Stable progress in client spending, a resurgence of tourism and the return of foot visitors to pre-pandemic ranges in lots of prime retail corridors throughout the U.S. are among the many key tendencies highlighted in JLL‘s brand-new metropolis retail report for 2024.

Different central themes as we head into the brand new 12 months embrace the dominance that attire retailers have in prime corridors; the endurance of luxurious retailers, amongst which quite a few manufacturers are absorbing area; and the extent to which rising workplace attendance and growing lodge occupancy ranges are undergirding city retail progress.

READ ALSO: Retail Leasing’s Area Race

Examples of the prime retail corridors the report focuses on embrace Fifth Avenue in New York Metropolis, Michigan Avenue in Chicago, the Beverly Hills Triangle in Los Angeles and Newbury Avenue in Boston. All of those and roughly two dozen extra within the U.S., plus one other 5 in Canada, are characterised by mixes of high-street, nationwide and worldwide tenants.

“In 2023, the trajectory of prime city retail leasing has been carefully tied to the efficiency of different property sorts. Workplace populations have surpassed 50 p.c throughout all main metros, lodge occupancy is at pre-pandemic ranges, and residential inhabitants outflows from main cities have stabilized,” JLL stories.

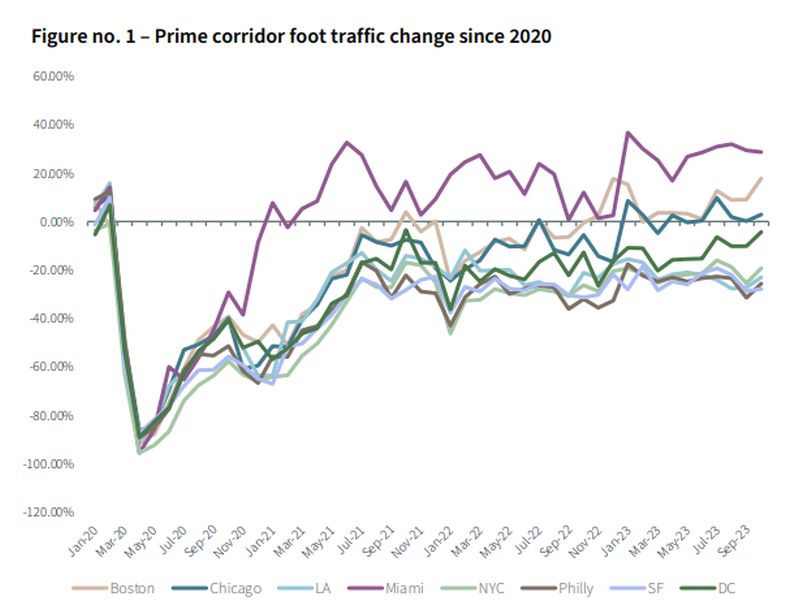

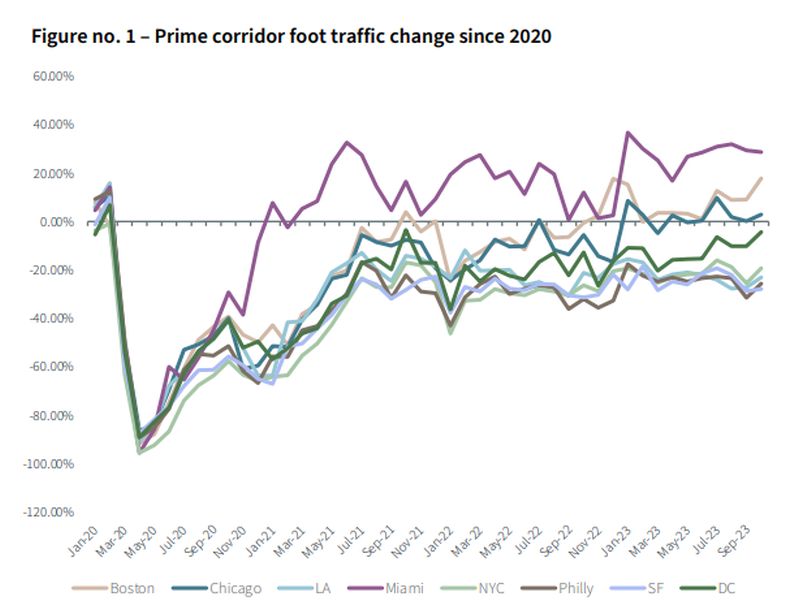

Prime hall foot visitors change since 2020. Chart courtesy of JLL

Diving slightly bit into the principle tendencies, the rebound in foot visitors outcomes from “customers’ persistent need for in-person purchasing experiences,” JLL says.

“Because of the mix of elevated tourism, stabilized inhabitants outflows, and the gradual return of workplace employees to the CBD, half of the prime city cities highlighted on this report have seen footfall utterly get better as of October 2023,” the report states.

Including to this can be a increase in worldwide tourism. Boston and New York Metropolis, for instance, are seeing main surges in abroad guests.

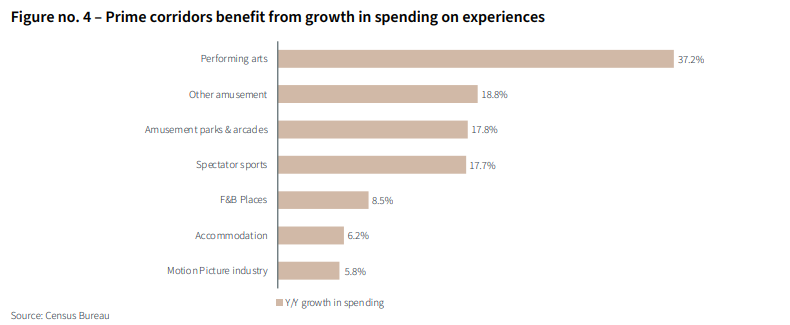

Prime corridors profit from progress in spending on experiences. Chart by the Census Bureau, courtesy of JLL

Prime retail corridors are a part of the experiential retail development, with performing arts venues being a major driver of client habits. Spending on performing arts was up about 37 p.c year-over-yer as of September.

The tenant aspect

In prime retail corridors, leasing by attire retailers surged from 35 p.c in 2022 to 48 p.c in 2023. Athleisure has been the star amongst attire retailers; chains like Lululemon, ALO Yoga, Vuori and Hoka have all been increasing in upscale places.

Luxurious retailers typically have contributed to sturdy absorption in virtually each hall. These embrace Burberry, Bottega Veneta, Cartier, Dolce & Gabbana, Chloe, Longchamp and Anine Bing. Luxurious boutiques have expanded into among the area vacated by Barney’s and Neiman Marcus. Two of essentially the most distinguished are Kith and Kirna Zabete.

Jewellery retailer Breitling has opened two prime hall shops lately, and Mejuri opened twice as many up to now 12 months.

The total report is effectively value a search for further depth on all of those tendencies, plus an appendix on prime hall move-ins.