Barbara Trachtenberg, Co-Vice Chair of the US Actual Property follow, DLA Piper. Picture courtesy of DLA Piper

Like many within the business actual property sector, the actual property attorneys at DLA Piper have seen a slower market within the first half of 2023 as lingering inflation, rising rates of interest and maturing loans are making buyers and lenders cautious, leading to decrease transaction volumes and lowered values for a lot of asset courses.

However offers are getting finished and the regulation agency’s annual Mid-Yr US Actual Property Developments Report discovered a lot of the exercise has been within the buy and sale of multifamily housing, notably the senior housing phase, and within the industrial sector.

Because the agency’s latest State of the Market survey predicted, industrial properties, together with logistics hubs, warehouses and chilly storage amenities, are enticing investments within the present market. The agency’s actual property group additionally noticed a rise in retail, lodge and information middle offers within the first half of 2023. Life science offers slowed, primarily as a consequence of a enterprise capital crunch and doable considerations of overbuilding lately. Though the workplace sector continues to battle, workplace offers represented 12 p.c of the transactions dealt with by DLA Piper within the first six months of the 12 months, in comparison with 9 p.c within the first half of 2022.

READ ALSO: How Will Workplace Area Values Fare in 2030?

“The uptick in workplace I assumed was very attention-grabbing,” Barbara Trachtenberg, co-vice chair of the US Actual Property follow at DLA Piper, instructed Industrial Property Government. “I believe that reveals individuals are making an attempt to determine reposition their workplace, refinance their workplace, possibly redo the capital stack.”

Whereas the share of offers finished within the first half of 2023 was down barely from the identical time in 2022, multifamily was nonetheless the highest asset class dealt with by DLA Piper, in keeping with the report.

“Halfway by 2023, multifamily properties, together with house complexes, pupil housing and cell dwelling communities, proceed to drive a large portion of our acquisition and disposition work,” the report acknowledged.

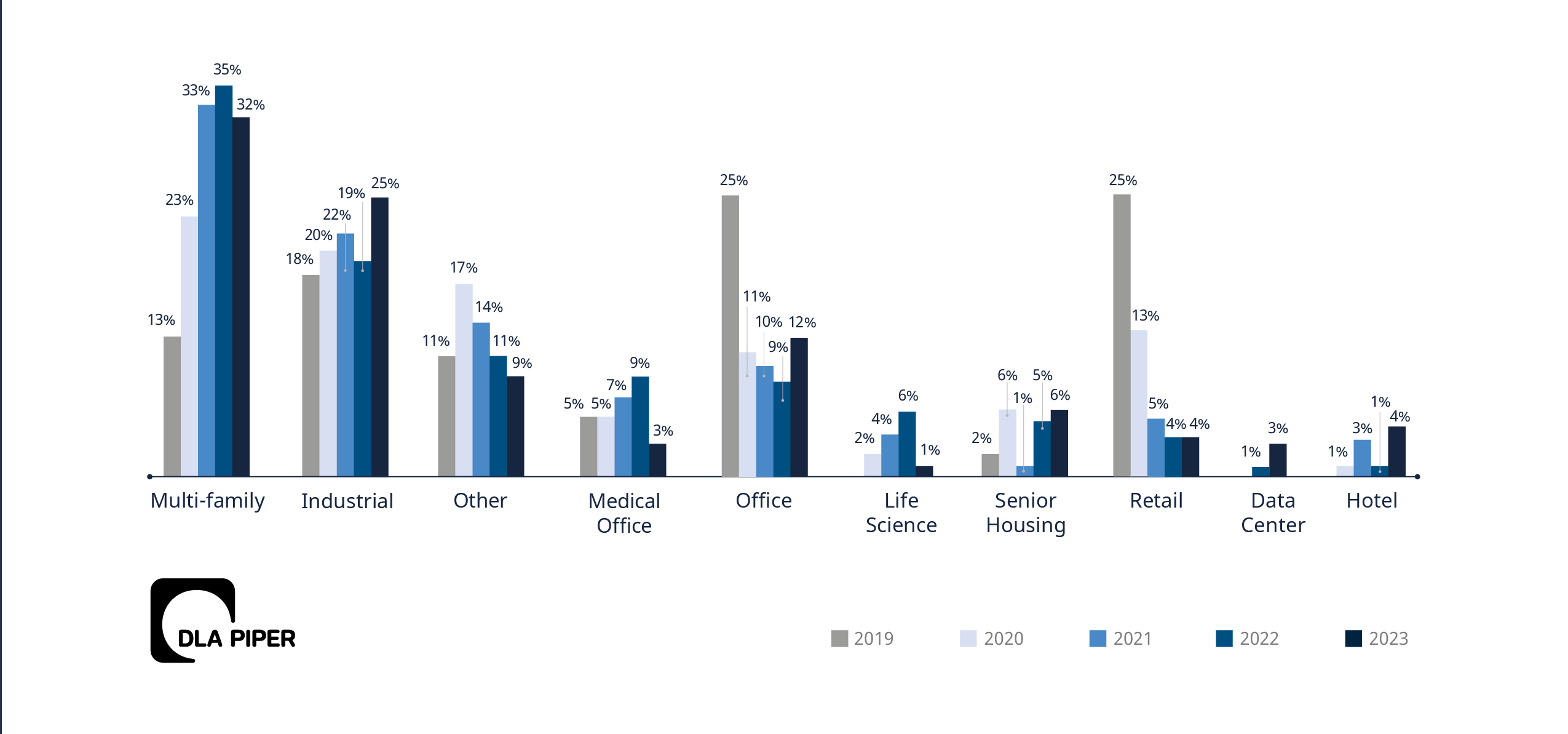

Multifamily represented 32 p.c of the agency’s offers adopted by industrial (25 p.c); workplace (12 p.c); different (9 p.c); senior housing (6 p.c); retail and lodge (4 p.c every); information facilities and medical workplace (3 p.c every) and life science (1 p.c).

Acquisition and disposition traits. Chart courtesy of DLA Piper

Trachtenberg mentioned information facilities are a small phase of the general actual property market, however there was exercise within the first half of the 12 months, each at DLA Piper and elsewhere. She mentioned individuals nonetheless believe in these investments.

“AI (synthetic intelligence) is creating a necessity for extra cloud area, which implies you want extra information middle area,” she mentioned.

Inflation, rate of interest impacts

Trachtenberg mentioned the general CRE deal quantity for the primary half of the 12 months is “nowhere close to as gradual as in the course of the international monetary disaster however quantity is certainly down.”

She mentioned the rise of inflation—adopted by the Federal Reserve’s actions to tame it by elevating rates of interest—tracked with the slowdown in transactions.

“As soon as the Fed began getting aggressive with rates of interest, that’s when individuals began to say I don’t know value this. There’s inflation, cap charges are shifting, the rates of interest are going up. How do I sit down right now and say what I believe this property is basically price.”

Trachtenberg mentioned there’s loads of capital obtainable for deployment however the bid-ask hole continues to be an issue leading to many buyers ready on the sidelines.

For these patrons who’re going after offers, Trachtenberg mentioned they’re being extra demanding leading to two new traits within the report—financing contingencies and longer illustration and guarantee survival intervals.

“Patrons who’re prepared to pay extra need to get what they’re paying for and I believe that’s bearing out whenever you see longer rep and guarantee survival intervals or whenever you’re beginning to see, albeit it’s comparatively small, however beginning to see financing contingencies,” Trachtenberg instructed CPE.

Due to the lowered availability of capital this 12 months, DLA Piper added financing contingencies to the checklist of tracked metrics for the report back to see what share of acquisitions have been contingent on both the client acquiring new financing or assuming the prevailing financing on a property. The agency discovered it’s nonetheless uncommon, with greater than 94 p.c of the transactions continuing with out contingencies.

However Trachtenberg mentioned seeing them in any respect was shocking and one thing she had not encountered in any respect previously a number of years.

“If we went again and checked out all our offers in 2021, that quantity can be zero,” she mentioned.

Trachtenberg mentioned they started to note a pattern towards 270-day rep/guarantee survival intervals in 2022 and it has continued into 2023 with 9 months being essentially the most frequent rep/guarantee interval within the buy and sale agreements they negotiated throughout first half of the 12 months.

In 2021, she mentioned solely 23 p.c of the offers negotiated had a nine-month survival interval.

“Now we’ve obtained 67 p.c at 9 months or extra,” she mentioned. “It’s vital. It’s not simply a rise on the nine-month, but additionally a rise on the 12 months or extra so it’s been an attention-grabbing dynamic.”