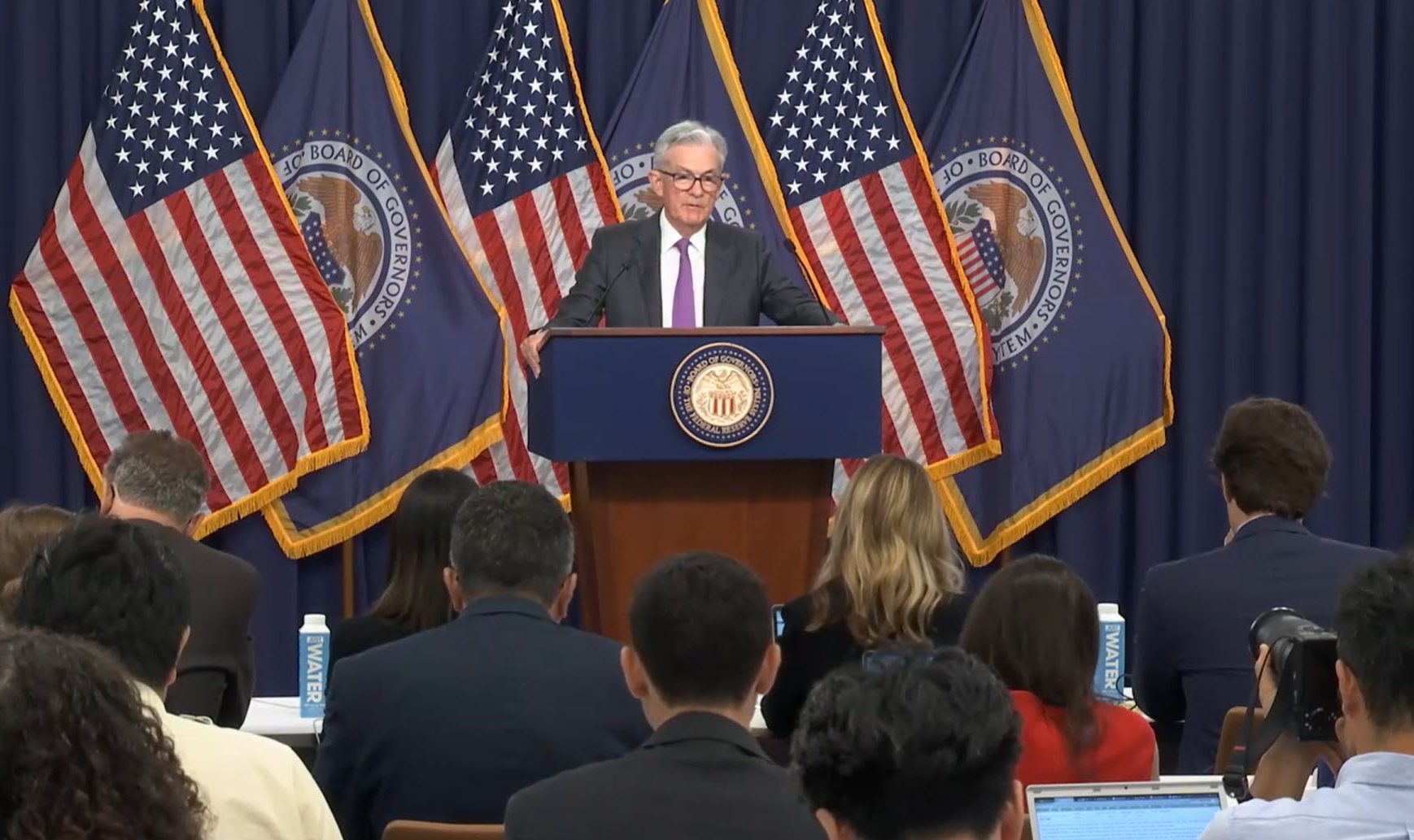

Fed Chair Jerome Powell answering questions on the July 26 press briefing. Screenshot by Gabriel Frank for CPE

On the Federal Reserve Open Markets Committee’s assembly on Wednesday, the central financial institution introduced its 11th fee hike since March 2022. The step raises the federal funds fee 25 foundation factors, to a variety of between 5.25 p.c and 5.5 p.c.

The broadly anticipated transfer follows final month’s pause on will increase, throughout which the Federal Reserve took inventory of the affect of its 10 consecutive will increase. “It should take time for the complete results of our ongoing financial restraint to be realized,” Fed chair Jerome Powell informed reporters following the announcement.

Additionally of notice, Powell stated that the central financial institution is not forecasting a recession. The choice to boost charges is accompanied by favorable knowledge for inflation, employment and wage development, all of which level to a resilient financial system. “The intermeeting knowledge got here in broadly in keeping with expectations,” he stated.

READ ALSO: US Market Stacks Up Properly Towards the World

On the similar time, these issues had been weighed with considerations surrounding the Fed’s purpose of decreasing core inflation to 2 p.c. “We’re seeing items of the puzzle coming collectively, however coverage has not been restrictive sufficient for lengthy sufficient to see the specified results,” Powell added.

As such, Powell didn’t decide to both a pause or a rise on the FOMC’s September assembly, amid predictions of at the very least another hike this yr. He pointed to 2 extra job stories, together with two extra units of CPI knowledge earlier than the following assembly as influencing the Fed’s subsequent choice.