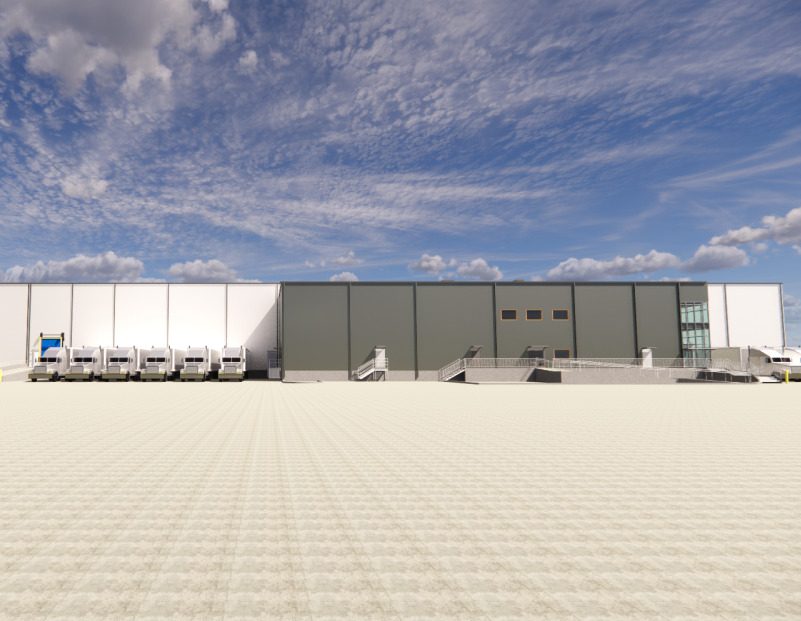

Moses Lake Commerce Heart. Picture courtesy of Cushman & Wakefield

Third Safety has begun the event of Moses Lake Commerce Heart, a 42-acre, 800,000-square-foot industrial park in Moses Lake, Wash. Hansen-Rice Inc., investor and grasp planner for the event, is dealing with the mission’s planning, design and building.

Through the first part of growth, a 108,000-square-foot, food-grade processing facility shall be constructed over 10 acres. The rest 32 acres might embrace as much as 5 Class A speculative or built-to-suit property totaling 692,000 sq. toes. Cushman & Wakefield’s Greg Millerd and Nic Alfieri, along with Keller-Williams’ Russ Roberts, are the mission’s leasing brokers.

READ ALSO: Industrial Funding’s Altering Danger Image: DWS’ Todd Henderson

Moses Lake Commerce Heart is taking form on the intersection of Randolph Highway NE and Highway 7 NE, in a Certified Alternative Zone. The property is simply south of Grant County Worldwide Airport and 1 mile from Freeway 17, offering direct entry to Interstate 90.

The economic sector, nonetheless going robust

Regardless of successive raises of rates of interest, an unstable financial surroundings and excessive building and labor prices, the nation’s industrial sector has continued to see robust fundamentals, together with a 5.8 % enhance in rents, a 10-basis-point lower within the common emptiness fee and practically 714 million sq. toes of house below building on the finish of October, in line with a current CommercialEdge report.

The markets with the most important pipelines on a share of present inventory foundation have been Phoenix (46.6 million sq. toes below building, 15.6 % of inventory), Dallas (66.7 million, 7.8 %) and Indianapolis (24.2 million, 7.4 %), the report exhibits. Though a number of the sector’s largest gamers have taken a cautious strategy to the brand new growth pipeline and leasing, deliveries are anticipated to stay at an all-time excessive up till 2024.