underway to reposition the location right into a dwell, work and play setting by constructing greater than 1,000 multifamily models and including workplace and resort elements together with further retail and restaurant area.

PRCP additionally made its first foray into Arizona in September, when it assumed administration and leasing obligations at a 1.1 million-square-foot retail heart in Tucson, Ariz. Park Place entered particular servicing earlier this 12 months, when Brookfield Properties defaulted on a $200 million mortgage.