Incomm Agent Options offered Biscayne Middle, a 156,849-square-foot workplace asset in North Miami, Fla. Picture courtesy of CBRE

The rising strain on the workplace sector is likely one of the key actual property tendencies of 2023. As CommercialEdge knowledge exhibits, nationwide funding quantity dropped 73 % year-over-year through the first quarter to simply $5.7 billion. But amid the turmoil, consultants observe that some main markets are exhibiting resilience, even within the face of fast-changing work fashions.

Based on CommercialEdge knowledge, workplace funding throughout the U.S. year-to-date by March totaled $5.7 billion. This accounted for a 72.7 % lower from the identical time in 2022, when $21.1 billion in workplace property was offered. Whereas the workplace funding panorama is predicted to shift additional, some markets appear to be extra resilient within the face of upcoming adjustments.

“I might emphasize the submarkets and places inside every market and product sort greater than particular markets,” Anita Kramer, senior vp of the City Land Institute’s Middle for Actual Property Economics and Capital Markets, informed Business Property Government. “There seems to be a bifurcation within the workplace sector, much like what we’ve seen for many years within the retail sector, with newer buildings in well-connected, walkable places getting the lion’s share of leasing—and subsequently, investor consideration.”

READ ALSO: ULI, PwC Decide These CRE Tendencies to Look ahead to in 2023

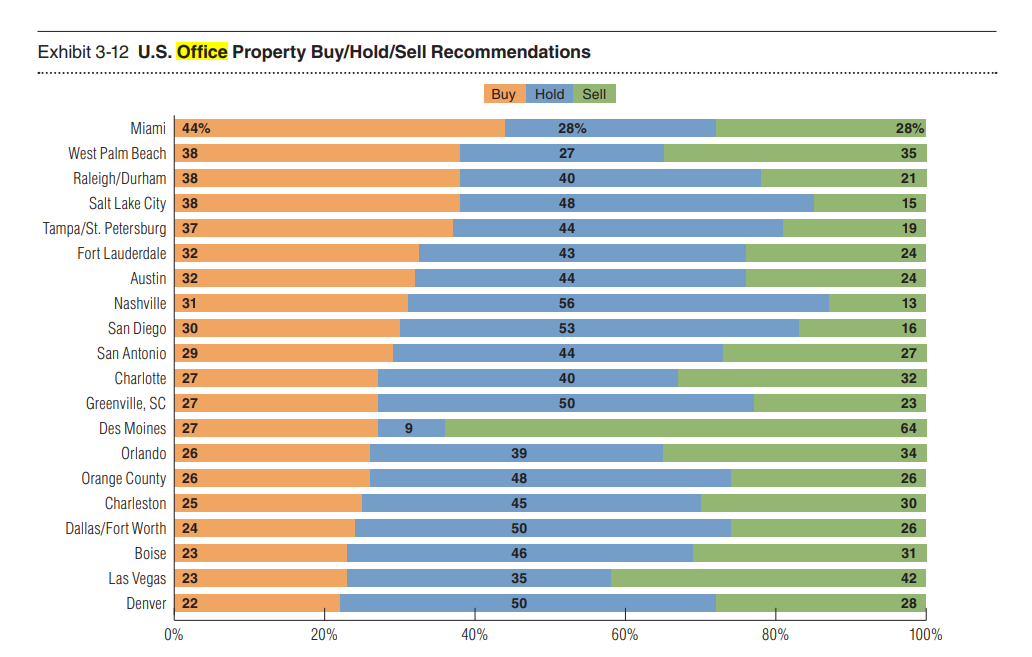

ULI and PwC’s report on Rising Tendencies in Actual Property 2023 means that sure workplace markets are more likely to see sturdy funding efficiency within the coming years. Exhibit 3-12 presents the 20 markets that acquired the best proportion of ‘purchase’ suggestions for workplace investments in comparison with different choices like ‘maintain’ or ‘promote.’

Nevertheless, when evaluating these percentages to related reveals for industrial and multifamily sectors, it turns into evident that the markets in these sectors have considerably stronger ‘purchase’ suggestions. This highlights the uncertainty that surrounds the workplace market, though there are some comparatively sturdy workplace markets in comparison inside the sector, Kramer defined.

Exhibit 3-12 from ULI & PwC’s Rising Tendencies in Actual Property 2023 report. Picture courtesy of ULI

To find out future workplace funding alternatives in 2023 and past, we analyzed funding quantity knowledge from CommercialEdge year-to-date as of March, thought of metrics and forecasts from the ULI and PwC report, and consulted native consultants.

1. Boston

As a market with a robust tutorial presence and a thriving health-care business, Boston gives traders a chance to faucet right into a extremely educated and expert workforce. The PwC and ULI report names it as one of many nation’s data and innovation facilities and an ongoing world chief in life sciences.

Based on a latest CBRE U.S. Life Sciences outlook, the life sciences business—which skilled outstanding development through the well being disaster—has returned to a extra typical price of growth in 2023. Nevertheless, the demand for laboratory and analysis and improvement house continues to outperform pre-pandemic ranges.

Whereas the amount of funding gross sales within the sector has decreased to pre-COVID-19 ranges, costs stay excessive and capitalization charges are at document lows on account of sturdy investor confidence, positioning Boston because the first-ranked marketplace for workplace funding on our record.

Workplace transaction quantity through the first quarter of 2023 amounted to $680 million, CommercialEdge knowledge exhibits. Whereas this represents a steep decline from the $2.3 billion recorded within the first quarter of 2022, the market encompassed 10.5 % of the nation’s complete workplace gross sales quantity on the finish of March. Furthermore, the typical sale value for an workplace asset was $555 per sq. foot on the finish of the primary quarter, well-above the nationwide price of $195 per sq. foot.

Funding exercise was concentrated within the Route 128 Central submarket, the place TPG Actual Property offered CenterPoint, a 578,130-square-foot life sciences campus in Waltham, Mass. The property was acquired by Capital Administration for $578 million, commanding practically $1,000 per sq. foot.

2. Miami

Miami has skilled constant financial development through the years, pushed by sectors resembling finance and worldwide commerce. The market has diversified its economic system past its conventional reliance on tourism, changing into a regional hub for a various vary of industries, and offering traders with a spread of alternatives to capitalize on its rising business actual property market.

Workplace gross sales totaled $435 million year-to-date in March, a forty five % improve from the $239 million recorded within the first quarter of 2022. Belongings traded at a mean of $396 per sq. foot, twice the nationwide common. The area has skilled accelerated development on account of an growing variety of people being drawn to its local weather and favorable enterprise circumstances because the begin of the pandemic.

Within the Biscayne Hall, Incomm Agent Options offered Biscayne Middle, a 156,849-square-foot workplace asset in North Miami, Fla. The property modified palms in a $39 million deal in March, and underwent conversion from condos proper earlier than it was offered. Going ahead, as Miami continues to draw companies from across the globe, it’s poised to maintain its momentum and function a thriving hub for workplace funding all year long.

3. San Diego

San Diego’s workplace sector is supported by a various vary of industries, together with protection contractors, health-care suppliers, life sciences companies and expertise firms, in addition to a thriving expertise and biotechnology market. The presence of many universities has facilitated the expansion of a vibrant biotech ecosystem and incubator tradition, with the metro being a premier life sciences market as we proceed into 2023.

Workplace funding quantity in San Diego totaled $302 million year-to-date by March, accounting for a 54.2 % lower from the $660 million offered within the first quarter of 2022, in line with CommercialEdge knowledge. Workplace property traded at a mean of $295 per sq. foot, thrice greater than the nationwide common of $195 per sq. foot.

Based on Peter Quinn, senior vp and investments specialist inside Kidder Mathews’ San Diego workplace, the Carmel Valley/Del Mar Heights and College City Middle submarkets have been essentially the most sought-after and secure workplace markets previously a number of years. That has been strengthened within the post-pandemic interval on account of proximity to high quality workplace product, government housing, procuring and the Pacific Ocean.

The Kearny Mesa submarket emerged as the most popular space when it comes to workplace funding within the first quarter of 2023. Three property totaling 400,000 sq. ft offered for $185.4 million, with the biggest sale consisting of Rexford Industrial’s acquisition of Cubic Corp.’s headquarters.

Quinn believes the pandemic has affected San Diego’s workplace market and expects 2023 to be a sluggish yr for brand spanking new funding transactions as institutional and personal traders proceed to press the pause button.

“As monetary markets stabilize—hopefully later this yr—traders can be again out there,” Quinn stated. “Conventional workplace investments are going through vital headwinds as valuations have taken a success on account of return expectations from traders and continued hesitancy to return to the workplace from staff and their employers handle by the hybrid-work mannequin,” he added.

4. New Jersey

New Jersey has tailored to the post-pandemic new regular by implementing and supporting distant work insurance policies and investing in digital infrastructure. Demand for knowledge middle capability happens throughout North America however is most closely concentrated in 10 major markets, with the Northern New Jersey area rising as one of many leaders within the subject.

The market’s workplace funding panorama is impacted by a spillover impact from close by Manhattan, the place the value per sq. foot for workplace property surpassed the $1,000 mark, CommercialEdge knowledge exhibits. The waning workplace market within the borough has prompted workplace traders to redirect their consideration and allocate their capital towards adjoining workplace markets.

12 months-to-date as of March, workplace gross sales in New Jersey amounted to $280.8 million, representing a 78.4 % lower from the $1.3 billion offered in 1Q 2022. What’s extra, workplace property modified palms at a mean of $106 per sq. foot, properly beneath the nationwide common of $195.

A lot of the exercise out there is pushed by single-asset purchases, with the Cranford-Union submarket rising as essentially the most energetic space. Right here, two buildings modified palms for a mixed $195 million. In February, Merck Sharp & Dohme offered its former world headquarters, a 108-acre Class A life science campus in Kenilworth, N.J., to a three way partnership between Onyx Equities and Machine Funding Group. The $187.5 million sale included greater than 1.4 million sq. ft of laboratory house, 500,000 sq. ft of workplace house, in addition to 30 acres of developable land.

Like Boston and San Diego, New Jersey’s life sciences business reveals sturdy demand, pushed by the state’s fame as a number one hub for pharmaceutical and biotech sectors.

5. Orange County

Based on PwC and ULI’s report, Orange County is the second—and one of many few—California markets the place funding could be headed in 2023. Dominant workplace demand drivers within the metro embody sturdy demographics, main training facilities, entrepreneurial enterprise cultures and rising, high-margin industries.

Like many different metros on this record, workplace funding in Orange County recorded a noteworthy decline when in comparison with final yr’s figures. A complete of $253 million was offered within the first three months of 2023, a 39.6 % lower from the $419 million offered throughout the identical timeframe final yr. The typical sale value for an workplace asset was $239.16 per sq. foot, 18.5 % above the nationwide common.

Funding exercise within the first quarter of the yr was concentrated within the Irvine Enterprise Advanced, the place $140 million value of property traded. Based on Rick Putnam, government vp and investments specialist at Kidder Mathews’ Orange County workplace, the best-performing submarkets proceed to be nodes with the perfect workplace product, engaging to rising industries. He distinguished the Newport Middle district, the airport space and South County as being extremely sought-after, due to exercise fueled by the monetary, software program and biotech industries.

Whereas PwC and ULI metrics predict a good future for Orange County’s workplace funding panorama, Putnam’s forecast includes extra warning.

“A really uneven, haves and have-nots efficiency amongst particular workplace property and submarkets will make for huge disparities in funding efficiency, whereas the expansion of the workplace inventory can be near zero for the subsequent few years, as we work by a repositioning of many property and the monetary recapitalizations which that suggests,” he continued.

6. Tampa-St. Petersburg-Clearwater, Fla.

Favorable demographics drive a steady inflow of residents to Florida, particularly the Tampa-St. Petersburg-Clearwater metro. Not like different places, the world faces geographical constraints imposed by water our bodies, which limit city sprawl and contribute to a extra centered and environment friendly city improvement. The health-care, insurance coverage and cybersecurity subsectors lead demand for workplace house.

Based on CommercialEdge, workplace gross sales within the metro within the first quarter of 2023 totaled $196 million, with property buying and selling at a mean of $165 per sq. foot, or 18.2 % greater than the nationwide common of $195. The quantity represents a 142.5 % improve from the $81 million offered throughout the identical time in 2022.

Funding exercise was concentrated within the Westshore submarket, the place gross sales totaled $86 million year-to-date by March. The submarket boasts a primary location, located in shut proximity to Tampa Worldwide Airport, main highways and downtown Tampa, making it an excellent alternative for companies that worth comfort and simple connectivity.

Ken Lane, principal & managing director of Avison Younger’s Tampa operations, believes the success of this submarket may very well be attributed not solely to its new stock, however the entire walkable facilities inside its tasks. Anticipating a restructuring of the interstate system across the district, builders proceed to push extra multifamily tasks and eating places. Others have a look at underperforming buildings to change or recreate a mixed-use choice on the identical website. The Westshore Alliance is pushing to make all the things extra walkable and bike-friendly for everybody.

“Whereas the workplace market from an funding standpoint is somewhat difficult at the moment on account of back-to-work and lending constraints, I do wish to remind people who workplace will not be useless,” Lane stated. “Similar to retail skilled greater than seven years in the past, workplace is being redefined. From this, I imagine the traders which acknowledge this early on will see the largest returns as soon as it turns into in style to spend money on once more. With this stated, the long run workplace might want to have extra facilities supplied to the tenant and its workers. If the facilities usually are not inside the constructing, they should be inside a couple of minutes’ stroll,” he concluded.