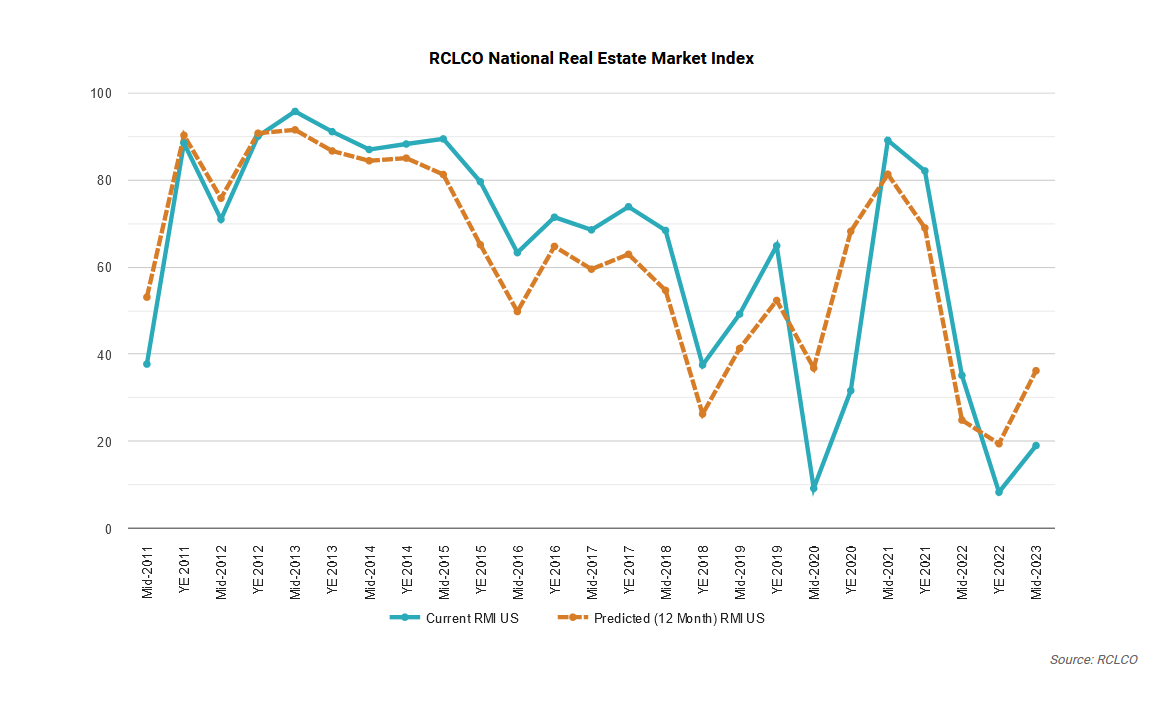

“Higher, however nonetheless not good” is how RCLCO describes their mid-year Nationwide Actual Property Market Index (RMI), the product of the corporate’s newest Sentiment Survey.

Prior to now six months, the RMI has risen by 10.7 factors, from a record-low 8.3 factors at year-end 2022 to 19.0 now, but the index stays in perilous territory. An RMI beneath 40 (on a scale of 0 to 100 factors) “is often in keeping with a interval of actual property market misery/recession,” RCLCO says.

RCLCO Nationwide Actual Property Market Index. Chart courtesy of RCLCO

Over the dozen years that the RMI has tracked actual property market situations within the U.S., the previous three years have been particularly risky, what with the pandemic, conflict in Ukraine and up to date fee hikes by the Fed.

READ ALSO: Barkham Predicts Gentle Recession, Speedy Restoration

Though the survey’s respondents, who’re primarily buyers or builders, predict continued enchancment in the true property market, in addition they see it remaining in misery for an extra six to 12 months.

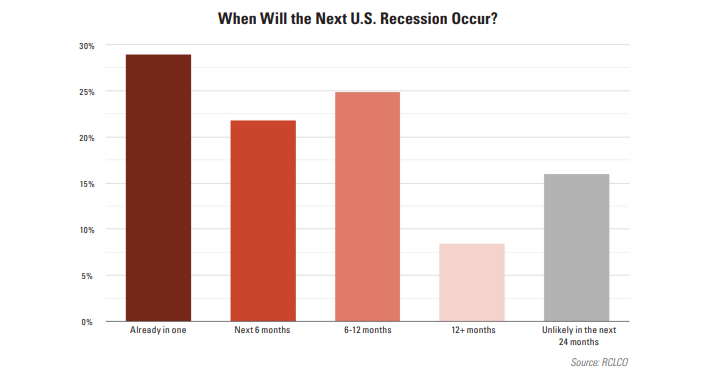

That’s in opposition to a backdrop of recession considerations. An amazing majority of these surveyed (84 %) foresee a recession within the subsequent two years, and almost half (47 %) predict one inside 12 months.

Recession forecast. Chart courtesy of RCLCO

“One potential silver lining,” RCLCO reviews, “is that almost all of respondents anticipate that the looming recession will possible be of shallow to average depth,” or at most unfavourable 2 % of GDP.

Almost half of respondents (47 %) count on inflation to begin to lower.

Downturn’s impression on CRE sectors

Over the following 12 months, survey respondents anticipate that almost all CRE sectors can be in a point of downturn, “although some area of interest sectors equivalent to self storage, seniors housing, grocery/necessity retail and hospitality are anticipated to have extra resilience.”

Unsurprisingly maybe, the workplace sector is the one which respondents consider will see the biggest peak-to-trough asset worth declines, averaging an estimated 16.3 % beneath peak. Retail was second on this unwelcome record, at 8.3 %, adopted by lodges (7.0 %), multifamily (6.5 %), industrial (4.0 %) and self storage (3.6 %).