When do you assume the tempo of financing and transactions will decide up?

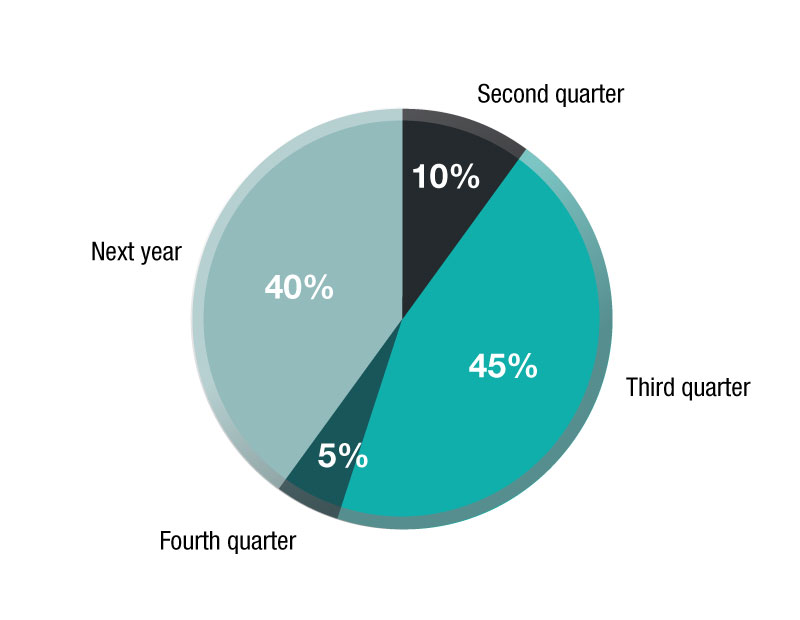

In CPE’s newest month-to-month ballot, industrial actual property professionals had been requested about their ideas on when the financing of latest offers, in addition to transaction volumes might attain extra productive ranges. The outcomes reveal a major majority seeing both the third quarter of this yr or someday in 2024 because the time wherein volumes will decide up the tempo in much less unstable lending environments.

The overwhelming majority of respondents see both the third quarter or 2024 because the instances dealmaking would almost certainly be on the upswing, probably as a result of Federal Reserve’s closing anticipated rate of interest hike in March, and a tapering-off of inflation in the summertime. By and enormous, the market has accounted for these will increase, and offers have slowed primarily because of lender and borrower pricing discrepancies. As such, 45 % of respondents see the financing and transaction quantity will increase coming within the third quarter, whereas 40 % see them coming subsequent yr.

READ ALSO: The 2023 CRE Outlook: CEOs Weigh In

On the other finish, 10 % see an acceleration of the above within the second quarter, whereas solely 5 % see it happening within the fourth quarter. These instances are in between anticipated alleviations to the present dealmaking panorama. Regardless of being a time when dealmaking is usually at its best degree, the fourth quarter is seen because the least probably time when transactions will decide up pace.

Click on right here to see CPE’s newest ballot, and the outcomes of earlier surveys.