Regardless of inflation challenges, the sector’s lease progress, leasing and capital markets exercise stay strong, JLL studies.

Regardless of inflation headwinds which have introduced challenges for consumers, lowering spending energy and shopper confidence, JLL’s Q2 2022 Retail Outlook finds that retail fundamentals are strong, with web absorption remaining optimistic for six straight quarters, leasing hitting its highest quantity in practically 5 years, sturdy capital markets’ exercise and rents rising in neighborhood and strip facilities.

Whereas issues stay as inflation continues to stay stubbornly excessive with July’s CPI coming in at 8.5 p.c year-over-year, simply barely under the 40-year excessive in June, JLL’s retail crew has discovered quite a few vibrant spots throughout the sector.

READ ALSO: The Finest Anti-Inflation Hedge Is Clear Pondering

“Retail spending has continued to develop general, even bearing in mind inflation. However we’re now seeing rising costs affecting shopper habits in a extra vital manner,” James Cook dinner, Americas director of analysis, retail, JLL, advised Industrial Property Govt.

“Shopper surveys present that customers are searching for a price and are altering buying habits with a view to get it. However whereas they might have stated that inflation will trigger them to spend much less, we’re not at all times seeing that occur. For instance, our latest back-to-school survey confirmed that folks deliberate to spend about the identical as they did final yr. I’m cautiously optimistic that will probably be true for vacation buying as properly.”

High findings

A number of the key takeaways from the outlook embody:

- Retail gross sales excluding fuel, auto and non-store retailers totaled $378 billion in June—a 22 p.c enhance from pre-pandemic ranges.

- The primary half of 2022 has seen sturdy exercise within the U.S. retail capital markets, with complete transaction quantity coming in slightly below $44.7 billion, together with M&A transactions, for an 81 p.c year-over-year enhance.

- Experiential tenants have seen the strongest rebound in foot visitors with second-quarter visits to film theaters, leisure venues and health facilities rising 39.4 p.c year-over-year. Spurred by two main blockbusters—High Gun: Maverick and Jurassic World Dominion—theaters noticed a whopping 127.6 p.c enhance in foot visitors within the second quarter in comparison with the earlier yr. These two motion pictures every grossed greater than $300 million in June alone. Health facilities additionally noticed second-quarter foot visitors that was the best in years.

- Client spending rebounds in June and for back-to-school buying, with retail gross sales rising 1.0 p.c in June in comparison with Might, which noticed a 0.3 p.c decline in retail gross sales. Actual spending on sturdy items additionally rose 1.2 p.c month-over-month in June, after dropping 3.5 p.c in Might.

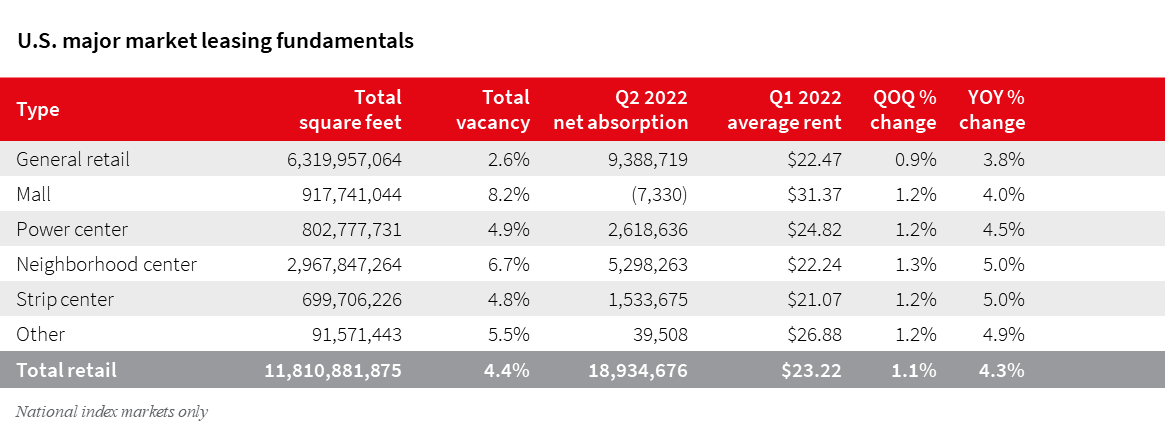

- U.S. web absorption remained optimistic for the sixth straight quarter, though it did drop 12.2 p.c to 18.9 million sq. toes. Nonetheless, during the last 12 months, web absorption hit one other five-year excessive of 94.3 million sq. toes.

- JLL studies simply over 250 million sq. toes of retail house was leased during the last 12 months. Present estimates count on the ultimate second quarter 2022 leasing quantity to be 78 million sq. toes, which might be the best for the reason that fourth quarter of 2017. Small-space leasing is being pushed by QSR eating places like Starbucks and Taco Bell and mobile retailers together with T-Cellular and AT&T. Greenback shops, off-price retailers like TJ Maxx, health facilities and experiential retailers are more and more leasing bigger areas as shoppers return to pre-pandemic behaviors.

- Retailers have introduced 4,432 retailer openings to date this yr in comparison with 1,954 closings. Yr-to-date web openings totaled 2,478. Low cost shops have been probably the most lively, adopted by eating places and attire shops. JLL notes if this tempo continues, it will likely be second straight yr of optimistic web openings after three years of detrimental web openings from 2018 to 2020.

- Neighborhood and strip retail facilities noticed the best lease progress within the second quarter, up 1.2 p.c from the earlier quarter and 5 p.c year-over-year.

- Absorption for the smaller retail facilities was additionally up, totaling 6.8 million sq. toes within the second quarter and 41.6 million over the previous 12 months. Malls, nonetheless, noticed web absorption drop barely to detrimental 7,330 sq. toes, as a consequence of fewer tenants transferring into tremendous regional malls through the second quarter.

Cook dinner stated it wasn’t shocking that the smaller retail venues had been faring higher than malls.

“Retail that providers our every day wants is often present in neighborhood and strip facilities. This sort of retail has seen probably the most shopper demand since 2020. Nonetheless, that will pull again within the coming yr as consumers spend extra time in leisure journey, enterprise journey and going out with family and friends,” Cook dinner advised CPE.