Regardless of their success in decreasing inflation to three.2 %, the Fed’s insurance policies have had deleterious impacts on business actual property finance, funding and growth, plunging transaction volumes and spiking capital prices, with the workplace sector taking a very unhealthy hit.

READ ALSO: In a Low-Deal Yr, These Transactions Stand Out

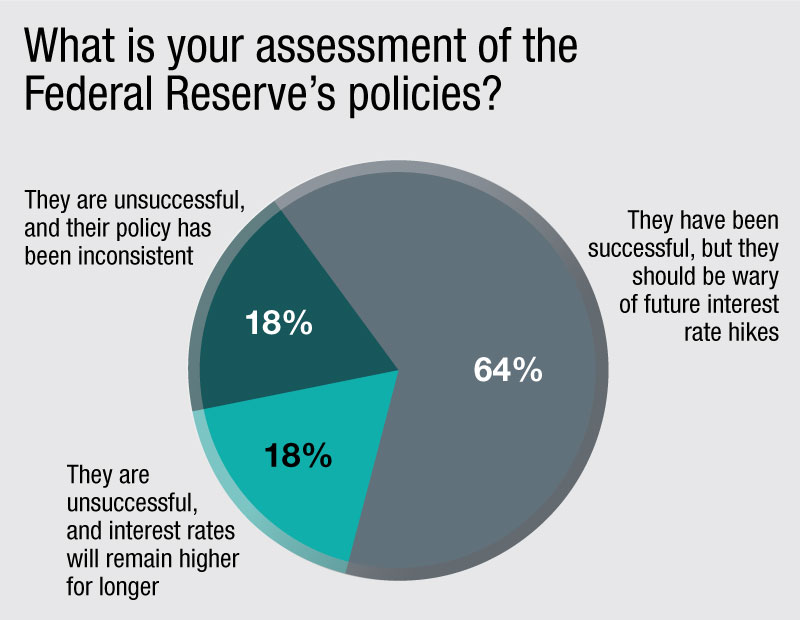

Nonetheless, respondents didn’t deny the insurance policies’ efficacy relating to the Fed’s said objectives of decreasing inflation. Almost two-thirds of respondents, 64 %, said that the Fed’s actions have been profitable, however that they need to be cautious of elevating charges additional.

Such a response displays a widespread trade sentiment across the Fed’s insurance policies, with many specialists beforehand telling CPE that the one means for lending to stabilize and for transaction volumes to extend is for there to be some “stability” within the Fed’s messaging and actions. In flip, one other charge hike, one that would occur as quickly as this month, would add to lots of the aforementioned difficulties.

The remaining 36 % of respondents said that the Fed’s insurance policies have been unsuccessful, with one camp saying that their general coverage of month-to-month raises and pauses has been inconsistent, and one other saying that charges will stay increased for longer. To some extent, this can be out of the Fed’s management, given latent political struggles, geopolitical tensions and bigger uncertainties round financial efficiency, significantly with regard to inflation itself. Merely put, there’s an excessive amount of out of the Fed’s management for one particular person resolution across the funds charge to make an influence.

Click on right here to enter our newest ballot, and to see the outcomes of earlier polls.