Richard Barkham, International Chief Economist & Head of International and Americas Analysis, CBRE. Picture courtesy of CBRE

CBRE expects an financial slowdown within the U.S. subsequent 12 months that can impression industrial actual property with financial institution lending remaining tight all through 2024, funding quantity reducing 5 %, cap charges increasing and property values declining.

However the U.S. might be able to keep away from a recession and rates of interest must be diminished later within the 12 months as exercise picks up within the second half of 2024, in response to the agency’s 2024 U.S. actual property outlook.

Property varieties with comparatively sturdy fundamentals, together with demand, emptiness and lease progress, like industrial, retail, multifamily and information facilities will likely be most favored by traders in 2024, in response to CBRE.

Richard Barkham, CBRE world chief economist & world head of analysis, mentioned in ready remarks there may be nonetheless some extra ache forward for the industrial actual property trade in 2024, together with general funding volumes remaining down for the 12 months. However he expects an upturn by the second half and general leasing exercise to choose up as nicely. He notes stabilization and the early phases of restoration are additionally not far off.

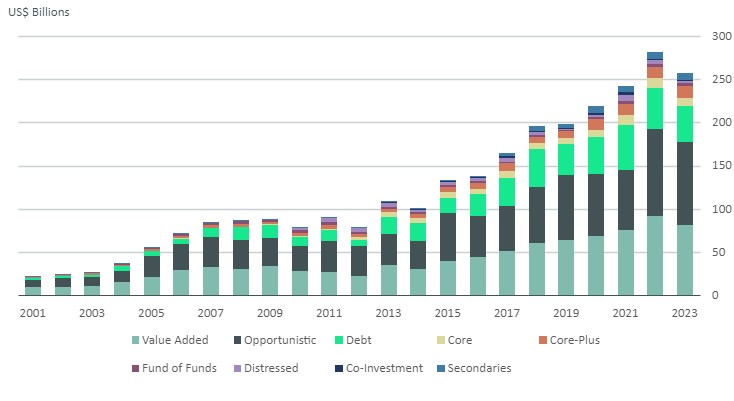

North America dry powder by technique. Chart courtesy of CBRE

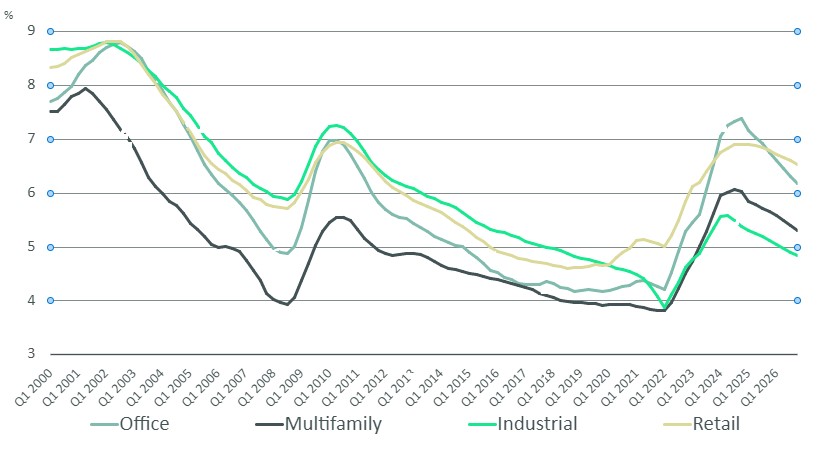

With inflation easing, the Federal Reserve is predicted to start lowering short-term rates of interest in 2024, probably to round 4.25 % by the tip of the 12 months and to three.5 % in 2025.

There must be shopping for alternatives within the first half of 2024, particularly for all-cash patrons like sovereign wealth funds, pension funds and endowments. CBRE expects the bottom pricing for belongings will happen within the first two quarters.

The report notes growing cap charges, which have risen by about 150 foundation factors between early 2022 and late 2023 relying available on the market and asset kind, indicate a 20 % decline in values for many property varieties. For workplace, the rise was greater, rising by a minimum of 200 foundation factors.

“We predict cap charges will increase by one other 25 to 50 foundation factors in 2024, with a corresponding 5 % to fifteen % lower in values,” the report states.

CBRE expects actual property values for many property varieties will doubtless not stabilize earlier than mid-2024.

Historic & forecast cap charges. Chart courtesy of CBRE

Workplace vacancies to peak

The outlook expects one other powerful 12 months forward for the workplace market with workplace emptiness peaking at almost 20 % in 2024, up from 18.4 within the third quarter of 2023 and 12.1 % on the finish of 2019.

CBRE notes a slowing financial system within the first a part of 2024 and growing acceptance of hybrid working preparations will proceed to restrict workplace demand subsequent 12 months. The 2023 U.S. Workplace Occupier Sentiment Survey discovered greater than half of the respondents deliberate to additional cut back their workplace house in 2024.

Corporations seeking to lease lower than 20,000 sq. toes will account for many of the leasing exercise, in response to CBRE. Leasing exercise ought to rise by 5 % in 2024, nonetheless that’s nonetheless 20 to 25 % decrease than pre-pandemic ranges.

READ ALSO: How Incentives Increase Workplace Conversions

In the meantime, the flight-to-quality development ought to proceed with occupiers looking for house in newer, prime workplace properties with the most effective facilities. However workplace development ranges will likely be at their lowest ranges since 2024, which might lead to a scarcity of that sought-after Class An area later within the 12 months. CBRE forecasts that common prime workplace asking lease will improve by as a lot as 3 %.

On the funding aspect, the higher-for-longer outlook for rates of interest will trigger some house owners of Class B and C workplace belongings to promote as a result of additional erosion in values. Lots of these older buildings that lack trendy facilities will proceed to battle to draw tenants, so a better share of older workplace belongings are prone to be transformed to different makes use of. Whereas workplace conversions may be difficult, the report notes the federal authorities is offering grants, low-interest loans and tax incentives and native governments are additionally providing incentives.

Not all workplace markets are struggling, and the outlook shines a light-weight on a number of lively cities within the U.S. In Nashville, Tenn., the place absorption and rents are up, demand for brand spanking new workplace house is predicted to stay sturdy. Miami is seeing one of many highest lease will increase within the nation and the emptiness charge is dropping as new-to-the market tenants are maintaining the market wholesome. Las Vegas has seen an uptick in leasing exercise and powerful preleasing at speculative initiatives, placing the market in a robust place heading into 2024.

Industrial sector slowdown

The economic sector ought to see web absorption just like 2023 ranges and lease progress moderating to eight %. Development deliveries are truly fizzling out and anticipated to proceed to decelerate as a result of financial uncertainty, tight lending circumstances and oversupply in some markets.

READ ALSO: Property Administration Success: How AI Boosts Industrial

Emptiness is predicted to hit 5 % by mid-2024, up from 4.2 % within the third quarter of 2023 however lower later within the 12 months because of the decline in new development. Trying forward, CBRE is forecasting a 7.5 % improve in U.S. industrial manufacturing over the following 5 years as extra occupiers enhance their provide chains by including extra import areas and onshoring or nearshoring of producing operations. Markets to observe embrace Austin and San Antonio in Texas; Nashville; Salt Lake Metropolis and Central Florida.

Retail’s declining availability

The retail sector can be going through an absence of recent development. That can contribute to retail availability charges dropping by 20 foundation factors subsequent 12 months to 4.6 %. Asking lease progress is predicted to drop under 2 % for many of 2024 however go above 2 % by the fourth quarter.

READ ALSO: Blended Procuring Cart for Retail

Open-air suburban retail facilities will see demand develop sooner than different retail codecs and neighborhood, neighborhood and strip facilities could have steady occupancy all year long. Search for conventional mall-based retailers to hunt different new codecs exterior the shops for enlargement. Texas markets are anticipated to see extra luxurious manufacturers. Different markets to observe embrace Orlando, Fla.; Charlotte, N.C.; Denver; San Francisco and Orange County, Calif.

AI to gas elevated information middle demand

The information middle market is seeing progress, typically pushed by advances in cloud-based options, synthetic intelligence and different new functions and applied sciences. CBRE notes demand will proceed to be greater than provide and development in main markets will exceed 3,000 MW in 2024, up from the corporate’s 2023 estimate of two.500 MW. Markets to observe embrace Austin; San Antonio and Omaha, Neb.