Regardless of e-commerce, and regardless of COVID, the continued revival of the retail actual property sector has continued, to an extent the place retail gross sales have risen for six straight months, and it’s a restricted provide of area in fascinating places—not an absence of demand—that’s constraining retail leasing.

General, internet retail absorption was down roughly 10 % within the third quarter.

In the meantime, multichannel retailing stays robust. About 57 % of U.S. vacation buyers anticipate to avail themselves of two or extra channels.

These are a few of the observations within the new U.S. Retail Outlook Q3 2023, from JLL. The report additionally delves into important shifts amongst tenants and house owners.

READ ALSO: Rising Developments for CRE in 2024 and Past

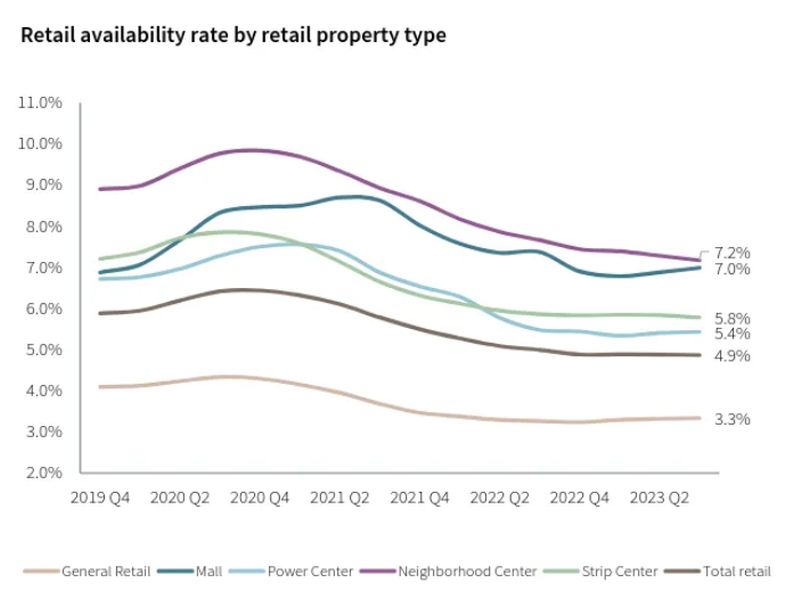

The dearth of appropriate area outcomes from a dearth of recent building, alongside the demolition of about 145 million sq. toes of retail area over the previous 5 years. At this level, JLL notes, “The provision price is sort of 200 foundation factors beneath its historic common of 6.8 %.”

Pushed partly, however not completely, by inflation, retail gross sales have grown by 3.8 % year-over-year.

Retail availability price by property sort. Chart courtesy of JLL

Whereas the image is bettering, it’s rosier for some than for others. Meals and beverage tenants, quick-service eating places particularly, had been liable for practically 20 % of leasing over the previous yr, and health and experiential tenants proceed to broaden, particularly in big-box areas.

On the opposite aspect, JLL studies, “Some conventional mall tenants have introduced plans to relocate a few of their mall shops to open-air neighborhood and neighborhood facilities with larger foot site visitors.”

Mall emptiness is the worst it has been in 15 years. Class B and C malls have taken the toughest hits, however Class A malls have fared solely a bit higher.

And as has been amply reported, retailer closures by retailers from JCPenney (242 shops) to GNC (1,200 shops) have been a pressure throughout the mall sector.

Looking for recent air

In parallel to straight-up closures, a number of main chains which have historically most popular mall places are shifting to open-air neighborhood and neighborhood facilities.

Amongst these are Foot Locker (closing greater than 400 mall places and opening 300 off-mall places), Bathtub & Physique Works and Macy’s. The latter, in response to JLL, “plans to open 30 smaller shops roughly one-fifth the dimensions of its conventional shops in strip facilities over the following two years. The comfort and better site visitors of those open-air facilities increase retailer efficiency.”

Tenants that seem to favor malls presently embrace attire and equipment shops, health tenants, well being/medical tenants, and experiential tenants (the report singles out Round1 and Picklemall).